Earlier this year, digital payment major, Paytm launched its Payments Bank with features at par with a traditional bank in the country. Paytm, in May 2017, said that the Payments Bank will be live for customers later this year. All these days, Paytm took interest from customers who're looking for a saving account in its Payments Bank.

However, the Paytm Payments Bank is now live for the customers across India. Although, the service has been made live only in the Paytm Beta app. Yes, you heard it right. Paytm users who want to open a savings account in the Paytm Payments Bank should download the beta version of the Paytm app of version 6.0.

Also, do make a note that a user can open a savings account in Paytm Payments Bank only if he's a verified user by Paytm. The user must have verified his Aadhaar card and PAN card before opening a savings account. If your account is not KYC verified, then the Payments Bank won't show up in the application.

I have downloaded the application (Paytm beta v6.0) and am already a KYC verified user of Paytm. So, the application successfully allowed me to open a savings account without any hassle.

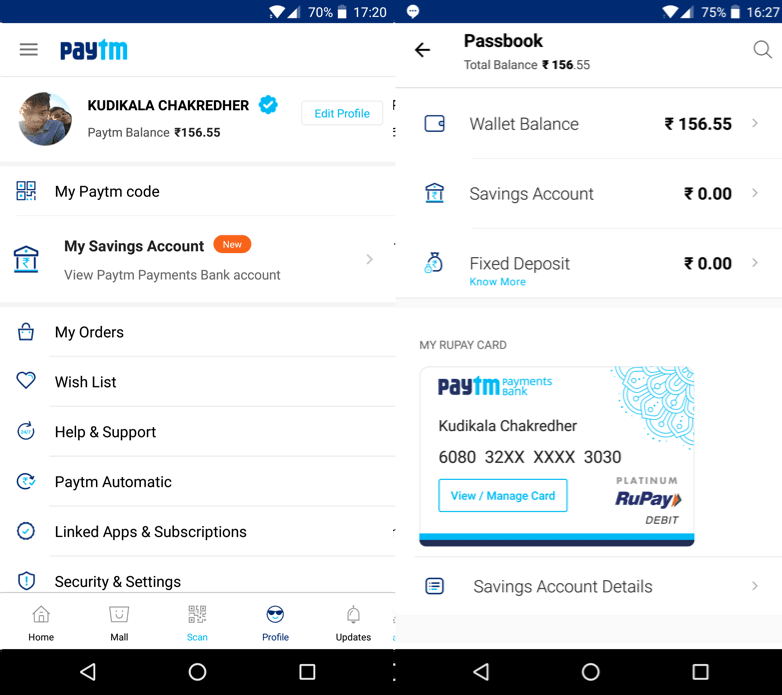

So, right after installing the Paytm beta v6.0 application, log in with your credentials, and head over to the profile section. In the profile section, you can clearly see the My Savings Account menu. Just hit that and follow the steps.

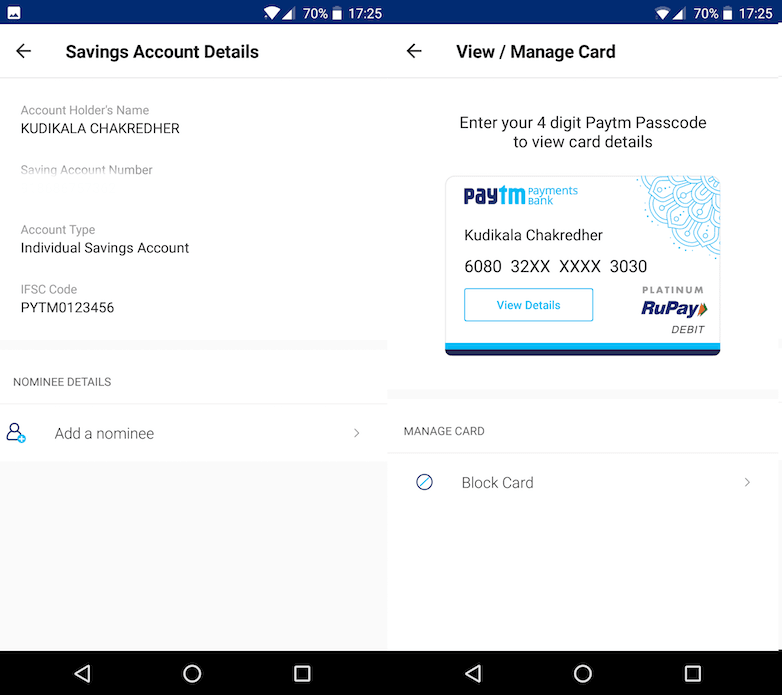

After going through all the steps, your Paytm Payments Bank savings account will be successfully created, and you will be assigned a virtual Paytm Payments Bank RUPAY card. Having said that, the savings account number is your mobile number.

In the Payments Bank section, there are three tabs- summary (which shows the entire paytm summary), Wallet (paytm wallet summary), and Savings Account (which shows all the related info about the Paytm Savings account).

It is a bit surprising that Paytm did not merge the wallet and savings account, even though I notified Paytm to merge wallet and savings account in May 2017. Paytm confirmed that Paytm wallet business will merge into Paytm Payments Account, meaning all your money will be moved to the savings account.

Moreover, when we tried to use the assigned RUPAY debit card of Payments Bank, the transaction was unsuccessful. Maybe the company is still working on the virtual debit card feature. In addition, it seems like the feature is still in beta stages, and the company did not reveal anything about the roll out of Payments Bank service to the public as of now.

Besides this, Paytm Payment Bank will be offering 4% interest rate and cashback on deposits, zero fees on online transactions and zero minimum balance. The company is targeting to acquire 500 million customers by 2020.

As of now, there's no info on whether Paytm is opening KYC centres to make it easier for customers in opening a savings account. Paytm plans to offer current accounts facility to merchants. It plans to open 31 branches and 3,000 service points in the first year itself.