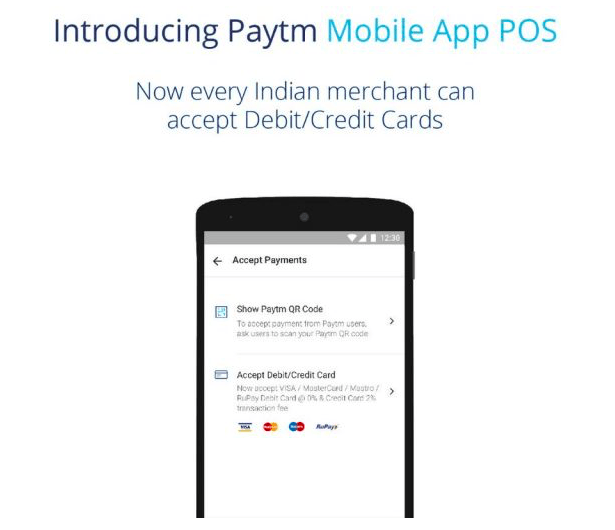

One company to witness the biggest jump in business after demonetisation is PayTM. The company became the centre of transactions right from the day PM Modi announced the huge move. Now, to help regular merchants to take Credit/Debit cards as payment, PayTM has launched a new feature for its mobile app dubbed as POS (Point of Sale).

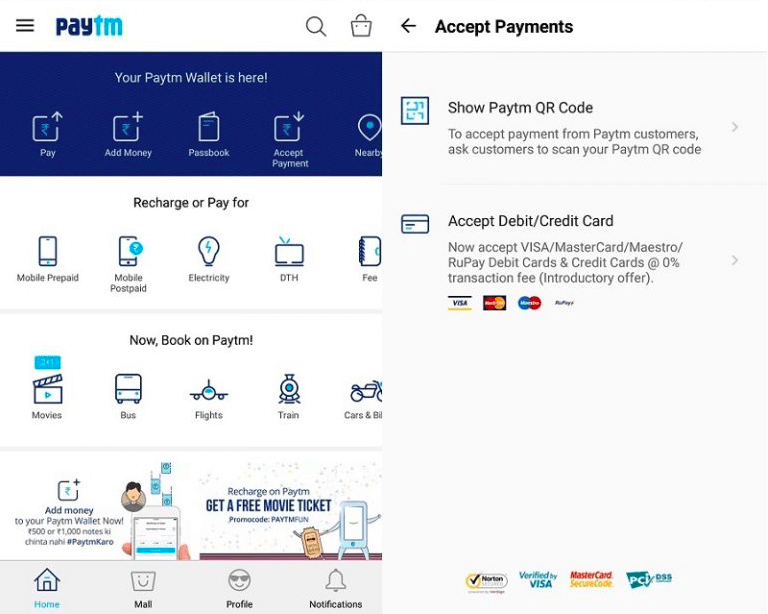

To accept card payment, a shopkeeper will just have to generate the bill on the POS and then give the phone to the payee to enter his card details. After entering the details, the payee will receive an OTP on his phone and the payment will be approved once the correct OTP is entered. The new POS feature accepts cards such as RuPay, Visa, and MasterCard. Merchants will be allowed a transaction limit of up to Rs. 50,000, after which they will be required to submit their documents for KYC.

The feature will especially benefit the small merchants as they can now accept card payments without installing a bank provided swipe machine. The wallet will impose zero transaction fee for the payments made until December 31, 2016. The POS (Point of Sale) will allow merchants to accept payments made by buyers through Credit/Debit cards. Explaining the sale motto of the feature, PayTM's CEO Vijay Shekhar Sharma said that the company expects up to 10 million POS app downloads by the end of this week. Sharma also stated that around 1.5 million merchants have already started using PayTM after demonetisation to accept payments.

PayTM app for Android has already received an update, which will now show a list of merchants who accept PayTM payment through QR codes or Credit/Debit card. The list can be found under the "Accept Payment" option in the app (as seen in the image above). The company is working on a similar update for its iOS app.

The POS feature could prove to be a boon for small vendors who have been facing financial crunch since the currency ban. Earlier today, RBI raised the balance limit on digital wallets from Rs 10,000 to Rs. 20,000 for every month.