Vodafone Idea (Vi) has just released the performance reports for Q1 FY23. The telco said that its revenues grew to Rs 104.1 billion, a QoQ growth of 1.7% and 13.7% YoY growth. The average revenue per user (ARPU) of the telco jumped to Rs 128 during the quarter. This is a 23.4% YoY jump in ARPU as the figure stood at Rs 104 in Q1 FY22. Vi said that it continued network capacity expansion supported by spectrum reforming and network upgrade to 4G.

Vodafone Idea Performance in Q1 FY23 - Key Metrics

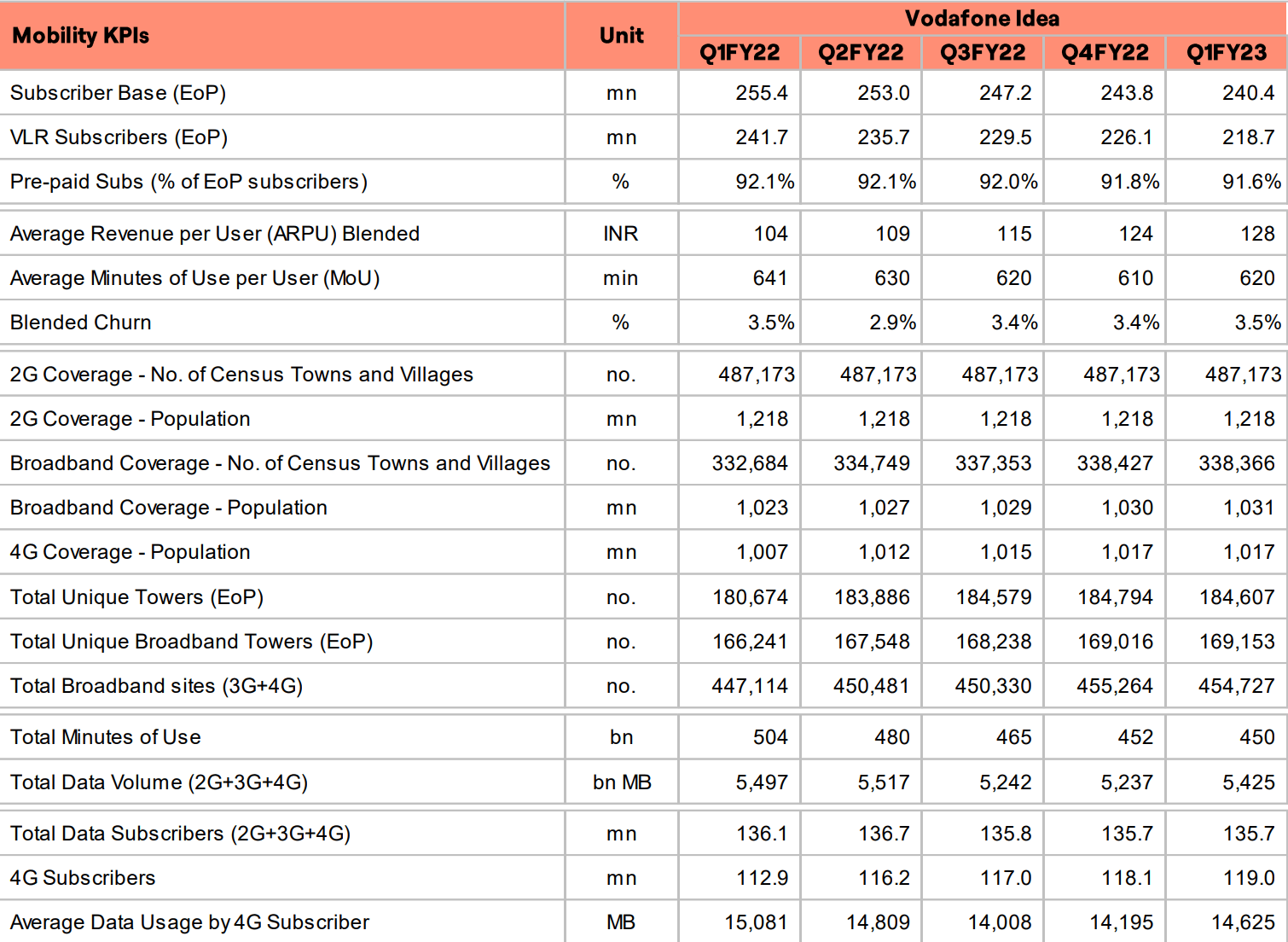

The subscriber base of Vodafone Idea declined from 243.8 million in Q4 FY22 to 240.4 million in Q1 FY23. The telco's VLR subscribers also declined from 226.1 million to 218.7 million QoQ. The blended ARPU grew from Rs 124 to Rs 128 QoQ, which is not that big a difference.

However, the average minutes of use per user (MoU) increased from 610 in QY FY22 to 620 in Q1 FY23. The blended subscriber churn rate increased to 3.5% in Q1 FY23 from 3.4% in the previous quarter.

In terms of population, the 4G coverage is still at the same figure, which is 1017 million users. What's worth noting is that Vi's total broadband sites decreased from 455,264 million to 454,727 million in Q1 FY23. Vodafone Idea said that it shut down 3,100 3G sites during the quarter while it added 2,600 4G sites.

One positive that Vi will take out from these results is that its 4G subscribers went up from 118.1 million to 119 million QoQ. Average data usage by 4G subscribers also grew to 14,625MB in Q1 FY23 as compared to 14,195MB in the previous quarter. Take a detailed look at the metrics below.

Vodafone Idea Capex Spends Reduced

The capex spend of Vodafone Idea for Q1 FY23 was Rs 8.4 billion, while it was Rs 12.1 billion in Q4 FY22. The decline in capex spending could be because of liquidity issues. But this is one of the biggest limiting factors for Vi when it comes to competing with Airtel and Jio. The total gross debt of the company stood at Rs 1,990.8 billion as of June 30, 2022.

Ravinder Takkar, MD & CEO of Vodafone Idea Limited, said, “We are pleased to announce the fourth consecutive quarter of revenue growth. We continue to witness 4G subscriber growth on the back of superior data and voice experience offered by Vi GIGAnet as well as due to our focus on creating differentiated digital experience for our customers. In the recently concluded spectrum auction, we have acquired sufficient spectrum in our key markets to offer superior 5G experience to our customers. We also completed the first tranche of fund raising in the form of preferential equity contribution of ~Rs. 49.4 billion from our promoters, including the incremental infusion of ~Rs. 4.4 billion by Vodafone Group in July 2022. We continue to remain engaged with lenders and investors for further fundraising.”