The wireless segment in India has reached a great height since the arrival of Jio. Telcos have rolled out 4G PAN-India and are close to rolling out 5G in every corner now. Telecom operators like Airtel are focusing on reaching more rural areas of the country to complete their network coverage. The growth in the wireless segment will come from 5G in the remainder of the decade and from consumers shifting from 2G to 4G/5G.

However, the next big opportunity for the telcos might lie in the fixed-broadband segment. It is not just the telcos, but also the regional internet service providers (ISPs) that can grow fast due to rising demand for FTTH (fiber-to-the-home) services. A report from Future Market Insights estimates the global FTTH market to reach $95.88 billion by 2033, growing at a 15.1% CAGR.

Read More - Jio is Charging Rs 11,988 for 150 Mbps Annual Plan, Check Here for Extra Benefits

FTTH or Fixed Broadband is Capex Heavy

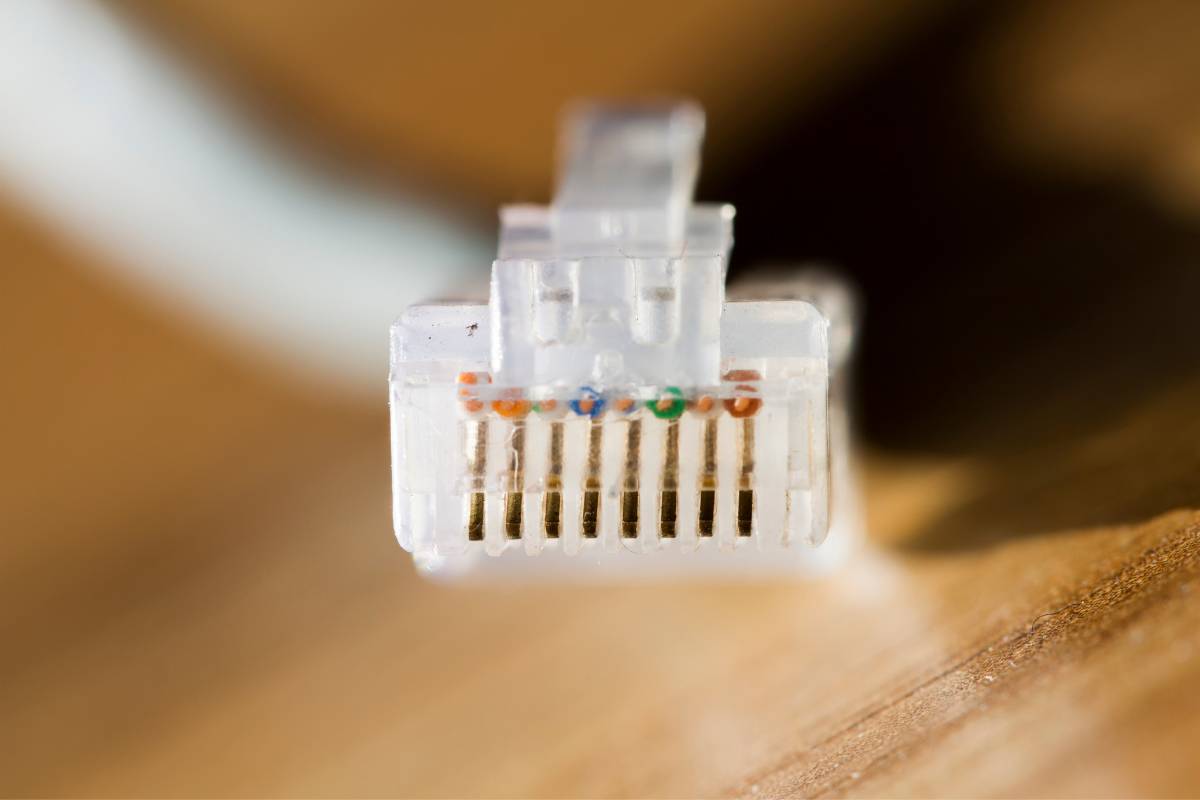

To offer FTTH services or fixed-broadband services anywhere in the world, the telcos or the ISPs need to deploy fiber. It takes a lot of money to do that, especially in India, where the population is very scattered and diverse.

Deploying fiber in every area before launching commercial services is a capex (capital expenditure) heavy task. Not every business can engage in such an activity, but telcos can. Jio and Airtel are aggressively rolling out FTTH for consumers.

This is because these consumers are high-paying in nature, and it also helps telcos in selling more services of their ecosystem to the customers. Compared to the wireless subscriber base, the wireline subscriber base of the telcos is fairly non-existent. Less than 4-5% of the population in the country can access fixed-broadband internet today.

Read More - Top Broadband Plans under Rs 500 in India in 2024

In the urban India, everyone who is working from home needs a reliable internet source, and it is not 5G or 4G, it is FTTH. Given the rising nature of digital ecosystem and IoT, more and more people would require a FTTH connection to connect several smart devices in their homes and offices.

This is where the telcos can find an opportunity to grow their revenues.

But it is worth noting here that FTTH is not just capex heavy, it is also time taking. It takes time to get the necessary approvals from the authorities to be able to lay fiber somewhere in India. Then there’s the process to deploy it and make it ready for commercial services.

Thus, while the growth will come slowly in the FTTH segment, it can be the next big thing for the telcos.