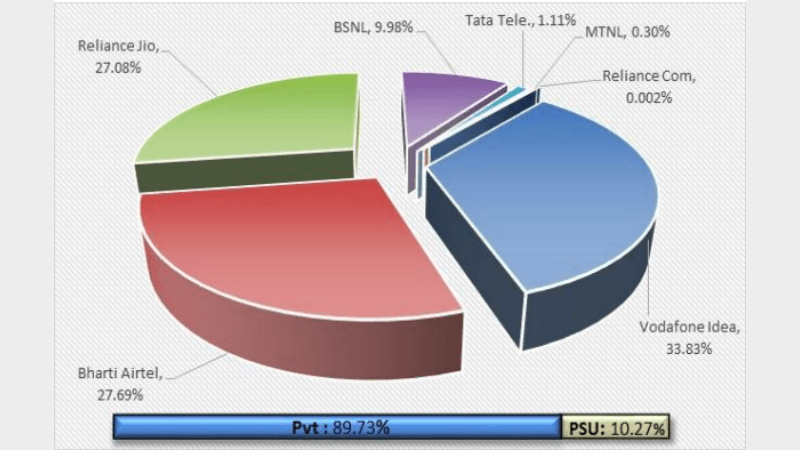

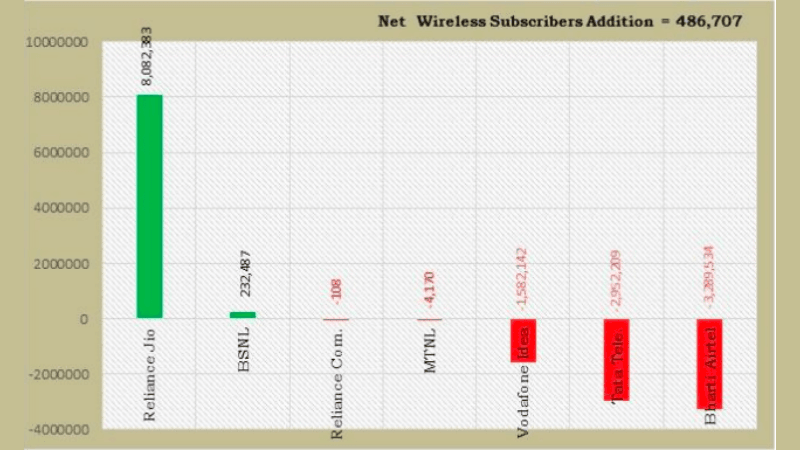

Telecom operator, Reliance Jio, has added a whopping eight million subscribers in the month of April 2019, reveals the data released by Trai. At the end of April 2019, Jio's subscriber market share is 27.08%, which is right below that of Bharti Airtel's 27.69% share. However, this data by Trai is slightly confusing as Reliance Jio claimed its subscriber base has crossed 300 million during Q4 FY19 itself. Bharti Airtel reported a subscriber base of around 284 million at the end of Q4 FY19, so clearly Jio is ahead of Airtel right now. Also, according to the Trai data, Airtel lost close to 3.3 million subscribers during April 2019, which will further dent its subscriber base. Leading telecom operator, Vodafone Idea, managed to lose just 1.5 million subscribers during the same month, and BSNL has added 2.3 lakh new customers.

Reliance Jio Continues to Add New Subscribers in Large Number

Mukesh Ambani-led Reliance Jio Infocomm continues its subscriber growth at a quick pace. The telecom operator is quickest in the world to reach 300 million subscribers in just 30 months of starting the operations. And it seems like the growth will continue and the telco might soon surpass Vodafone Idea as well. While other telcos like Vodafone Idea and Bharti Airtel are focusing on improving their ARPU, it's Reliance Jio which is concentrating on both ARPU and subscriber growth.

According to the Trai data, Bharti Airtel has lost 3.2 million subscribers during April 2019, while Vodafone Idea lost slightly over 1.5 million users. RCom, MTNL and Tata Teleservices lost 108, 4170 and 2.9 million subscribers respectively.

Earlier, we expected that Airtel's subscriber base would get a boost once its merger with Tata Teleservices completes. However, that seems to be not the case as Tata Teleservices' subscriber market share is just 1.11% as all the customers are moving onto other networks or phasing out their mobile numbers. On the whole, private telcos lead the Indian telecom market with an overall share of 89.73%, while government operators are serving 10.27% customers.

Talking about the overall numbers, the number of telephone subscribers in India slightly increased from 1,183.51 million to 1,183.77 million during April 2019, which is an increase of 0.02%. As for the wireless subscribers, the number has increased from 1,161.81 million at the end of March 2019 to 1,162.30 million at the end of April 2019.

BSNL is the Only Operator to Add New Subscribers on Board

State-run telecom operator, Bharat Sanchar Nigam Limited (BSNL) is the only network service provider to add new subscribers every month alongside Reliance Jio. Even in April 2019, BSNL added 232,487 new users, thus taking its overall market share to 9.98%. BSNL' subscriber base will soon reach 120 million, which is a huge achievement for the company as top telcos are losing the battle against Reliance Jio in the subscriber addition game.

Bharti Airtel and Vodafone Idea introduced minimum recharge scheme, which made a lot of users leave the network and join alternatives like BSNL and Reliance Jio. It'll be interesting to see when Reliance Jio becomes the leading telecom operator of India.