CyberMedia Research (CMR), today released the numbers for India Mobile Handset Market for 1st six months of 2017. In the report, CMR said that several Chinese brands like Xiaomi, Lenovo, Vivo, Oppo and iTel have shown growth in the range of 7–33% in smartphones (iTel being the exception with growth of 293% on a small unit base), the focus is now all about competition among these brands to occupy the leading positions in the market.

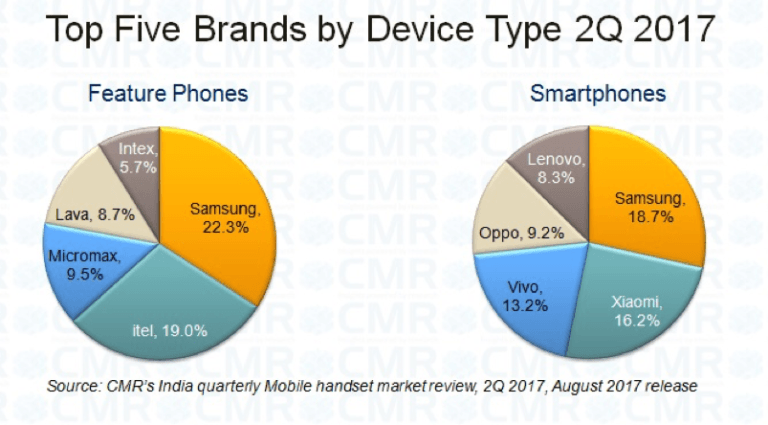

As per the report, a total of 61.8 million mobiles were shipped in the 2Q 2017, of which 54% were feature phones witnessing 9% sequential growth. As the Jio Phone launch looms the prospects of feature phone as well as entry-level smartphones, brands aligned to these markets pushed the shipments in wake of anticipated contraction of the market due to JioPhone availability in 3Q 2017, and beyond.

Chinese brand Xiaomi is one of the ace performers in the quarter not only taking to No. 2 in the smartphone market in India but also contributing to the revival of Rs. 4000 – Rs. 6000 price segment of the market. The segment witnessed 55% growth sequentially. CMR believes that going forward, the entry level smartphone market will see a lot more action for a few quarters from now onwards.

Thomas George, SVP & Head CMR while sharing some insights of the report said, “As Smartphones complete its first decade in India, Samsung will continue to enjoy the market leadership, 6th time in a row. He, however, cautioned that though it will continue to leverage the offline physical reach and access, there has to be a clusterised strategy for each of the geo-markets in the country Samsung will have to adapt.”

The price segment of Rs. 8000 – Rs. 10000 should also see some upward trend as a lot of 3G owners would want to go for a 4G upgrade. At present of estimated 350 million smartphone users, 150-160 million have a 4G smartphone opening up a huge opportunity for sub Rs. 10,000 price category 4G smartphones. This will be targeting late adopters as well as the technology laggards.

Foxconn owned Rising Star India Pvt. Ltd., overtook Samsung as the No. 1 ODM for Smartphones making phones in India. However, Samsung continues to be the overall leader ODM in the country.

While camera will continue to be the focus component in coming quarters as well due to its increasing significance of becoming the default input and content creation device, the security hardening at the hardware level will also be the prime focus of the handset makers. CMR believes smartphones with biometric security features will see an increase in shipments.

At the same time, Android-powered smartphones contribute over 95% of the shipments, it becomes very important that users have the latest OS version on their devices as dependency on smartphones for financial transactions, IoT, etc. is on rising. Though a good sign is that in 2Q 2017, 73% of 4G smartphones were having Android 6.0 Marshmallow or later version, the OS is still fragmented across the installed base. The affordable smartphones are generally equipped with Latest -2 OS version and the handset makers rarely upgrade it to the latest versions. This could cause serious security loopholes and jeopardise the data integrity of users on their smartphones.

CMR believes that the market will be pretty flat for CY 2017; however, there should be a replacement of certain volumes of feature phones as well as smartphones for a 4G feature phone. This could impact volume sales of feature phones in the range of 25-30% and for smartphones, the offset could be 5-6% for the calendar year.