Native Snapchat lenses on the upcoming JioPhone Next is an “interesting integration,” says Ygal Arounian, an analyst at Wedbush Securities. Arounian told TelecomTalk that such native integrations could “help” Snap to welcome “more international audiences into Snapchat’s ecosystem.” JioPhone Next, the smartphone “jointly developed” by Jio Platforms, a majority-owned subsidiary of Reliance Industries and Google, was unveiled by Mukesh Ambani, Reliance Industries chairman, at the company’s annual general meeting in late June. While the smartphone is scheduled to be made available in the market beginning September 10, 2021, Ambani shared several details about the JioPhone Next, such as it being “ultra-affordable.” Ambani said that the upcoming smartphone includes features like “voice assistant, automatic read-aloud of screen text, language translation, smart camera with augmented reality filters.”

Indian Snapchatters Watching Shows, Publisher Content Increased 150% YoY

In a release jointly issued by Jio and Google, it was highlighted that the internet search giant has “partnered with Snap to integrate Indian-specific Snapchat lenses directly into the phone’s camera.”

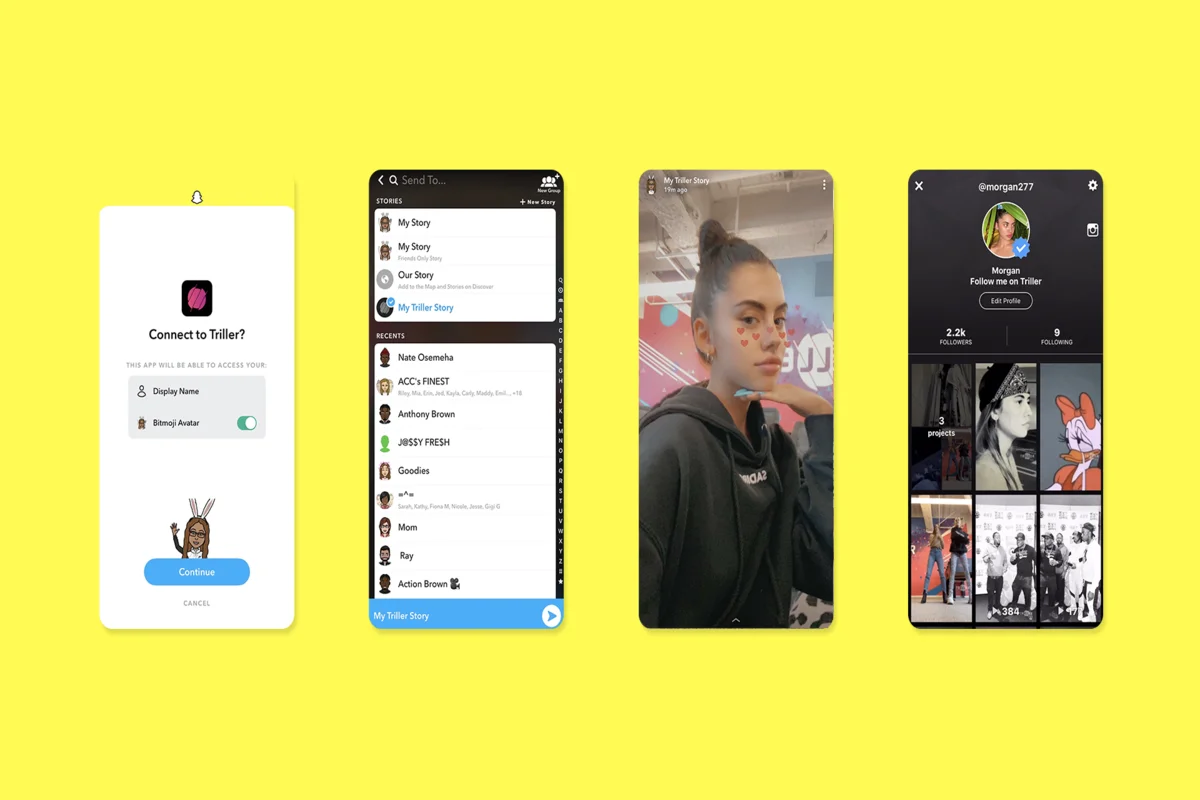

Evan Spiegel, chief executive officer at Snap in the second-quarter earnings call in late July, said that the company has “partnered with Bumble and Viber” and is also “working with Google.”

“We also partnered with Bumble and Viber to bring lenses to their respective mobile apps, and are working with Google to bring our lenses directly to the new JioPhone in India with a native camera integration,” Spiegel said in the second-quarter earnings call.

In its investor presentation for its second quarter, Snap highlighted that over 20 lakh lenses are available on Snapchat, with the platform home to over 200,000 global active lens creators.

Arounian told TelecomTalk that the native camera integration could “definitely” be seen as a way for Snap to capture more market share in India.

“That could have positive implications for overall international users and engagement, which would certainly be a positive,” Arounian told TelecomTalk in an email interview.

However, Arounian said that the native camera integrations, despite Snap doing it “more often”, is “not overly crucial” for the company in terms of it being a financial driver.

“It’s not overly crucial in terms of what is going to be the largest driver(s) of results in the near-term,” Arounian said.

In the second-quarter results of its current financial year, Snap, a camera company, recorded US$982 million (around Rs 7284 crores) in revenue, translating to an 116% year-over-year (YoY) increase. The parent company of Snapchat highlighted that its daily active users (DAU) hit 29.3 crores, translating to a 23% YoY increase.

Crucially, it was highlighted that the DAUs increased both on a quarterly basis as well as YoY, “in each of North America, Europe, and rest of world” markets. Further, the company highlighted that the increase in DAUs, both sequentially and YoY, was also recorded both on the iOS and Android platforms. In the previous quarter, Snapchat, a platform enabling users to watch video content and send disappearing messages to other users, recorded 28 crores DAUs, with the majority of its users on the Android platform.

“We launched a record 177 new international Discover Channels, including 36 in the UK and 24 in India, one of which is a partnership with Sony Pictures Network to launch five Shows,” Snap said in a release in late July.

Spiegel, in the earnings call, said that the total daily time spent by the Indian Snapchat users “watching Shows and publisher content” jumped 150% YoY.

“Significant Opportunity To Expand” Globally Says Snap

Arounian said that the rest of the world region “doesn’t monetize the same way the US and Europe does” for Snap as it only contributes around 15% of Snap’s total revenues. However, Arounian said that the region does account for a “decent portion” at around 40% of Snap’s daily users.

“There’s a long runway of global users for Snapchat, and they are very early in terms of monetizing that user base,” Arounian said.

In its investor presentation for its second quarter, Snap highlighted that it has a “significant opportunity to expand,” its community globally as it has only a 5% penetration in the rest of world region. In comparison, the company highlighted that it has a 24% penetration in North America and an 14% penetration in Europe.

Additionally, Jeremi Gorman, chief business officer at Snap, said that the recent changes to the iOS platform “came later” in the second quarter than “initially anticipated.” With the recent iOS 14.5 update, Apple requires user permissions for apps to track them for advertising purposes. Gorman said that the users have been slow to update their iPhones but that the company has noticed “higher opt-in rates” as compared to its peers.

“As Apple rolled-out its App Tracking Transparency-related changes near the end of Q2, we observed higher opt-in rates than we are seeing reported generally across the industry, which we believe is due in part to the trust our community has in our products and our business,” Gorman said in the earnings call.