Though we like it or not, we end up contacting customer care numbers of various brands whenever we face issues. This one call often turns out to be a frustrating experience thanks to the IVR Systems.

The Present Situation

Let's take an example of a customer who is facing issues w.r.t. a failed bank transaction and calls up customer care. The typical workflow of the bank's IVRS would be -

- Thank you for calling...

- Choose your language (and the system goes on to declare all the available languages)

- If you have a card or account number press 1 or else 2. If this is a yes, navigation to Mobile PIN.

- The next level would describe various child options but mostly none would be allowing to directly talk to an agent

- For card blocking

- For net banking

- For investment queries

- ...

Needless to say, each of the child options would have more child and grandchild options. After careful selection of options, reaching a support agent would mean prolonged wait times. During peak hours, this can extend to several minutes. Telcom companies' IVR Systems are no different. My colleague, Srikapardhi had published detailed analysis back in 2013 (the options may have changed significantly now) - Detailed Analysis on Customer Care IVR of Vodafone (Infographic), Detailed Analysis on Customer Care IVR of Airtel ( Infographic )

Again, if it's a poorly implemented IVR system, it won't take a key press until the system has finished declaring all the available options. :(

The Result

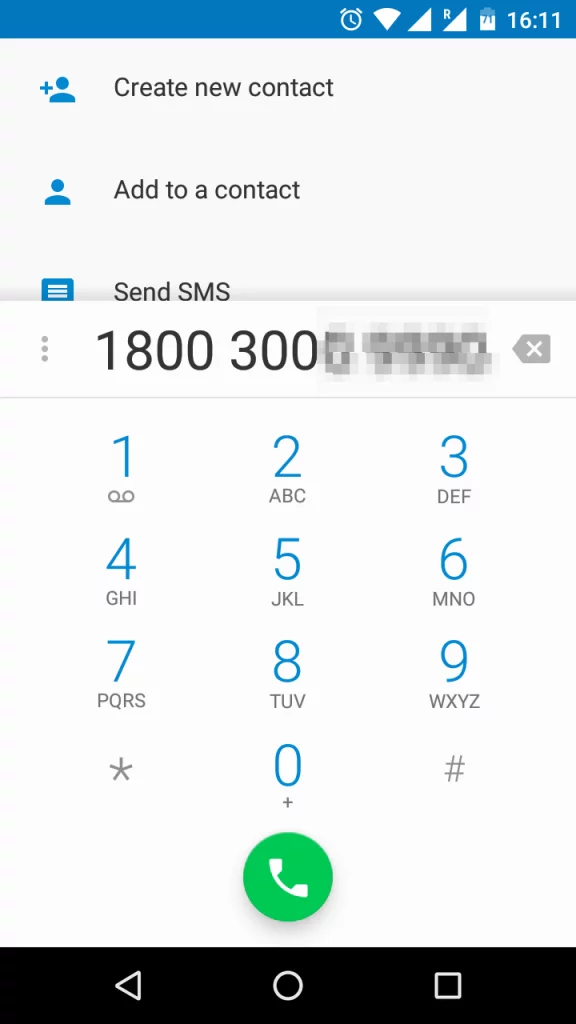

Frustration plus time and money lost. Every second counts for consumers, thanks to per-second billing and more and more brands ditching the 1800 series toll-free customer care numbers only to be replaced with 1860 series paid numbers.

If your call disconnects or you miss some option or press a wrong button in between, good luck! You will have to start all over again. When you are an occasional caller, it becomes even more difficult since the options change almost every time and you will have to listen to the instructions.

Possible Solutions

Despite significant developments in customer data analytics, artificial intelligence and CRM Systems, the IVR systems have remained more or less the same. Today majority of the customer care agents are in a position to retrieve all the information about the calling customer in a few clicks. However, as described above reaching the right agent is where all the trouble comes.

We believe the process of reaching an agent or at least the right section (in banking, say savings account; in telecom, prepaid section) can be made a lot easier. This is certainly a possibility when customers call from their registered numbers.

Default options

Brands could use some default options to help callers save time. For instance,

- English could be the default language

- A customer who does not have a credit card need not be presented the option to press for credit card section. However, the same option could be included in a category - "For any other queries" which has to play at the end

A customer could also be provided the options in the brand's self-service platform to choose a default language, default service, which would be put to use when a call is made to the customer care from the registered number.

Predictive Analytics

AI (Artificial Intelligence) / Machine Learning based predictive analytics can actually make a difference to customer touchpoints. Taking the same experience of transaction failure above, a call originating from the customer with ten minutes of a transaction failure could be directly routed to the appropriate section of the customer care.

There used to be occasions when some e-commerce brands used to ring up a customer when a high-value transaction failed just to assure the customer that everything is safe and also encourage the customer to try again. This approach when used occasionally, will improve customer satisfaction.

What can a customer do?

Until above solutions are implemented, a customer can save time (and money) by using alternative channels -

- Call during off-peak hours - If you really need to call, try to call during off-peak or odd hours like late in the night or early morning.

- Missed Call - for banking needs like checking account balance or last few transaction details, one can use missed call banking options wherein details are received by SMS after giving a missed call

- Social media -

- For needs like account balance register for hashtag banking. Just by sending a twitter DM, many things can be done - balance enquiry, mobile phone recharge, locate bank branch or ATM

- For complaints tweet to the brand's official handle - Brands often call back and some even register contact details in their CRM thereby avoiding the need to provide contact details every time

- Website - Some brands have 'Request a call back' option on their websites. Use this!

- Email - the least desirable approach since brands take an indefinite time to respond. Some have standard response times set as one week! The same brands respond in less than two hours when approached on twitter.

How do you approach a brand when you face issues? Let us know via comments or tweet to me @gischethans.