Size of Active Indian Mobile market is much smaller than what actually it reflects.

Size of Active Indian Mobile market is much smaller than what actually it reflects.

According to latest report published by TRAI almost a third of Indian subscribers are classified as inactive.

TRAI started tracking mobile data based on what’s called the visitor location register (VLR) last December and has since maintained a monthly log record to mark a distinction between active and non-active users.

The VLR contains a copy of the records of all subscribers that are currently in the geographic area covered by a mobile switching centre (MSC.) It is, however, temporary data which exists for only as long as the subscriber is “active” in the particular area covered by the VLR.

What this means:

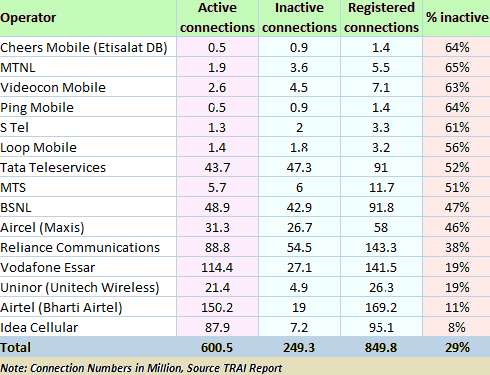

This means that almost 30% of total Subscriber base reported by Telecom operators to TRAI is Redundant/Inactive. Almost 250 Million Subscribers are inactive out of total 850 Million reported, which in other terms means 600 Million of Subscriber base is revised active market size. India’s Redundant/inactive subscriber base is almost equivalent to total major telecom market size of Russia & Brazil.

This statistics comes at a time when Indian Telecom Industry is jeopardize by fierce price/tariff war directly affecting profitability and operators are shifting their focus to redefine their existing business models to Customer Retention, offering personalized Value Added services & expanding Rural reach. (Pls. refer my previous article for more details –“Indian Telecom Industry – Redefining Business Models”)

Intense Price war has been the major propellant which fuelled subscriber growth to rocketing heights in past couple of years in India. Operators are now geared up to change their strategies to sustain their market share and profitability.

Based on the revised Active market size India’s mobile penetration rate comes down drastically from 68% to 48%, which in other terms means an amble number of opportunities are still untapped and will drive Indian telecom success story further in future.

Why this happened:

1. This market revaluation exercise is triggered by a rule change by TRAI for the activity period allowed to prepaid users. Initially it was a period of 180 days wherein a user was suppose to do a recharge or Place/receive a call over his card to be considered as a Active user, which was brought down to 90 days in 2010 and now it is been reduced to only 20 days. TRAI is measuring number of active subscribers VLR methodology. VLR data is calculated based on the date of Peak VLR of the particular month and gauged from the switches having a purge time of not more than 72 hours.

2. Another prominent reason behind this exercise is severe strain on the National Number Plan designed in 2003. Plan was designed for 750 million connections including 450 million for Mobile users; however Indian Mobile industry surpassed this number in mid 2009 itself. Hence the Regulator decided to allocate numbers to only Active subscriber base. According to Government forecast Mobile subscribers are likely to cross 1 billion mark by 2013, however under current numbering scheme there are not enough numbers available to allocate to the users.

Effects – Operators, Circles & Overall Teledensity :

Etisalat DB's Cheers Mobile and state-owned MTNL are two operators found to have the highest proportion of inactive subscribers at 65% of their Subscriber base.

They are closely followed by Videocon Mobile (64%) and S Tel (61%). India's largest mobile operators (BIG BOYS), by contrast, have proportionately fewer inactive subscribers. Only 11% of market-leader Bharti Airtel's 169.2 million connections are classified as inactive.

Fourth-placed Idea Cellular has outperformed all the 15 Indian operators by having the lowest inactive base at only 8%.

In terms of India's individual telecoms circles, Mumbai has the highest share of inactive subscribers (43%), while Jammu & Kashmir has the highest share of active VLR subscribers (80%), closely followed by Assam (76%) and Maharashtra (74%). These regional trends reflect the high level of saturation in Indian urban areas, which represent two thirds of the country's connections base, yet only a third of the country's total population.

Mobile penetration in urban areas - as reported by operators - reached 156% in Q2 2011, however, using the new active connections definition, Urban penetration can be estimated at 110%.

Between Jan’11 to Jun’11 TRAI reported that rural penetration increased by a mere 2% to 35%, adding 16 million connections, while urban penetration has increased by 6% to 156%, adding 24 million connections. At this rate, it is expected that rural India will cross 100% mobile penetration in 2020, by taking almost 8 years to connect around 600 million rural consumers

Growth, Revenue & Way forward:

Mobile market growth & network expansion –are dependent on the sector returning to profitability mode. The recent price war, which caused a 'revenue gap' as Income growth failed as estimated by acquiring higher subscribers. According to the TRAI's report, total revenue from India's telecom sector grew by less than 4% year-on-year in 2009 after years of double-digit growth.

There was a regain last year, as revenues grew 8%, but non-voice services currently contribute only 11% of revenues which is directly impacting ROIs. ARPU has fallen to Rs. 120 this year from Rs. 350 five years ago, and the effective-price-per-minute (EPPM) has sunk to a world record low of Rs. 0.42.

Following the urgent need to meet profitability targets in order to generate ROIs and finance network expansion and improvements, operators have recently decided to cease the price war activities in a bid to ease margin pressure.

As per wirelessintelligence.com in June’11, Tata Docomo increased its tariffs in Tamil Nadu, followed by Bharti Airtel, which increased its 'Advantage' tariffs by INR0.10 per minute (to INR0.60) and its 'Freedom' tariffs by INR0.002 per second (to INR0.012) across several circles.

Such price rises reflect the fact that the rock-bottom low pricing levels in the country were unsustainable and that for operators to make the required investments to finance daily activities and meet coverage targets for both rural demand and 3G services necessitated a strong strategic change.

Snapshot of Subscriber Base with Inactive%:

Inputs from wirelessintelligence.com for a detailed report click here .

About the Author:

Tejas Dave is Regional Telecom Research/Business Analyst associated with one of the leading Telecom Operator in India. Previously he has worked with other Telecom operators and Worlds Largest Tower company. His role primarily gives him an opportunity to closely work with senior leaders of the Company,Industry and Government. He is also associated with Academic and professional organisations like WB India,World Economics Association,IDEAs & AMA.