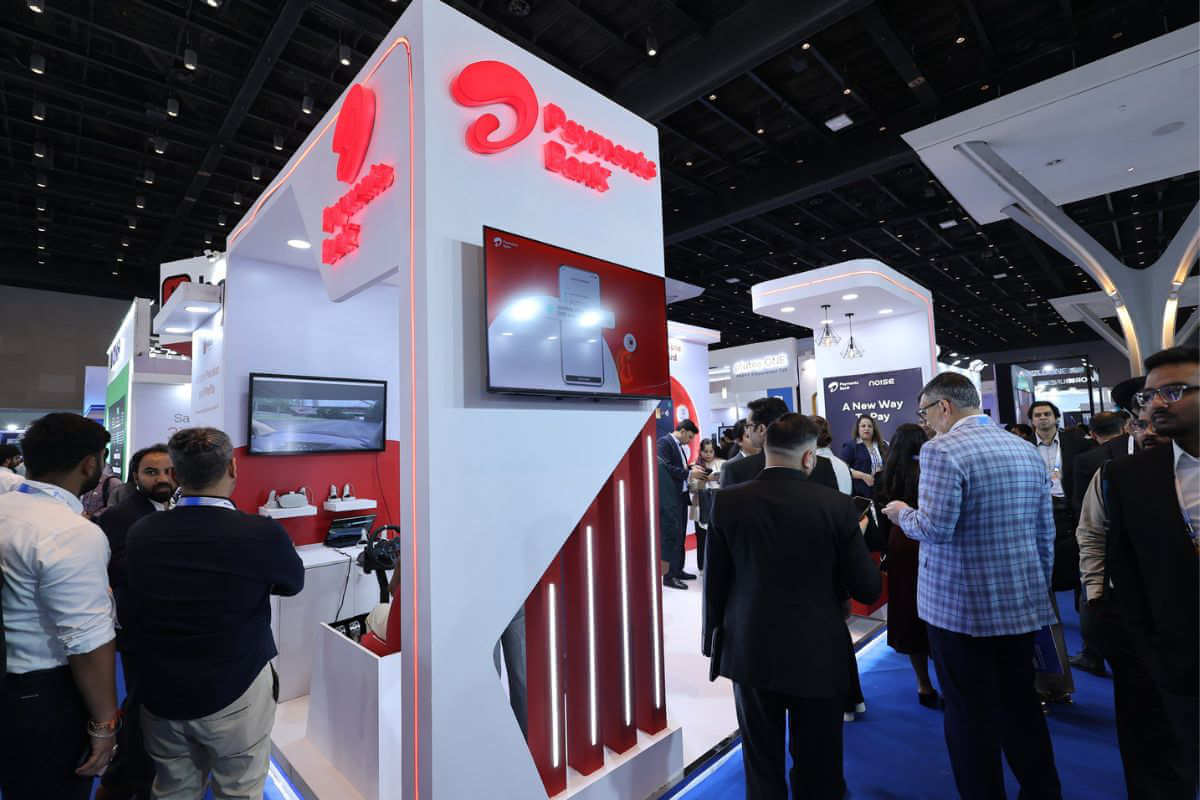

Airtel Payments Bank, the fintech arm of Bharti Airtel, participated in the Global Fintech Fest 2024, which took place from August 28 to August 30 in Mumbai. During the event, Airtel Payments Bank (APB) showcased several innovations aimed at advancing fintech in India. Let's take a look at the announcements APB made during the event:

Also Read: Airtel Payments Bank Launches NCMC-Enabled Smartwatch in Collaboration with Noise

1. Showcases Self-Reliant User Journey

Airtel Payments Bank, in partnership with the National Payments Corporation of India (NPCI), demonstrated a self-reliant user journey for NCMC-enabled cards, covering everything from issuance to card top-up and usage. NCMC stands for the National Common Mobility Card, an initiative by the Government of India to create a seamless and interoperable payment solution for various modes of transportation and other utilities. Along with NPCI and Razorpay, the bank also demonstrated personalised experiences on UPI at the event.

2. Announced NCMC-Enabled Smartwatch

Airtel Payments Bank, in collaboration with Noise and NPCI, announced the launch of its upcoming NCMC-enabled smartwatch, integrated with the RuPay chip. The bank showcased a prototype of this smartwatch at the Global Fintech Fest 2024.

With NCMC integration, users will enjoy the convenience of Tap and Pay transactions at merchant locations and NCMC-enabled transit payments across metro systems, buses, parking facilities, and more nationwide. Additionally, it supports the issuance of transport concessions and monthly passes, where applicable, by transport operators, making daily commutes hassle-free.

With this smartwatch, consumers can enter the metro with just a tap, making payments seamlessly, the bank highlighted during the event.

Read more about the announcement through the link.

3. India's Preferred Safe Second Account

Speaking to the media at the event, the CEO of Airtel Payments Bank said that Airtel Payments Bank is the first choice for India's safe second account. "We have seen a significant uptake in people applying for a digital second account. We are the largest bank in processing transit payments, with nearly a 48 percent market share across the country, especially in metros like Delhi, Mumbai, Ahmedabad, and Gujarat," the CEO said.

The bank expects that form factors for mobility payments will change and believes that mobility will be the next big theme. The bank noted that its customers appreciate the simplicity of being able to perform banking transactions easily on a single screen.

4. Two New Features in Airtel Payments Bank

The bank announced the launch of two new features on its payments platform, which it claims are firsts in India. These features are the Fraud Alarm and the Transparent Banking section.

The Fraud Alarm:

The Fraud Alarm is designed to provide immediate assistance in case of a fraudulent transaction, with just a single swipe. If customers suspect fraud, they can report the transaction with one swipe. The bank stated that a process that usually takes 4-5 steps to report fraud now happens with just one slide.

Upon sliding to report, the account gets temporarily blocked, the existing mPIN expires, an SMS is sent to reset the mPIN, a ticket is raised with the bank's fraud management team, and Airtel Payments Bank will call the customer within minutes for support.

Transparent Banking section:

And the second feature, The Transparent Banking section is designed to offer simple, easy, and honest banking with clarity in every transaction, the bank said.

Through this section, customers can see exactly what they are paying for, understand the terms and conditions, know what data is stored and why, learn how secure the data is, and understand the permissions and the reasons for them.

"Experience Trust, Safety, and Transparency with Airtel Payments Bank," the bank marketed this feature.

Also Read: Airtel Payments Bank Launches Smart Watch for Contactless Payments

5. Additional Developments

Airtel Payments Bank also enabled balance top-ups for NCMC cards in collaboration with NPCI and ISG. Additionally, the bank unveiled the new look of the NETC FASTag in partnership with NPCI and IHMCL.

These are the latest developments from Airtel Payments Bank in the digital fintech space, showcased at the Global Fintech Fest 2024.