Telecom regulatory authority of India has revealed the subscription data for the month of August 2015 . As per the report , India has crossed 1010 Million or 101 Crore telecom subscribers for the first time & now have a total of 1014.70 million telecom subscribers, out of which 988.69 are wireless (mobile) and 26.01 are wireline (landline).

In August , a total of 5.48 million new mobile subscribers were added, whereas wireline saw a fall of 0.09 million. Most of the new mobile connections came from urban areas. In wireless category, Bharti Airtel bagged most of the new users, while Idea Cellular & Vodafone gained almost similar number of subscribers. Reliance Communications saw maximum erosion in subscriber base in Bihar where its right to use 900 Mhz spectrum (2G) expires this December.

| Operator Wise Wireless Subscription Data - August | |||

| Operators | Total Subscriber | Net Addition | Active VLR (in %) |

| Bharti Airtel | 23,29,82,947 | 13,12,538 | 96.20 |

| Vodafone | 18,65,76,282 | 11,27,206 | 94.60 |

| Idea Cellular | 16,39,26,733 | 11,67,242 | 103.41 |

| Reliance Mobile | 10,99,50,781 | (-4,91,754) | 96.06 |

| Aircel | 8,37,48,691 | 3,84,004 | 70.07 |

| BSNL | 7,86,49,374 | 8,12,890 | 70.89 |

| TATA DOCOMO | 6,25,41,699 | 8,25,202 | 75.40 |

| Telenor | 4,75,53,200 | 3,90,426 | 73.49 |

| Videocon | 1,07,34,941 | 1,16,830 | 46.46 |

| MTS | 84,35,671 | (-1,82,791) | 62.60 |

| MTNL | 35,88,274 | 18,132 | 59.19 |

| All Total | 988.69 Million | 5.48 Million | 89.61 |

Highlights from the Wireless Segment :

- Total wireless subscriber base increased from 983.21 million at the end of Jul-15 to 988.69 million at the end of Aug-15, thereby registering a monthly growth rate of 0.56%.

- Wireless subscription in urban areas increased from 567.29 million at the end of Jul-15 to 570.33 million at the end of Aug-15, and wireless subscription in rural areas increased from 415.92 million to 418.36 million during the same period.

- The monthly growth rates of urban and rural wireless subscription were 0.54% and 0.59% respectively.

- Wireless Teledensity in India increased from 78.02 at the end of Jul-15 to 78.37 at the end of Aug-15.

- Shares of urban and rural wireless subscribers were 57.69% and 42.31% respectively at the end of Aug-15.

- 3.98 million subscribers submitted their requests for MNP. Among these MNP requests, 0.21 million MNP requests were for inter-service area MNP.

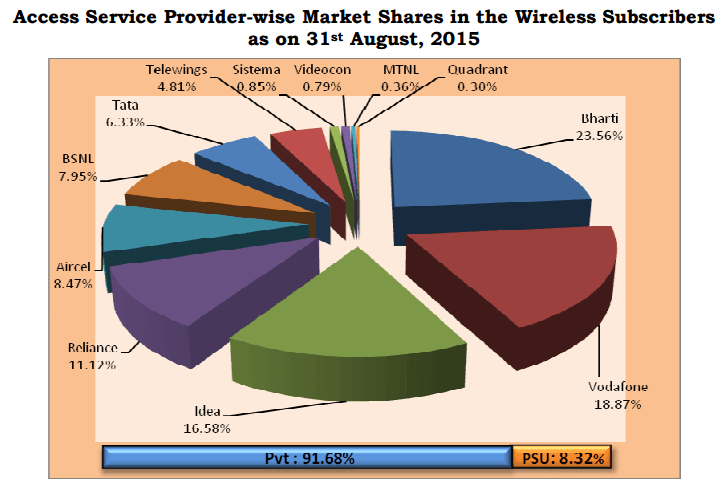

- Private service providers held 91.68% market share of the wireless subscribers whereas BSNL and MTNL, the two PSUs access service providers, held only 8.32% market share.

- In the month of Aug , a total of 4.31 million subscribers submitted their requests for MNP. Among these MNP requests, 0.36 million MNP requests were for Inter-Service Area MNP. With this, the cumulative MNP requests increased from 167.91 million at the end of Jul-15 to 172.22 million at the end of Aug-15.

- In MNP Zone-I (Northern and Western India), the highest number of requests till date have been received in Rajasthan (about 15.97 million) followed by Gujarat (about 13.64 million). In MNP Zone-II (Southern and Eastern India), the highest number of requests till date have been received in Karnataka (about 20.13 million) followed by Andhra Pradesh (about 16.56 million).

- Out of the total wireless subscriber base (988.69 million), 885.94 million wireless subscribers were active on the date of peak VLR in the month of Aug-15. The proportion of active wireless subscribers was approximately 89.61% of the total wireless subscriber base.

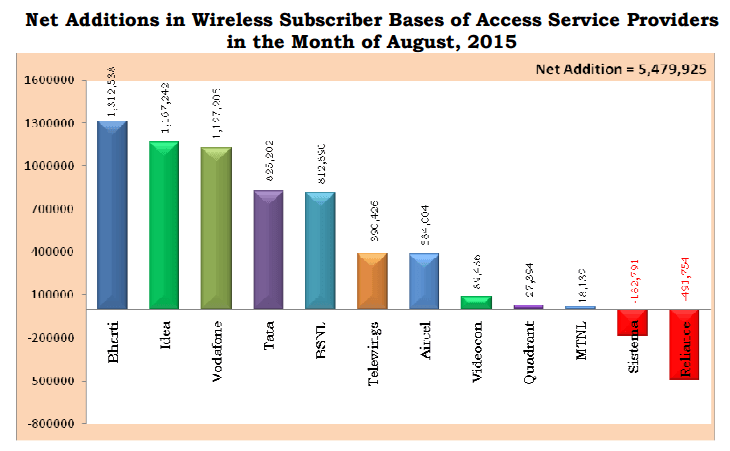

Operator Wise Wireless Subscriber Additions:

- Bharti Airtel bagged maximum new users in the month taking its subscriber base to 232.98 Million. The top operator added 1.3 Million new users.

- Idea added second highest number of users while Vodafone added few less than the Birla owned telco which make them third in subscriber addition data. Idea added 1.16 million new users while Vodafone got 1.12 million new users in their subscriber base.

- TATA DOCOMO added 0.82 million users after sharp decline in several months continuously.

- State run telecom unit BSNL managed to get 0.81 Million new users while another telco, MTNL got only 18,132 new users in Mumbai & Delhi circles.

- Maxis owned Aircel added 0.38 Million subscribers while Telenor India attached 0.39 Million new users. Videocon added only 0.16 million new users at the end of August.

- Sistema Shyam and Reliance Mobile , both companies that are in the process of consolidation, lost 0.18 million and 0.49 million users. Reliance Mobile saw maximum erosion in subscriber base in Bihar where its right to use 900 Mhz spectrum (2G) expires this December.

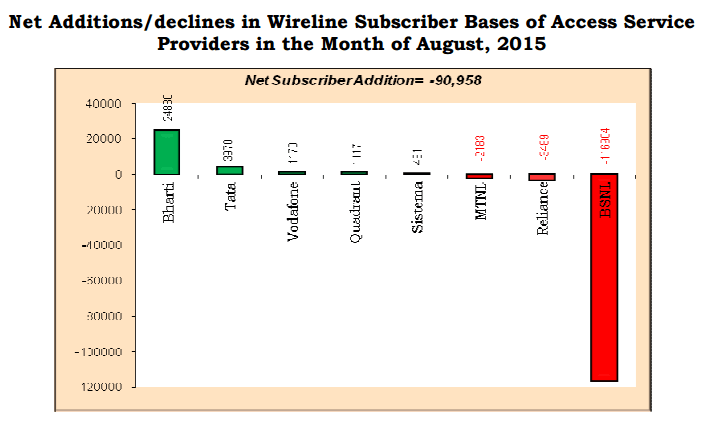

Landline subscriber base:

- Wireline subscriber base declined from 26.10 million at the end of Jul-15 to 26.01 million at the end of Aug-15. Net reduction in the wireline subscriber base was 0.09 million at the monthly decline rate of 0.35%.

- The Overall Wireline Teledensity slightly declined from 2.07 in Jul-15 to 2.06 in Aug-15, with Urban Wireline Teledensity and Rural Wireline Teledensity being 5.41 and 0.55 respectively.

- BSNL and MTNL, the two PSU access service providers, held 74.11% of the wireline market share.

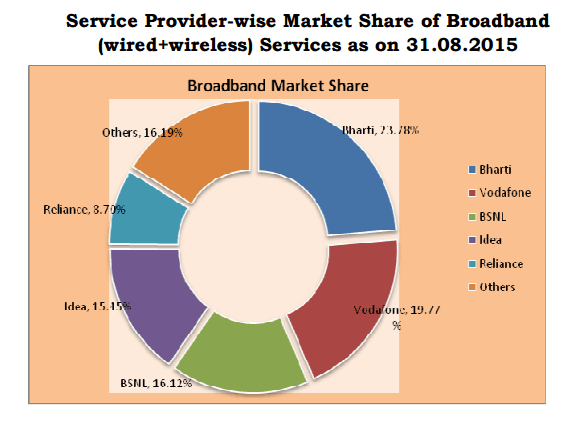

Broadband subscriber base:

- The number of broadband subscribers increased from 113.32 Million at the end of Jul-15 to 117.34 million at the end of Aug-15 with monthly growth rate of 3.55%.

- Top five service providers constituted 83.81% market share of total broadband subscribers at the end of Aug-15. These service providers were Bharti Airtel (27.90 million), Vodafone (23.20 million), BSNL (18.91 million), Idea Cellular Ltd (18.12 million) and Reliance Communications Group (10.21 million).

- Top five Wired Broadband Service providers were BSNL (9.92 million), Bharti Airtel (1.54 million), MTNL (1.13 million), Atria Convergence Technologies (0.77 million) and YOU Broadband (0.48 million).

- In wireless broadband segment , top operators are , Bharti Airtel (26.36 million), Vodafone (23.19 million), Idea Cellular (18.11 million), Reliance Communications Group (10.10 million) and BSNL (8.99 million).