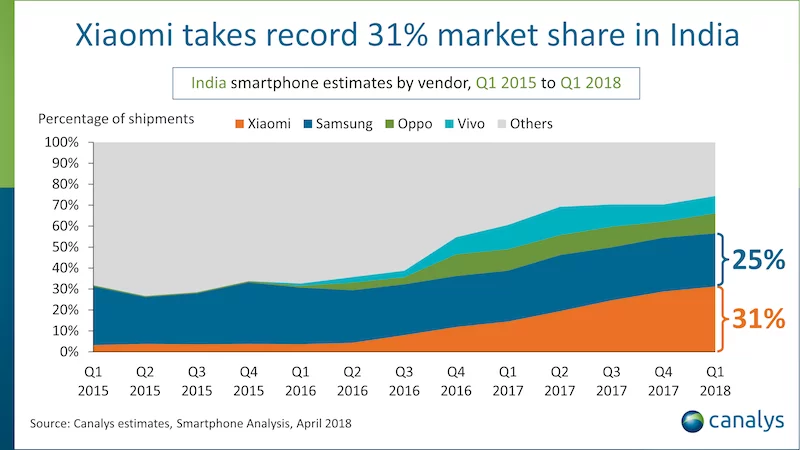

Xiaomi has shown no signs of slowing down in India as the Chinese smartphone vendor registered an impressive 155% annual shipment growth, extending the lead for the No 1 position. In the first quarter of 2018, Xiaomi shipped over nine million units, which amassed the firm a market share of just over 31%. As per research firm Canalys, this is the first time since Q1 2014 a vendor has secured over 30% market share in the country. Back then, Samsung had a market share of 33%, and at the moment, Xiaomi is widening the gap between itself and the South Korean giant Samsung, which secured a market share of 25%. Samsung shipped just under 7.5 million smartphones and grew by 24% on last year. Oppo took the third place with 2.8 million shipments and Vivo fourth with 2.1 million shipments. Overall, the smartphone market in India grew at 8% to 29.5 million units for the quarter.

Earlier, the challenge for Xiaomi was to supply adequate stocks, which is not an issue right now as some of Xiaomi's best devices can be purchased in more places and that too in larger quantities. “Xiaomi is becoming a force to be reckoned with in India,” said Canalys Research Analyst Ishan Dutt. He also added that Xiaomi's product and channel strategies are working very well for the company.

The recently launched Redmi 5 and Redmi Note 5 smartphones are have seen runaway success as per the firm. However, the massive growth for Xiaomi arrived with the Redmi 5A which was sold in a massive number of 3.5 million. Since the start of 2018, Xiaomi sold over 3.5 million units of Redmi 5A in India until March 31, 2018. In comparison, Samsung’s best-selling device, the Samsung Galaxy J7 Nxt, shipped just 1.5 million units revealed Canalys.

Furthermore, Canalys report added that the market also continues to consolidate, with smaller vendors finding it extremely difficult to succeed in the face of Xiaomi’s growing prominence. The top four vendors accounted for about 75% of all smartphone shipments to India, with Xiaomi and Samsung accounting for 56%.

The report further added that smaller vendors such as Lenovo and Gionee are facing the pressure of profitability, which has forced them to relook at their Indian strategies. In Q1 2018, Lenovo' smartphone shipments were down by 60% YoY with the overall shipments just short of a million units. Another Chinese brand Gionee shipped an all-time low of 150,000 units with shipments down by 90% YoY.

“Local production, offline channel expansion, and huge advertising and marketing costs are weighing down the smartphone vendors. And India’s inability to move quickly to a high-value market has only hurt them further,” said Canalys Research Manager Rushabh Doshi.

The Canalys report did not mention anything about the Redmi Note 5 Pro's numbers, which further confirms the struggles faced by Xiaomi to provide enough stocks for the smartphone. It will be interesting to see how Q2 2018 folds for the smartphone brands. This time around, Xiaomi will receive immense competition from Asus, which recently launched the Zenfone Max Pro M1 smartphone.