Popular PC and laptop chip manufacturer AMD or Advanced Micro Devices announced on Tuesday that it would be raising its annual revenue forecast, with the company betting on strong demand for its chips used in both personal computers and data centres.

This comes after a lacklustre year for the company’s primary competitor, intel, which failed to offer equally good chips at the same price, with AMD besting intel multiple times over the course of 2020.

What Does The Company Have To Say?

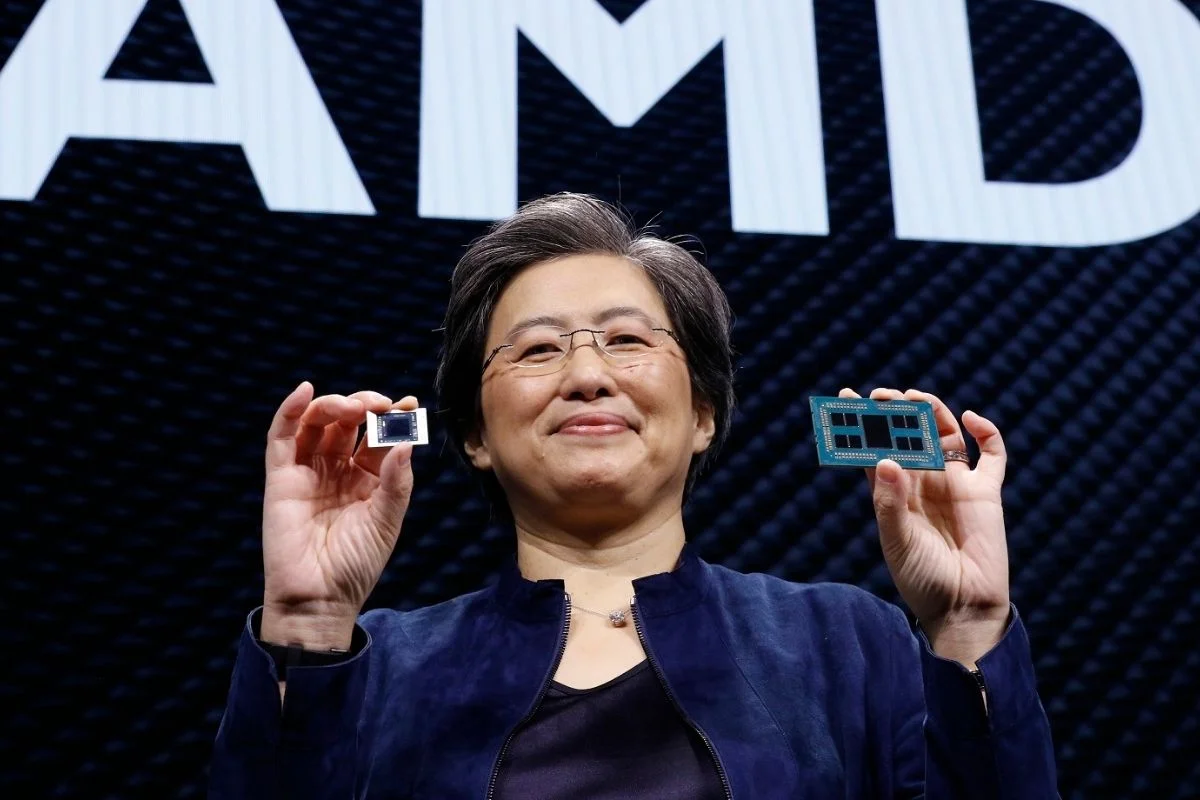

The CEO of AMD, Lisa Su, said that she was happy and confident that the company would be able to source chips despite the ongoing supply shortage, which has affected not only local markets but global sales as well.

To add to the good news factor, the chip designer saw a 4% rise for its shares during extended trading post announcement of a better than expected result for the first quarter in terms of overall sales. Ms Su mentioned that AMD had good visibility into being able to get additional chips through its manufacturing partners.

According to a statement offered to analysts by Ms Su, the entire semiconductor supply chain is supposedly very tight. To tackle this, AMD has been working very closely with its supply partners, observing improvements that have led to an overall improvement guide for the entirety of the year.

One of the key reasons for AMD’s success is the surge in demand for the company’s graphics chips, a pivotal component that saw more sales due to gamers becoming more active and upgrading their older rigs during the Covid-19 pandemic.

As per the chip maker, it now expects its 2021 revenue to rise 50% in comparison to 2020, at a figure of $14.64 billion in comparison to the prior forecast of a rise of 39%.

In terms of the revenue during the first quarter, it soared to 93% to reach $3.45 Billion, beating out the estimate of $3.21 billion due to the higher selling price (on average) for its chips.

In regards to this, Ms Su said that she felt very good about this progress, especially for notebooks. The company is seeing traction within the premium ultrathin, commercial and gaming notebook markets.

To add to all of this, the company’s enterprise, embedded and semi-custom segment, which is a unit housing data centre chips, posted a jump in sales to reach $1.35 billion.

If one excludes the items, the company saw an earning of 52 cents per share, in contrast to the forecasted 44 cents.