We all know that the Indian smartphone market is booming, and is one of the fastest growing markets in the world. However, IDC claims that smartphone sales in the country declined during Q4 2014, which is an unusual phenomenon.

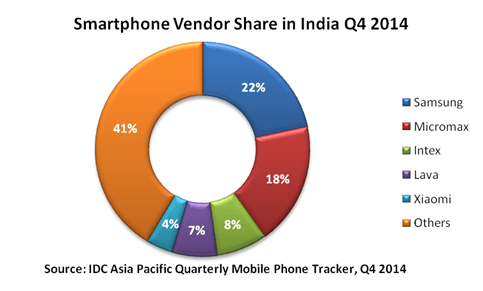

According to IDC's Asia Pacific Quarterly Mobile Phone Tracker for Q4 2014, the smartphone market declined by 4 percent (quarter on quarter basis). However, the research firm reasons this to high channel inventory at the beginning of the quarter amongst general trade, which was in turn caused by surge witnessed in online sales during the festive season. Samsung still stood as the largest smartphone brand in India with a market share of 22 percent, followed by Micromax who managed to grab a market share of 18 percent. Intex, Lava, and Xiaomi had market share of 8 percent, 7 percent and 4 percent respectively.

Operators are gearing up for the 4G network rollout. For vendors and ecosystem partners, greater emphasis on 4G enabled handsets at competitive price points will be the order of the day. End-users’ desire to upgrade and keep abreast with the latest technology will continue to drive strong growth for the smartphone market throughout the course of 2015.

– Kiran Kumar, Research Manager of Client Devices at IDC India

The overall mobile phone market in the country fell by 11 percent (quarter on quarter basis) to 64.3 million units, while the decline stood at 5 percent annually. When you combine feature phones into the metrics, Samsung still leads the sales with a market share of 17 percent, followed by Micromax with a market share of 15 percent.

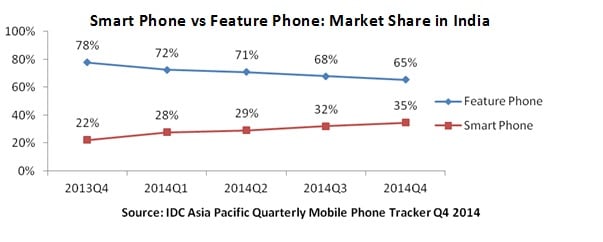

We can also clearly see that the smartphone sales are rising, while popularity of feature phones is decreasing. Of all the mobile phones sold in India, 35 percent were smartphones while 65 percent of them were feature phones.

In the current market scenario there is a drive in demand for products pitched with high specifications at low price points. This trend is likely to continue over the next four to 6 quarters, after which consumers are expected to turn back to the handset vendors who charge premium for quality.

– Karan Thakkar, Senior Market Analyst, IDC India.