Reliance Jio has increased the tariff prices in October 2017, and they're now almost on par with incumbent telecom operators tariff plans. On the back of the same, the numbers released by Trai for the month of October 2017 do not have good news for Jio, who is often regarded as the disruptor operator. That said, tariff plans from incumbent operators are yeilding good results, which is the primary reason for Jio' subscriber addition slowdown.

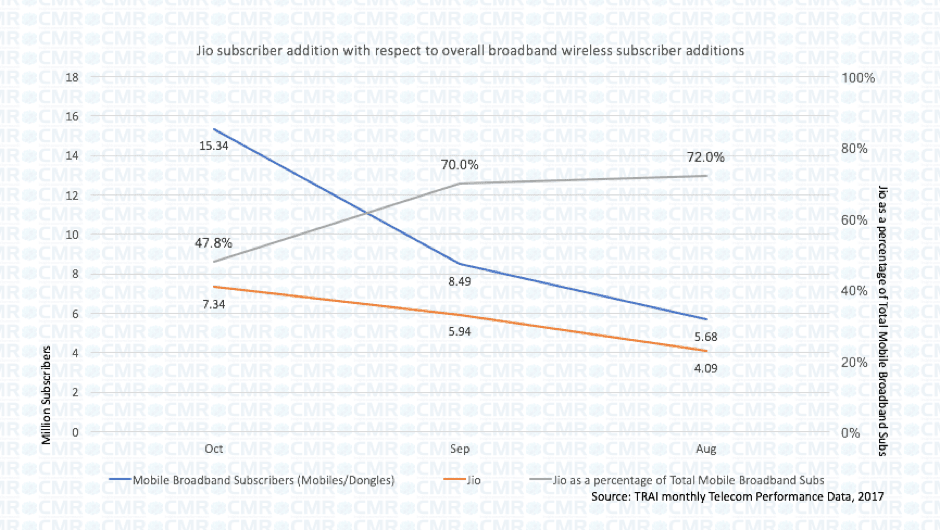

The Mukesh Ambani-led Reliance Jio has added 24% subscribers in October 2017 compared to September 2017, while the overall mobile broadband subscribers added during the period saw an increase of 81%.

"This means incumbents have been able to resurrect in the mobile broadband space. Though, just a small period to analyse, it could be an early warning indicator for Jio that things are not working in the right direction for them," CMR India said in its viewpoint release today.

In the previous two months of August and September, Reliance Jio subscriber addition was over 70% of the total monthly mobile broadband subscribers added, which has now gone down to less than half- 48% in October 2017. This essentially means that the sharp increase in the mobile broadband subscribers in October is not because of Jio after so many months, but this time the incumbents are credited with the addition.

CMR viewpoint further stated that the increase in the subscribers by incumbents indicate that the counter offers have started to show good results. As a result, they were able to add subscribers even in the 4G space, that is dominated by Jio otherwise, thanks to its LTE-only network. CMR is also expecting that the bundled smartphone offers from players such as Airtel, Vodafone, and BSNL are expected to help the operators going forward.

When it comes to devices perspective, Xiaomi was the biggest driver of smartphones in the July-September 2017 quarters, and also the increase in October new subscribers would be largely from Xiaomi buyers. "This also indicates that typical Jio users are not buying online and such customer segments prefer to go with the incumbents like Airtel and Vodafone," added the report.

Furthermore, the Jio offer of Rs 1,000 discount on Xiaomi Redmi 5A might help in bring more of Xiaomi profile users on the network. But to add more Xiaomi users on the board, the company has to increase the offers, as said by CMR.

Lastly, CMR suggests that Jio should have a long-term gain in the game and they have to strategise to reorient themselves as being a first preference rather as an affordable alternative.