The Telecom Regulatory Authority of India (Trai) which publishes various reports on the telecom industry has now compiled the subscription data for the sector. The Trai report on subscriber base has noted that the total telephone subscribers in the country currently stands at 1185.15 million. Out of these total telephone subscribers, Trai noted, 1161.86 are wireless subscribers, whereas the rest of 21.29 million subscribers are wireline subscribers. Trai has also stated that in May 2019, the industry lost 0.62 million subscribers out of which 0.44 million were wireless subscribers and the rest 0.18 million were wireline subscribers. However, what’s even more interesting to note in the latest Trai report about the subscriber base is the market share pie of each telecom operator.

Decline in Total Wireless Subscribers

The Trai report has noted that the number of active wireless subscribers in May 2019 was 989.60 million. Total wireless subscribers (GSM, CDMA & LTE) marginally declined from 1,162.30 million at the end of April 2019 to 1,161.86 million at the end of May 2019, thereby registering a monthly decline rate of 0.04%. Wireless subscription in rural areas declined from 509.95 million at the end of April 2019 to 505.59 million at the end of May 2019. However, wireless subscription in urban areas increased from 652.35 million at the end of April 2019 to 656.27 million at the end of May 19.

Reliance Jio Becomes Second Spot Telco

As on May 31, 2019, the report highlighted, the private access service providers held 89.72% market share of the wireless subscribers whereas BSNL and MTNL, the two PSU access service providers, had a market share of only 10.28%. The Trai data also noted that Reliance Jio currently holds 27.80% of market share, thus ranking on the second spot, whereas Bharti Airtel boasts of having 27.58% of the market share. The current telecom leader, Vodafone Idea boasts of a total market share of 33.36%. BSNL, on the other hand, has been revealed to hold 9.98% of the market share.

12 Service Areas See Positive Growth in Subscribers

Trai also stated that by May 2019, out of the total wireless subscribers (1,161.86 million), 989.60 million wireless subscribers were active, which amounted for 85.17% of the total wireless subscriber base. Bharti Airtel had the maximum proportion (99.86%) of its active wireless subscribers on its network. The Trai report also reported about the growth of subscribers in various circles as well. Out of the total 22 service areas, 12 service areas showed positive growth in their wireless subscribers during the month of May 2019. North East service area showed maximum growth of 0.80% and West Bengal service area showed a maximum decline (1.53%) in their wireless subscriber during the month.

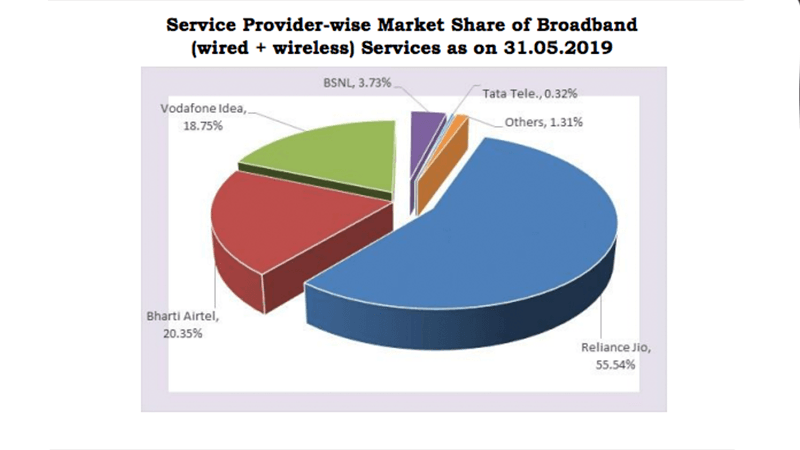

Reliance Jio Takes Lead in Total Broadband Subscriber

When it came to the combined compilation for broadband services including wireless and wirelines subscribers, Reliance Jio had the lead with 55.54% market share. Bharti Airtel had the second position with 20.35% market share, Vodafone Idea had 18.75% market share. Lastly, BSNL boasted of 3.73%. As per the report, by May 31, 2019, the top five Wired Broadband Service providers were BSNL (9.09 million), Bharti Airtel (2.39 million), Atria Convergence Technologies (1.44 million), Hathway Cable & Datacom (0.83 million) and MTNL (0.75 million) whereas the top five Wireless Broadband Service providers were Reliance Jio Infocomm Ltd (322.99 million), Bharti Airtel (115.95 million), Vodafone Idea (108.99 million), BSNL (12.57 million) and Tata Teleservices (1.49 million).