The Indian telecom industry, which struggled a lot due to issues like 2G scam, regulatory uncertainty, and debt over last few years, finally saw a bright light in the year 2015. This year was indeed an exciting one for the telecom industry, and it saw the biggest ever spectrum auction, followed by the spectrum trading and sharing policy.

The telecom market also observed the launch of mass-market 4G services by India’s leading telco, Bharti Airtel, while Vodafone and Idea joined this race just a few days back. Reliance Jio launched its 4G LTE services as well, but it's still limited for its employees (finally). The telecom infrastructure is also improving rapidly with telcos increasing investments in this regard, which is not only helping them in serving customers better, but also in building a backbone for PM Narendra Modi’s Digital India project.

We bring you the highlights of Indian telecom industry in 2015

Spectrum Auction

The biggest ever telecom spectrum auction in India took place this year. After 19 days and 115 rounds of fierce bidding in four bands, the auction managed to fetch $17.6 billion to the government. Eight telecom firms fought for 20-year spectrum licence across four bands and 22 circles. The major highlight of the February auction was the battle for the renewal of spectrum licence in the 900 MHz band, with Bharti Airtel, Vodafone and Idea Cellular clinging to their turfs. Reliance Communications was the biggest loser, while Reliance Jio solidified its presence in the 4G market with the new circle wins in the 1800 MHz/800 MHz bands.

Spectrum Trading and Sharing

In India, unlike other countries, the spectrum availability is relatively small. Therefore, spectrum sharing and trading were necessary steps to make up for the inadequacy. In India, spectrum has been lying unutilised with some of the players while other operators (incumbents) faced spectrum crunch as they grew quickly.

The nod from the Indian government came as a breather for bigger telecom operators that were seeking to grow further, and for smaller ones that were looking to monetise their spectrum assets, and reduce debts. Videocon and Tikona were some of the smaller players that were looking to monetize their spectrum assets via sharing and trading routes. We expect to see more trading and sharing deals in 2016.

Mass Market 4G

The year 2015 is a stepping stone towards the world-class mass-market 4G LTE services in the country. The industry observed 4G services launch by Bharti Airtel in over 300 towns a few months back, which is being further expanded by the telco. Vodafone and Idea Cellular joined the race as well by launching limited 4G services in India. Both the telcos will expand their high-speed wireless data service in 2016.

The India industry however is at a cusp of a digital revolution, according to Mukesh Ambani, whose telecom venture Reliance Jio will launch commercial services starting early next year. Jio certainly is going to be the telco to watch out for in 2016, as it looks to disrupt the market with never-seen before data tariffs.

The Call Drop Menace

After the introduction of mobile telephony in India, 2015 was the first year when the Communications and IT Ministry took an aggressive approach to criticise the state of quality of service, call drops to be precise. The over-the-top push from the Telecom Minister, Ravi Shankar Prasad, on call drops was also the main reason.

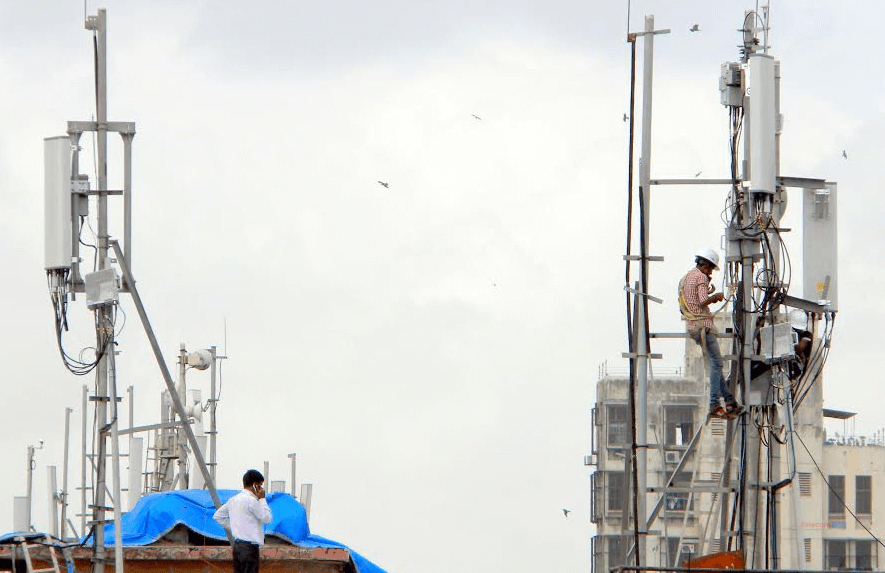

The government’s focus on call drops not just helped telcos to address the radiation related challenge, but allowed them to expand their network by adding more cell sites, which was not possible earlier due to Right of Way (RoW) issues. However, the industry and the government have locked horns over the issue of call drops compensation to customers, recommended by the Indian regulator.

Consolidation

The industry has seen a number of announcements by bigger telcos as they look to prepare for a stiff competition in the 4G space. Bharti Airtel acquired Augere, while RCom announced merger with Sistema Shyam Teleservices, and talks with Aircel for a three-way merger. Players like Vodafone and Idea Cellular however are looking to grow in the 4G space through spectrum and trading route.

Consolidation also happened in the tower infrastructure space. American Tower Corp (ATC) acquired 51% stake in Viom Networks, and also bought tower assets of KEC. Further, Reliance Communications also divested its tower assets recently, while BSNL received the cabinet approval to hive off its tower assets into a separate company.

Also read: Year 2015 in Review: How smartphone brands fared in India this year

Net-Neutrality

The dust of the net-neutrality storm is yet to settle in the country. The year started with the debate around Bharti Airtel’s Zero rating platform, called Airtel Zero, while discussions are still on the legality of social networking major Facebook’s Free Basics or Internet.org program. The country's telecom regulator, TRAI, is currently inviting submission of comments on its consultation paper on differential data pricing, and it has extended the last date to January 7 from December 30. The issue will continue to be the newsmaker of 2016.