Vodafone Idea (Vi), the third-largest telecom company in the country, has announced its quarterly reports for Q2 FY23. The telco has reported a rise in the average revenue per user (ARPU) figure, but the losses have widened, which is an alarming thing for investors. 5G rollout is still not in the near future as the telco hasn't managed to raise funds yet. Vi has been waiting for the government to convert the dues into equity, but that won't happen until the time promoters infuse more capital into the company. Let's take a look at the key things from the results that Vodafone Idea announced.

Vodafone Idea Key Metrics for Q2 FY23: ARPU, Net Income, 4G Subscribers and More

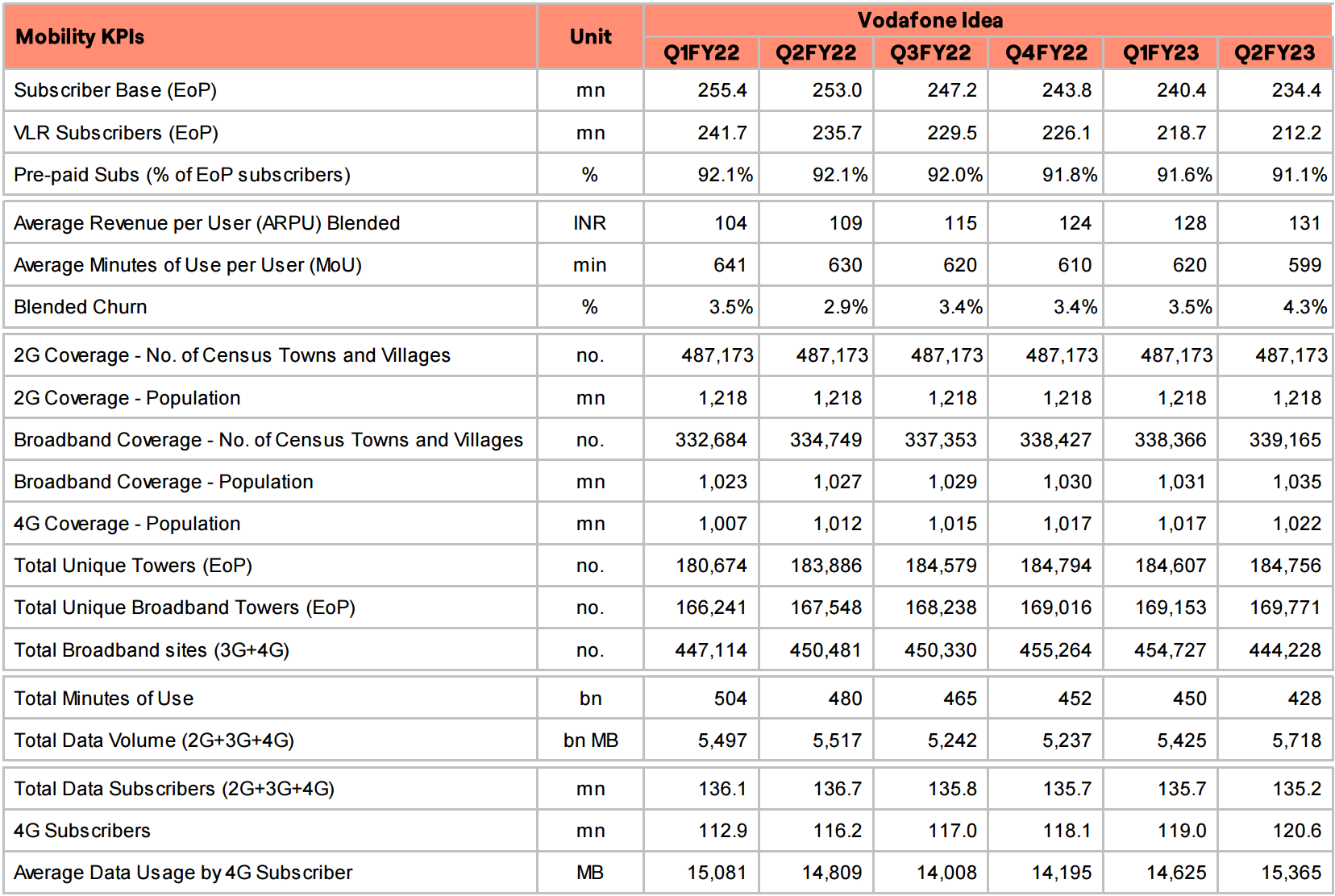

Vodafone Idea said that its ARPU has risen to Rs 131 from Rs 128 in the previous quarter. But at the same time, the telco's subscriber churn rate stands at 4.3%, which is quite high compared to the previous quarters. Vi said that it added 1.6 million new 4G subscribers as the total count of 4G users rose to 120.6 million. However, at the same time, the total subscriber base came down to 234.4 million from 240.4 million in the previous quarter. Total data subscribers also fell by 500k users. The active subscriber base came down from 218.7 million in Q1 to 212.2 million in Q2. Take a look at the table below to understand things in more depth.

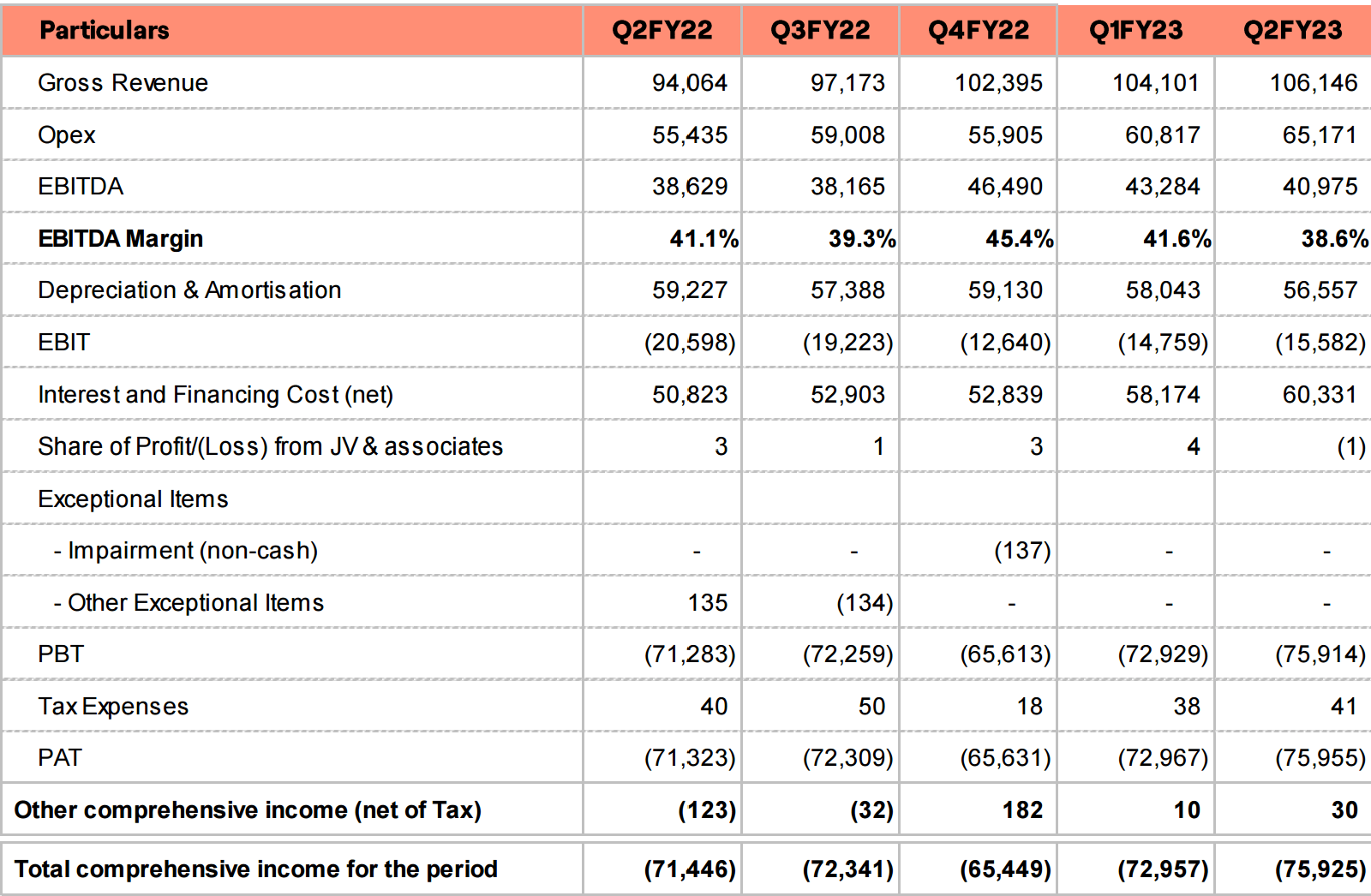

But the worst thing amongst all this is the kind of loss that the company has posted. Vodafone Idea posted a net loss of Rs 7592.5 crore during the quarter. The company's cash resources are depleting, and it has a ton of dues to pay to Indus Towers, ATC (American Tower Company) and more. Take a look at the image below to understand the financials.

Akshaya Moondra, CEO, Vodafone Idea Limited, said, “We are pleased to report fifth consecutive quarter of revenue growth and 4G subscriber addition. Such performance is primarily driven by the continued increase in 4G subscriber base on the back of superior data and voice experience offered by Vi GIGAnet. In the recently held IMC, we showcased a wide range of 5G offerings for our enterprise and consumers on the Vi 5G Live network. Our board has recently approved issuance of Optionally Convertible Debentures amounting to Rs. 16 billion to ATC India. We continue to remain engaged with our lenders and investors for further fund raising to make required investments for network expansion and 5G rollout.”

While the revenues are growing for the telco, its cash crunch situation is getting worse. Vi needs funding as soon as possible to pay off debts as well as be able to expand 4G services in the nation.