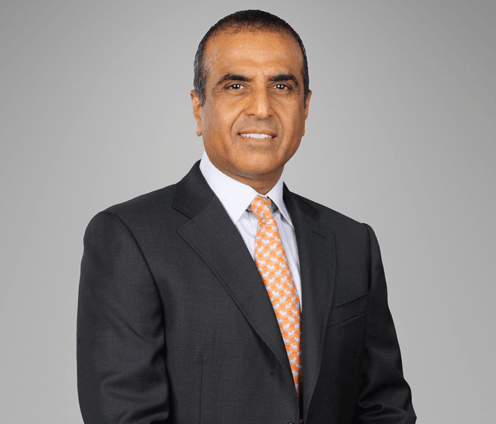

Indian telecom service providers were forced to write off investments of up to $50 billion due to Mukesh Ambani-led Reliance Jio’s prolonged free voice and data offers, and the latter is now opposing a relief package for the debt-laden sector, according to Bharti Airtel chairman Sunil Mittal.

In an interview with ET, Mittal said, " My estimate is about $40-50 billion have been written off by various companies, many of whom are international investors. It (the write-offs) is largely due to Jio…the pricing. Having such a long, free promotional period and in some sense, decided by laws of the land in their favour, is unheard of. "In my opinion, in Europe or US, this would have been stopped. It would have been seen as predatory,” the telecom czar added.

Reliance Jio, which started operations in September 2016 with free unlimited calls and data till March 2017, which disrupted the Indian telecom space, and brought down profits of top Indian telecom operators. These offers also forced incumbents like Airtel, Vodafone and Idea to cut tariffs to retain customers and stay competitive. The 4G entrant, however, has been charging for its services since April this year, but the offers are still competitive with voice bundled as a free service.

Mittal now reckons that the price war will take two more quarters to stabilise. Notably, Jio is now focusing on achieving profits, having reported an average revenue per user (ARPU) of Rs 156.4 in the September quarter, which was higher than the Rs 154 reported by market leader Bharti Airtel in the April-June period.

Bharti's top boss also said that Airtel would explore acquisition talks with Maxis-owned Aircel, whose merger with Reliance Communications (RCom) recently fizzled out. Airtel had last year acquired Aircel's 4G spectrum in the 2300 MHz band in eight circles for Rs 3,500 crore. “I think for them (Aircel), it’s only Vodafone-Idea combination for us. Whenever there will be a possibility of a conversation, I have no doubt; we will be a part of that conversation,” he said.

Mittal also told the publication that Bharti Airtel had benefited from the rapid consolidation in the telecom industry, and it could beat the Vodafone India-Idea Cellular combine to grab the No. 1 slot by revenue market share by March 2019.

“Market has consolidated to a level which was an aspiration, but never thought to be possible. No. 2 Vodafone and No 3 Idea being put together, is unprecedented… you never see two strong companies merging,” Mittal said.