With underground cables spanning across length and breadth of the country, BSNL continues to enjoy a monopoly in the wired broadband segment. To BSNL’s relief, due to the sheer CapEx requirements involved in building a wired network from scratch and other associated investments like exchanges, staff etc. competition does not emerge in small towns and villages.

It is only in densely populated cities that BSNL’s faces stiff competition from numerous providers like Bharti Airtel, You Broadband, Hathway, ACT Fibernet etc. for wired broadband. Interestingly, survival instincts make BSNL offer matching or better plans and support to customers. As a result, the Tier-I and some Tier-II city consumers enjoy good choices and consumers living in the majority of Tier-II / III and below cities, rural regions end up with just one choice for wired broadband, BSNL!

The City Advantage - Plethora of Options

A perfect example to explain the situation would be Hyderabad. The city has for long been known for best internet speeds at very affordable rates in the country provided by Beam Fiber (now ACT Fibernet). Today, the city’s internet demand is served by nearly a dozen prominent and non-prominent (hyperlocal providers who sublease bandwidth) wired broadband service providers including BSNL and 4G services in the wireless segment. A choice is good as it is driving fierce competition here. Wherever there is competition, BSNL has launched special plans to gain / retain subscribers.

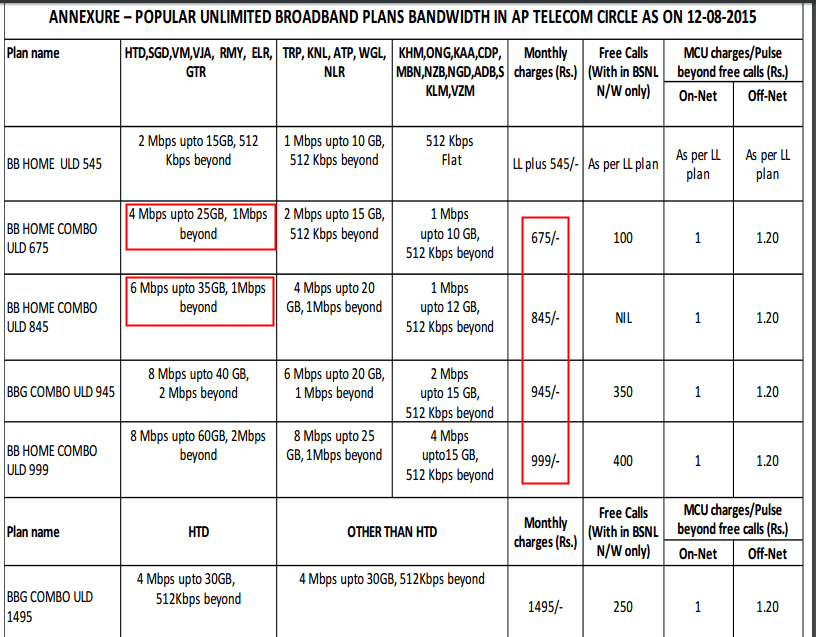

BSNL Plans in select cities of AP Circle

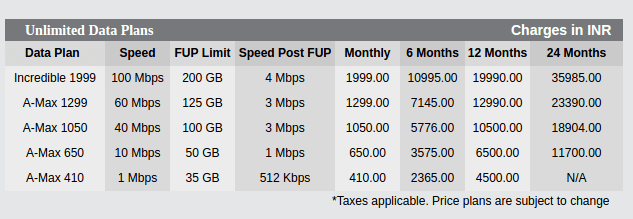

ACT Fibernet Plans

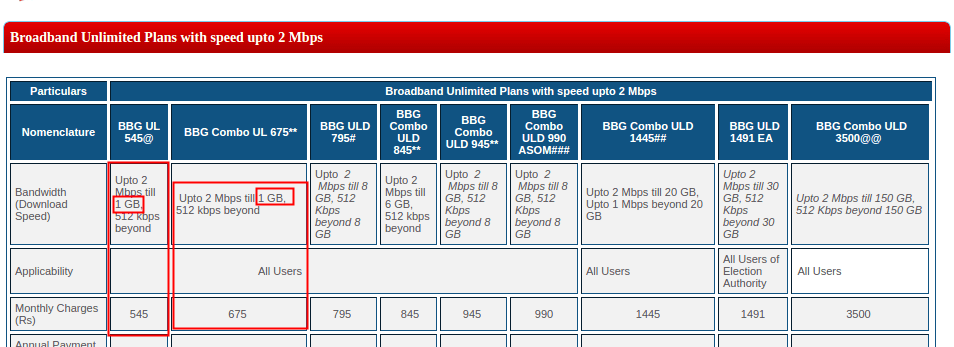

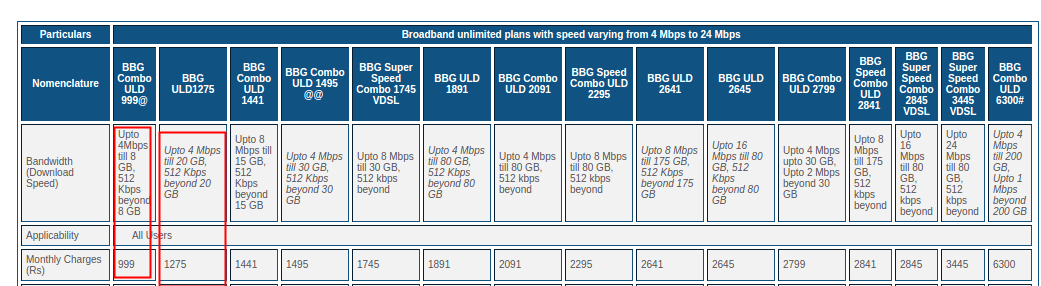

The same BSNL offers these plans PAN India

BSNL can simply afford to do this discrimination since there is no significant threat to their user-base. Yes, many have ditched BSNL Landline and Broadband for 3G / 4G services but someone who uses more than 10 GB data per month has to stick to BSNL Broadband. Another problem is BSNL’s lack of interest in providing quality connectivity. In suburbs and rural areas, the broadband speeds are far lesser than promised 2 Mbps. Further, BSNL is not interested in expanding the user base either. Lots of requests get turned down citing no free cable pair.

Where is the real demand?

The financial crisis of 2008 brought a tremendous amount of uncertainty in its wake, but RS Kalsi, executive director - marketing and sales, Maruti Suzuki remembers it differently. Even as he fretted about the implications for Maruti (he was head - sales at the time), a dealer from a semi-urban area told him, "Sir, the recession is only for the people who watch business channels and read pink newspapers. In the rural economy, we have good crops, good prices and there is no recession here." On hindsight, Kalsi believes, "This was the inflexion point for us to focus on rural markets."

He realised that even at the store level, an English speaking tie and blazer wearing salesman was intimidating to his rustic customer. And so Maruti put together a special team of RDSEs or resident dealer sales executives; sons of the soil who spoke the local language. They staff Maruti's emerging market outlets and the company claims to have recruited nearly 10,000 local youth. Kalsi admits, "They may not be slick language masters but what's important is they strike a good chord with the local community." The result: encouraging sales. Rural markets are up 26% as of February 2015 and account for 34% of the company's annual sales. Kalsi says with a measure of pride, "We have been able to reach even the smallest villages — today more than 7% of MSIL sales are from villages with less than 200 households."

Source: Economic Times

I am not trying to point out that we are heading towards a recession here! The point I am trying to make is just like Maruti discovered the market for their cars in Rural India, telcos need to realize that there is a market for 3G and 4G internet there. For a business, it is always important to find a new user base and what can be a better base than an entirely untapped segment of users?

A leading telco’s executive recently told me that they simply can’t propose upgrading the 2G BTS to 3G BTS in areas with lesser population due to lower projected ARPU. This reasoning is driving operators to install one or two 3G BTS per tier-III town, usually at some central location where more users assemble in the day time - bus stations, education hubs etc. and hope for the best. However, the heavy users can and actually reside away from these central locations. One can easily notice how the youth these days are hooked onto smartphones as soon as they board a bus or a local train to travel to colleges or offices. It is easily understandable that they would love to have the same level of connectivity back at their homes. I have personally observed how people struggle with 2G and wish they had proper 3G connectivity. Telcos actually need to put some efforts to identify such users. (Big data?) Analytics can help here.

Possible Solutions

Strengthen network in residential areas

The most reliable factor in determining future ARPU in a region would be demographic data. Now that obtaining demographic data can be a challenge in India, an easy way would be to use GIS Analysis.

Home is where people spend more than 12 hours per day in small towns and villages. In large cities time is spent in travelling. :( Along with modern approaches like GIS, providers can tap their vast dealer network. While a GIS Analyst can easily identify densely populated area like this one

it will take a local person to identify which area is more suitable for a new 3G BTS depending on age-groups, the income level of residents living in a locality such as this one.

A map dashboard built using a modern GIS solution like ArcGIS Online can help in the identification of potential locations with minimal training. It would be interesting for them too and now almost everyone knows how to navigate Google Maps. Other maps like Esri's are similar. Further, they can be given incentives based on the success rate and can become role models for others! Such areas could turn better revenue generators if people with higher incomes live there. The opportunities for a telco are even more if such areas are far from the city and have no broadband connectivity!

500 MB or 1 GB data packs are passé

Just like Henry Ford innovated leading to reduced costs and prices, and sold more cars than ever, telcos must think of a similar approach. Several reports indicate that the demand for video content is growing fast in India and availability of 3G at affordable pricing can change the entire data consumption scenario. 1 GB data packs are very popular but they are generally used to complement wired broadband and for chat apps. 5 GB and more is the ideal data limit. Availability of 5 GB 3G data at say Rs. 500 can give tough competition to BSNL Broadband and due to the portability and reliability aspect of wireless over wired broadband, takers for 3G would be more. Unlimited plans at ~Rs. 1000 (15 GB + Post FUP speeds of 256 kbps or more would be welcome).

Do you live in a small town or a rural area with no other choice than BSNL’s wired broadband? Do you wish cheaper and reliable 3G/4G plans were available? Let us know.