Indian telecom service providers Bharti Airtel (Airtel) and Reliance Jio gained wireless subscribers in January 2025, while Vodafone Idea (Vi) and state-run telco BSNL lost wireless subscribers during the month, according to TRAI's Telecom Subscription Data as of January 31, 2025. The data shows that the total number of wireless subscribers increased from 1,150.66 million (mobile) at the end of December 2024 to 1,1157 million (mobile + 5G FWA) at the end of January 2025, marking a monthly growth rate of 0.55 percent.

Also Read: Airtel, BSNL, and Vi Lose Wireless Subscribers, Jio is the Only Gainer in November 2024: TRAI

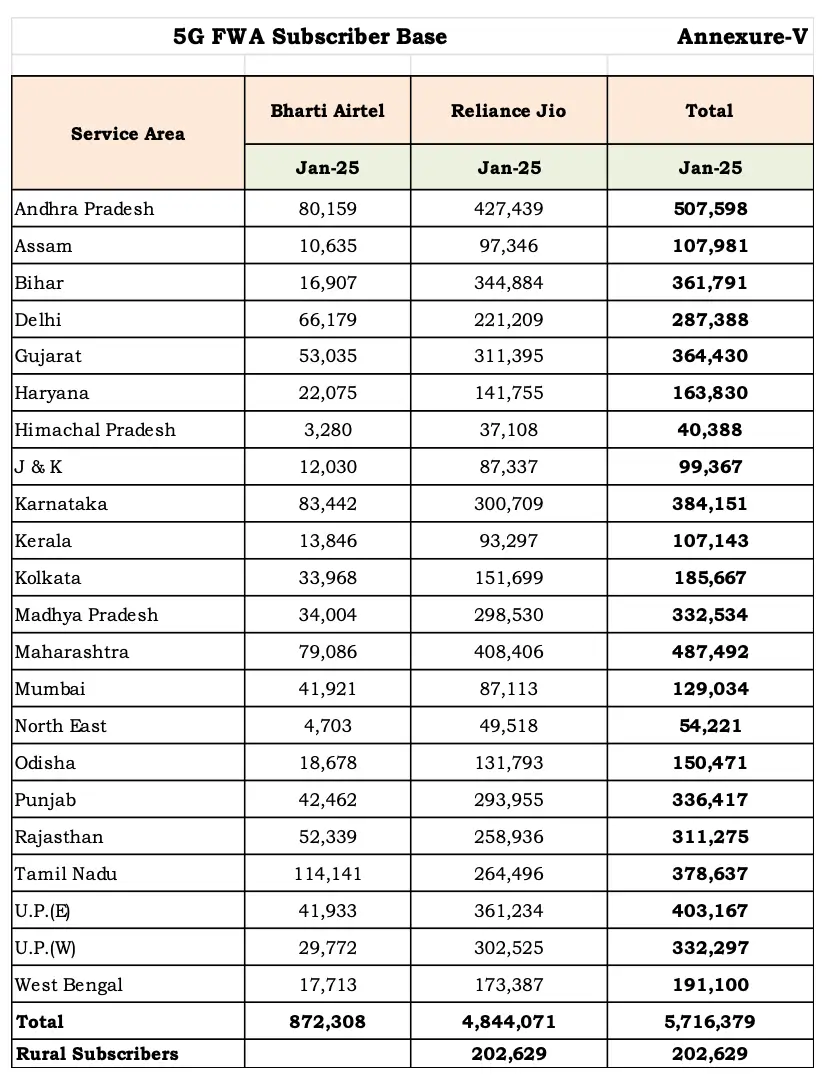

5G FWA Subscribers

The number of 5G FWA subscribers, which was previously reported under the wireline category, has now been included in the wireless category with effect from January 2025. As a result of this inclusion, the monthly growth rate has increased, TRAI stated in its report released on Monday, April 21, 2025.

As of January 2025, Bharti Airtel reported a 5G FWA subscriber base of 872,308, while Reliance Jio reported 4,844,071 FWA users, bringing the total to 5,716,379—including 202,629 rural subscribers from Jio alone.

Gain and Loss of Wireless Subscribers

Bharti Airtel added 1,653,303 (1.65 million) wireless subscribers, while Reliance Jio added 686,143 (0.68 million) subscribers. Meanwhile, Vodafone Idea lost 1,338,301 (1.33 million) wireless subscribers during the same period. Public sector units (PSUs) BSNL and MTNL lost 152,181 and 2,617 wireless subscribers, respectively.

Wireless Market Share of Operators

As of January 31, 2025, private access service providers held a 91.96 percent market share of wireless subscribers, while BSNL and MTNL, the two PSU service providers, had a combined market share of only 8.04 percent. This translates to Reliance Jio holding a 40.46 percent market share with 465.8 million wireless subscribers, Bharti Airtel with 33.61 percent market share and 386.96 million wireless subscribers, Vodafone Idea with 17.89 percent market share and 205.92 million wireless subscribers, BSNL with 7.95 percent market share and 91.58 million wireless subscribers, and MTNL with a 0.09 percent market share and 1.0023 million wireless subscribers.

BSNL also revised its rural subscriber count from 29,300,726 to 29,946,250 for the month of December 2024, TRAI noted.

Also Read: Airtel, BSNL, Jio, and Vodafone Idea Step into 2025 with Growth Optimism

Wireless Broadband Subscribers

Reliance Jio reported 465.10 million wireless broadband subscribers, followed by Bharti Airtel with 280.76 million, Vodafone Idea with 126.41 million, and BSNL with 31.52 million subscribers. The data for Jio and Airtel is based on reports as of November 2024.

Wired Market Share

Wireline subscribers decreased from 39.27 million at the end of December 2024 to 35.03 million at the end of January 2025. The net decrease in the wireline subscriber base was 4.24 million, representing a monthly decline rate of 10.80 percent. "This decrease is due to the accounting of 5G FWA subscribers’ numbers earlier being erroneously reported under the wireline category but now being accounted for under the wireless category w.e.f January 2025," TRAI noted.

In the wireline segment, Reliance Jio held a 36.03 percent market share with 12,619,375 wireline subscribers. Bharti Airtel had a 28.45 percent share with 9,965,082 wireline subscribers, adding 117,504 subscribers during the month, and Vodafone Idea reported a 2.40 percent market share with 839,278 wireline subscribers, losing 3,447 subscribers during the month.

M2M Cellular Connections

According to the report, the number of M2M (Machine-to-Machine) cellular mobile connections increased from 59.09 million at the end of December 2024 to 63.09 million at the end of January 2025. Bharti Airtel has the highest number of M2M cellular mobile connections at 33.04 million, holding a market share of 52.37 percent, followed by Vodafone Idea with 25.07 percent (15.82 million), Reliance Jio with 17.40 percent (10.97 million), and BSNL with 5.16 percent (3.26 million).

Also Read: Airtel, Vodafone Idea and Reliance Jio in Q2FY25: A Snapshot of ARPU and Subscribers

Active Wireless Subscribers

Out of the total 1151.29 million wireless subscribers, 1,065.01 million were active on the date of peak VLR (Visitor Location Register) in January 2025, according to TRAI. Airtel reported a peak VLR of 99.94 percent during the month, BSNL 61.55 percent, Vodafone Idea (Vi) 85.39 percent, MTNL 48.31 percent, and Reliance Jio 95.66 percent. Active wireless subscribers are based on VLR data.