The telecom regulatory authority of India has issued a consultation paper on the regulation of ‘Over the top’ (OTT) players like whatsapp, viber, skype, etc. which provide an alternate means of communication between subscribers by riding on the back of their infrastructure. This paper has been sent to all telecom operators for their consideration and to gather their inputs on the matter and to reach a workable solution for the same. Operators are required to send in their responses by 24th April 2015 and the counter comments to be sent latest by 8th May 2015.

The key points of the consultation paper include:

- The impact of VoIP apps on traditional Indian telecom services is minimal compared to the foreign markets as the call rates are innately low in India in line with 40 to 60p/min.

- Mobile internet penetration in India is only 20% that to 2G. While these services work best on high-speed mobile internet like 3G.

- Thirdly, the Quality of Service (QoS) of such OTT apps is not as good as traditional voice services offered by TSPs.

- VoIP apps have led to a fall in international outgoing mobile originating call volumes by 7 to 10%.

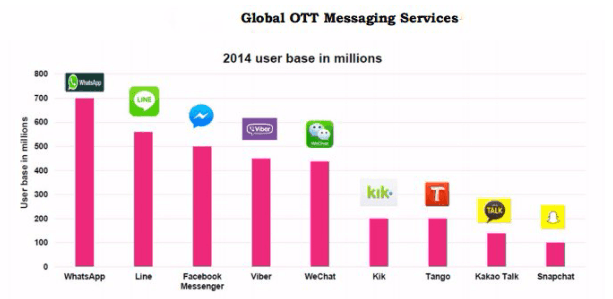

- The user base of OTT messaging services has grown to more than one billion in less than five years, as shown in Figure. This has impacted TSPs and other service providers all over the world. This impact has also been felt in India.

- Third-party applications such as WhatsApp, Viber etc. are open systems, often cross-platform, OS-agnostic and open to all devices.

- WhatsApp’s subscriber base in India has risen to 70 million and it has a free subscription model (unlike in developed markets where the annual fee is $1)

- Average revenue earned by an operator through a traditional voice call on GSM is 50p/min while that earned through data consumed by VoIP calls is 4p/min. (1 min of VoIP call consumes 150KB while the standard data rate with data packs is in the range of 25p/MB)

- The average revenue earned by a TSP for an SMS is around 16p, when compared to 1p of data usage charges (On average, revenue earned through data by TSPs is around 25p /MB of data and the average size of one message is 30 KB)

- Under the current telecom licensing regime, voice and messaging services can be offered only after obtaining a license. Companies offering OTT voice services, without holding a telecom license in India, circumvent Indian telecom licensing provisions and provide services that are otherwise permitted only under a telecom license.

- Telecom companies are subject to entry fee, license fee, spectrum usage fee. They also have to match up to the minimum quality of services, tariff regulations and consumer protection regulations which do not apply to OTT players.

- If the OTT players are allowed to conduct VoIP services at such a large scale without being regulated, it will endanger the investments of operators in the Indian telecom industry and hamper the growth and quality of services.

- OTT players have argued by stating that they are providing the voice and messaging services over the internet connection that is paid for by the subscriber and that the increased usage of data compensates for the loss of revenue through the traditional sources.

- Consultation whether Net Neutrality principles need to be adhered to in India and all data should be treated equally without any preferential treatment.

- Whether a deviation from net neutrality and creation of Internet fast lanes will hamper the growth potential of smaller start-ups.

- What needs to be done of the offerings by operators that breach the principles of net neutrality? For instance Reliance’s internet.org or Airtel’s one touch internet.

- Whether measures such as differential treatment of data including blocking of certain content, throttling and degrading of certain data streams like VoIP to distort quality is a viable option.

- Differential pricing for selective OTT applications.(including differentiation based on Volume of usage, speed and validity)

It remains to be seen as to what will be the outcome of this much-debated issue of differential treatment of VoIP in the light of net neutrality. Keep reading TT for more updates on this topic.