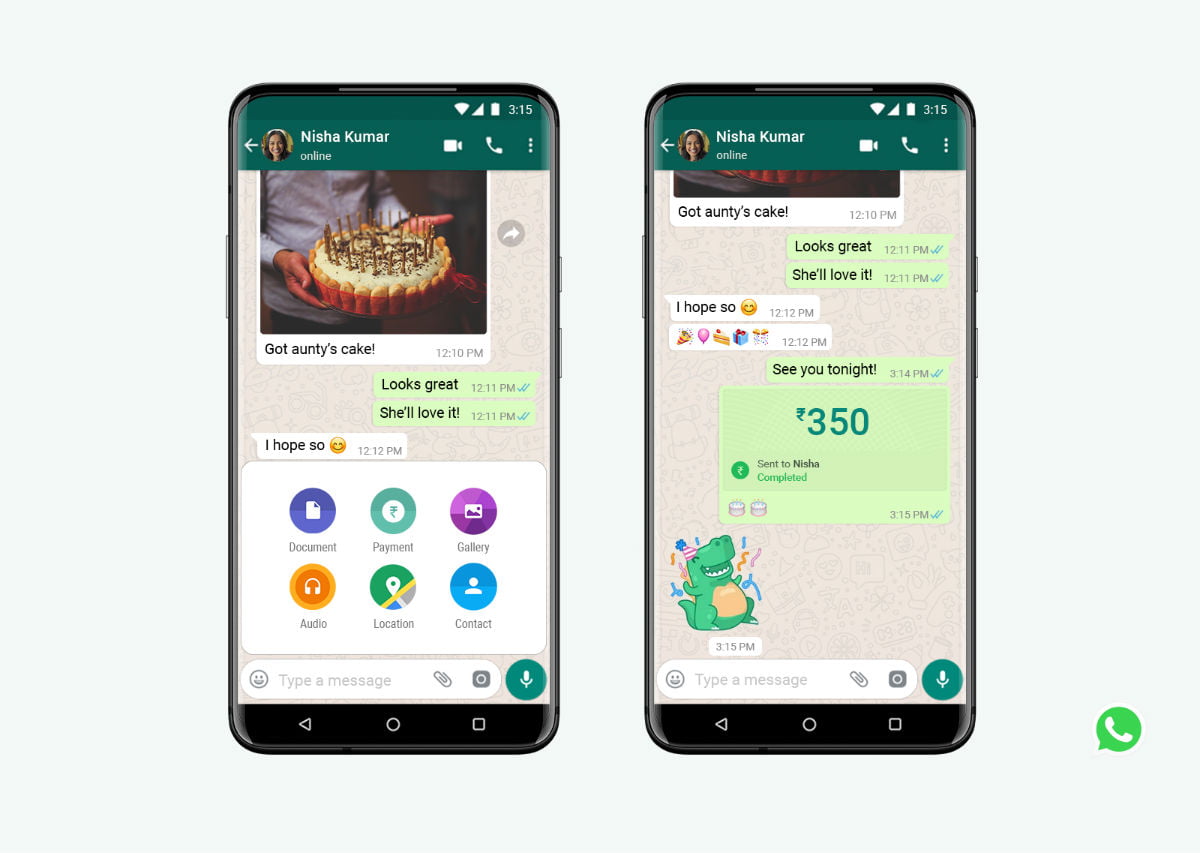

After more than two years since the beta launch, WhatsApp Pay has finally received the much-awaited nod from National Payments Corporation of India (NPCI) for a full-fledged launch. Starting today, people across India will be able to send money through WhatsApp. The instant messaging platform will make use of Unified Payments Interface (UPI) for secure payment experience. As for UPI, it is a real-time payment system with over 160 supported banks. WhatsApp also said it would initially roll out the payments service to 20 million users. WhatsApp last said it has over 400 million users in India. Besides the payments service, WhatsApp also rolled out disappearing messages to both Android and iOS users.

WhatsApp Pay Rolling Out to All Users in India

All the basic terms and conditions required to use UPI service apply to WhatsApp Pay. To send money on WhatsApp in India, it’s necessary to have a bank account and debit card in India. WhatsApp says it is working with five leading banks in India- ICICI Bank, HDFC Bank, Axis Bank, the State Bank of India and Jio Payments Bank. People can send money on WhatsApp to anyone using a UPI supported app.

"In the long run, we believe the combination of WhatsApp and UPI’s unique architecture can help local organizations address some of the key challenges of our time, including increasing rural participation in the digital economy and delivering financial services to those who have never had access before," said WhatsApp in a blog post.

WhatsApp Pay will be available for both Android and iOS users starting today. Initially, it will be rolled out to 20 million users.

In other news, WhatsApp also introduced the option to use disappearing messages. When this feature is turned on, new messages sent to a chat will disappear after seven days, helping the conversation to become more private. In a one-to-one chat, either person can turn disappearing messages on or off. In groups, admins will have control, confirmed WhatsApp.

The disappearing messages feature will be available to all the users across the world by the end of this month.