Paytm, the digital payments major recently opened its payments bank aka Paytm Payments Bank to the public via the Paytm Beta application. Today, the company itself revealed that it received over 10 million registrations until now since the beta launch last month.

At the end of August 2017, Paytm Payments Bank went live for users via Paytm 6.0 version of the application. The company announced the Payments Bank originally back in May 2017 with an aim to open 31 branches of the Payments Bank and 3,000 service points by the end of May 2018.

Paytm Payments Bank will be offering a 4% interest rate and cash back on deposits, zero fees on online transactions and zero minimum balance. The company is targeting to acquire 500 million customers by 2020. Yesterday, Paytm even announced its partnership with NPCI for RuPay digital card to every Paytm Payments Bank customer. This Rupay debit card comes with a free insurance cover up to Rs. 2 Lacs in case of death or permanent total disability.

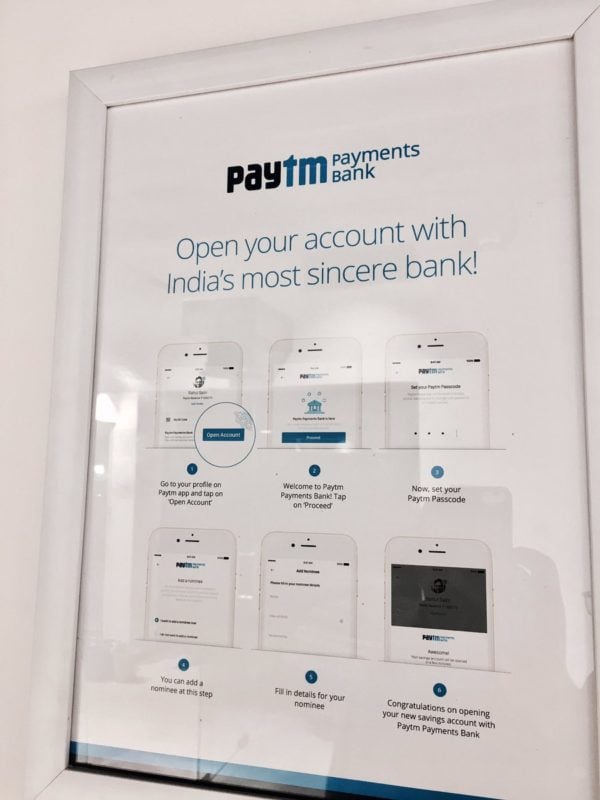

Also, KYC customers can open a Paytm Payments Bank account instantly on their smartphone even now by installing the Paytm beta application.

“Paytm customers are already using Paytm Wallet of Paytm Payments Bank. We have not pushed consumer beta for our savings account sign up aggressively, and 10 million organic sign ups without any marketing on a limited rollout is a very encouraging response,“ said Renu Satti, CEO of Paytm Payments Bank.

“Customers are gradually exploring the convenience and benefit of their savings account with Paytm Payments Bank and we expect deposits to increase in future,“ Satti added.

Paytm in its blog post also confirmed that it will soon partner with universal banks and roll out a full bouquet of banking services including term deposits, retail & SME loans. You can follow the procedure mentioned in this article to open a Paytm Payments Bank Savings account.