Back on November 8, 2016, our honourable Prime Minister, Narendra Modi announced the devaluation of high-valued notes (Rs. 500 and Rs. 1000), which accounted in a huge cash crunch situation across the country. Narendra Modi made this move to fight against corruption in the country, and that's a good move.

To compete with the private digital payment services, Indian Government announced the BHIM app based on the Unified Payments Interface (UPI) in December 2016. UPI is a payments platform that is built of IMPS (Immediate Payment Service) system, but it relies on a unique address of a user, which is known as 'Virtual Private Address,' to transfer/receive funds. The BHIM app was a massive success in the country, but to make any payment with the app, you need to carry a smartphone alongside you, which has become a hassle for many and in India, there are a lot of people without smartphones in rural areas.

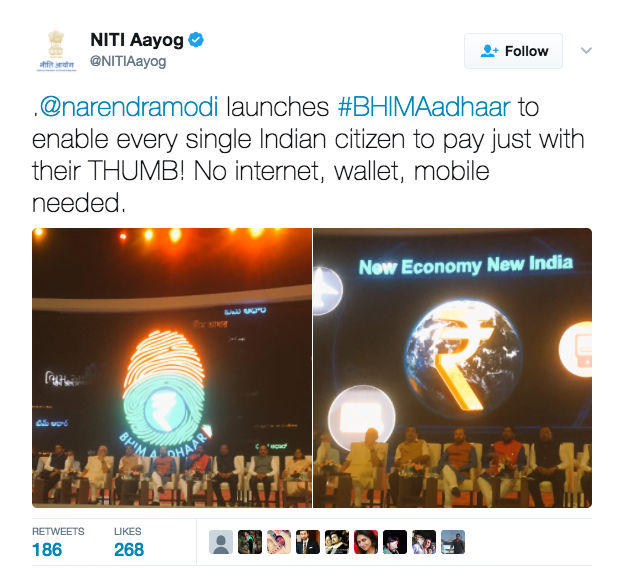

To solve that issue, the Government of India has come up with yet another app, called as BHIM Aadhaar. On the occasion of Dr Bhimrao Ambedkar's 126th birth anniversary, our PM Narendra Modi announced the new BHIM Aadhaar app at a summit in Nagpur. So, what is BHIM Aadhaar in the first place and how is it different from the earlier BHIM app?

Well, here's the answer. The BHIM Aadhaar app is exclusively designed for merchants. And with the new service, any Indian citizen who is a holder of bank account and Aadhar card can make cashless payments. The BHIM Aadhaar service doesn't require any smartphone; all you need is a bank account and Indian Aadhaar card.

The merchant should have BHIM Aadhar app installed on his phone along with a fingerprint authenticator. At the time of payment, the customer should select his bank account and enter his 12 digit Aadhaar card number in the app, and after that, he should scan his fingerprint to make the payment. That's it. The payment will be carried out without any barcode scan or QR code scan and importantly without the need for a smartphone.

However, for carrying a transaction, you should first register your fingerprint at the bank. Currently, 27 banks of India along with 3,00,000 merchants are under the platform. Also, Government is using the tagline as ‘New India, New Economy,’ for the application.