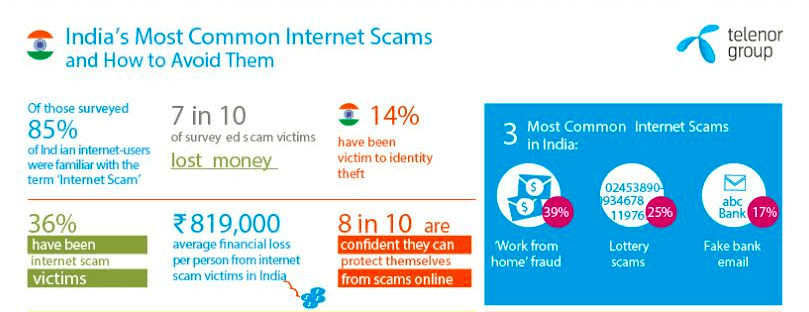

The top three online scams in India are ‘work-from-home’ fraud, lottery scams and fake bank emails scam, according to an internet scams study conducted by Norway’s Telenor Group. Those surveyed who indeed have been subject to an online scam in India, 90% have lost money and compared to neighbours, the amount of money stolen is the highest. Regionally the average financial loss per person is Rs 681,070, but alarmingly in India the average loss was Rs 819,000, the study said.

“As Indian netizens, we all know that scams exist but to see that the highest amount of money stolen via scams is in India shows this is an area we communally need to address. Telenor India is dedicated to enhancing internet safety,” said Sharad Mehrotra, CEO Telenor India.

Online security is extremely relevant in India where over a third of internet users surveyed have been victims to an internet scam and a further 57% know a friend or family member who had been scammed online, the study said. The study revealed that 85% of India’s internet users are familiar with the term ‘Internet Scam’ and feel open to online threats, with 63% saying they’re ‘very concerned’ about online scams—a third more than those who say they’re concerned with muggings.

While online scams are real, they are equally preventable. Half of internet users surveyed in India feel that responsibility to protect people online is with the government while nearly 60% feel the responsibility the website itself and equally feel a jail term for scammers is the best preventative measure to avoid an increasing online threat.

However, overall more than 80% of respondents feel it is the responsibility of each individual to ensure they’re safe online. As such knowledge and resources, helplines for victims, are key for reducing scam success. Telenor said that it is working closely with GSMA to launch Mobile Connect to preserve online privacy, create a trusted environment and help mitigate the vulnerability of online passwords. Mobile Connect will enable mobile users to create and manage a digital universal identity via a single log-in solution. It can help prevent online scams and frauds as it uses a combination of subscriber’s mobile number and a unique PIN to verify and grant online access anywhere.

The service securely and instantly authenticates users, enabling them to digitally confirm their identity and their credentials and grant safe on-line access to mobile and digital services such as e-commerce, banking, health and digital entertainment, and e-government, via their mobile phones,”said Sharad.