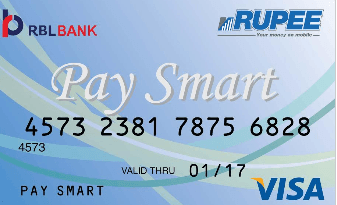

MMPL (a subsidiary of Tata Teleservices Ltd.) has launched a new Open Loopprepaid, VISA powered, card in partnership with RBL Bank (Also known as Ratnakar Bank). The new service will provide a platform for the users to move away from traditional cash based transactions into an easy, secure and private mode of payment. The minimum money value the PAY Smart card would hold is 200 rupees with the maximum value being 1 lakh rupees at any point in time.

By obtaining a PaySmart card, mRUPEE customers will be able to withdraw money from VISA licensed ATMs and also pay for goods and services at all merchants that accept VISA Debit/Credit cards nationally. Today, digital/plastic money has evolved quickly beyond just cash to take the center stage in an increasingly digitally endowed world. Tata Teleservices realizes that India is witnessing a form of ‘half-life’ adoption where the time required for each new platform or application to become genuinely mainstream, is half that of its predecessor.

One can own a PAY Smart card in few easy steps –

1. The prospective customer walks into an mRUPEE Retailer outlet & requests for the PaySmart card to the retailer. The MMPL Retailer initiates the customer registration and card issuance process. The card kit with an inactive card would be issued to the customer, who can walk out in a few minutes.

2. Customer will share the duly signed CAF & furnish self-attested supporting KYC documents to mRUPEE Retailer. These documents would be digitized and uploaded to be reviewed by RBL’s back-office systems.

3. After successful verification of the documents, RBL Bank will approve the request, The card would then be successfully activated.

4. The customer can now load money in the card at the mRUPEE outlet and start using it.