All of us know Samsung, the company which, over the past four years, has made its way to the top of the Android food chain. Its marketing efforts paid off in the form of big market share and big profits. However, recently, the company seems to be in troubled waters as their profits have been declining consequently over the past four quarters and they have also lost smartphone market share to local vendors from India and China.

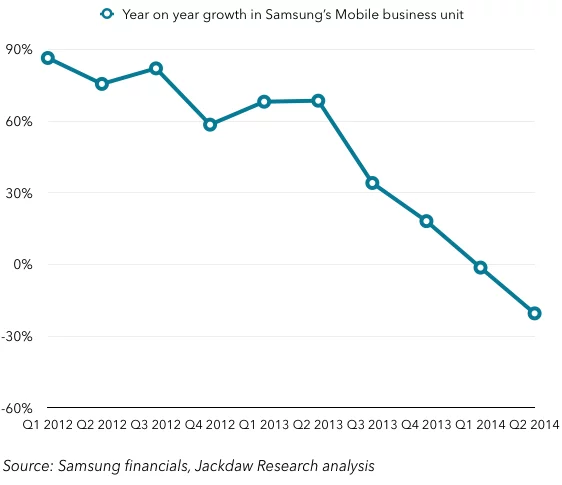

As can be seen in the above graph ever since Q4 2013 Samsung's year-on-year profits have declined.

Samsung’s story in the emerging markets like India and China

In countries like India and China, most of the smartphone sales occur at the bottom-end of the price segments (which is the less than Rs. 12K). In this price segment, Samsung's market share is declining rapidly. In India, they are facing tough competition from Micromax and other local brands. In the previous quarter, Samsung reportedly lost the top spot to Micromax. Google’s Android One initiative will add fuel to the fire. In China, Xiaomi surpassed Samsung last quarter to become the largest manufacturer as reported by Canalys.

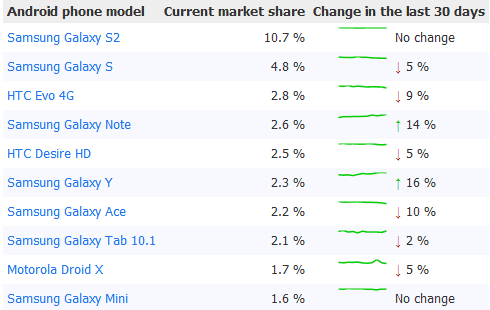

These were the 10 best-selling smartphones in 2012

Why can’t Samsung price their products as low as Xiaomi does?

Both Xiaomi, Motorola, and Asus have been releasing device which can be considered as terrific value for money smartphones. But we should also know that they have lower costs and expenditure than Samsung. In India, both Xiaomi and Motorola having taken the online exclusive approach allowing them to cut down on middlemen costs. Xiaomi hardly spends anything on commercial marketing. Motorola has done some commercial marketing in India but still I believe Samsung spends much more than Motorola. Motorola, despite record sales of the Moto G and the Moto E, is still not profitable. Similarly, Xiaomi despite posting record revenues has never stated their profits. Both, Motorola and Xiaomi, despite their amazing value for money factors, are not profitable companies.

Samsung on the other hand, cannot release online exclusive devices. They have a very wide offline retail distribution system. If Samsung makes a device with good specifications as online exclusive, various offline retailers would lose sales and might completely stop dealing with Samsung. E-commerce has had a great start in India, but its still no match for conventional brick and mortar stores.

So, what can Samsung do to improve themselves?

1. Improve specifications of entry-level smartphones

Samsung must definitely consider improving their specs in the less than 10k segment. If the Samsung Galaxy S Duos 2 is equipped with a more modern quad-core Snapdragon processor, 1GB of RAM, and a bigger battery (say 1700-1800 mAh), it can easily help Samsung fight with the likes of Moto E, Moto G, and Android One smartphones. If they provide better specifications at a lower price, they would lose margins but the developing countries are too important when the market reach is considered.

HTC tried to focus on the higher mid-range and the high-end segment when they were in a good position but their revenues started falling since 2011. Samsung saw the opportunity, and were an instant hit in lower-end and lower mid-range segment. As evident from the data, all the lower-end models were from Samsung. Devices like Samsung Galaxy S Duos 3 will not break the ice, especially in developing countries like China and India. Samsung should learn from HTC's mistake, not repeat it. The only solution is to provide better specifications, which can compete with the offerings of from other vendors such as Asus, Xiaomi, Micromax, etc.

| Samsung Galaxy S Duos 3 | Motorola Moto E | Xiaomi Redmi 1S | Android One | ||

| Screen | 4.0-inches, 480 x 800 pixels | 4.3-inches, 540 x 960 pixels | 4.7-inches, 720 x 1280 pixels | 4.5-inches, 480 x 854 pixels | |

| Operating System | Android v4.4.2 (KitKat) | Android v4.4.4 (KitKat) | Android v4.3 (Jelly Bean) | Android v4.4.4 (KitKat) | |

| Processor | 1.2GHz dual-core Cortex-A7 | 1.2GHz dual-core Qualcomm Snapdragon 200 | 1.6GHz quad-core Qualcomm Snapdragon 400 | 1.4GHz quad-core MediaTek MTK6582 | |

| RAM | 512MB | 1GB | 1GB | 1GB | |

| Storage | 4GB, microSD card slot | 4GB, microSD card slot | 8GB, microSD card slot | 4GB, microSD card slot | |

| Primary Camera | 5 MP, autofocus, LED flash, 720p@30fps | 5 MP, fixed-focus, WVGA videos, 480p@30fps | 8 MP, autofocus, LED flash, HDR, 1080p@30fps |

| |

| Secondary Camera | VGA | Not Present | 1.6 MP, 720p@30fps | 2 MP | |

| Battery | 1500 mAh | 1980 mAh | 2000 mAh | 1700 mAh |

Samsung's latest offering, the Galaxy S Duos 3 leaves a lot to be desired, especially when compared to offerings like Android One and Xiaomi Redmi 1S. Smartphones like Moto G run on stock Android and have better specs than Samsung smartphones in the same price, so there’s no doubt that they end up providing a much better experience than Samsung devices. The Android One initiative lets users be on the latest version of Android whereas entry-level Samsung smartphones are rarely updated to the latest version of Android.

2. Streamline their product line-up

Samsung has to streamline their product line-up. Sometimes, even technology enthusiasts like us get confused with their product names. They have admitted at their recent earnings calls that they had "unsold stock left in inventory which forced them to reduce prices and spend more on marketing”. When Samsung releases so many products not all the devices get the same love and attention. If you have a look at Xiaomi, Motorola, or Asus, you can clearly see how well-defined their product line-up is. They need to have clear price and feature differentiation between their products, something which is not present as of now.

Will Samsung fade away from the smartphone market?

Samsung is a big company and is not going to go anywhere soon. Despite a 60% drop in profits they are still the most profitable Android manufacturer in the world. Samsung is not the only Android manufacturer facing trouble. Even Sony has quadrupled their losses because of the poor performance of their smartphone division. HTC has been reporting lower revenues but looks like they are back on track, thanks to renewed focus on mid-range smartphones. Companies like Xiaomi and Motorola grabbing market share from Samsung are not able to make much money out of it either. From a long-term perspective, all these loss making (or minimal profit making) companies would not survive without increase in prices. This is already visible with the sale of Nokia, Motorola and Pantech. A sweet balance needs to be present between margins and the specifications.

Samsung is a huge conglomerate, with investments in various businesses such as electronic component manufacturing, home appliances, imaging, electronic device, etc. Samsung has been investing heavily in the chip manufacturing plants. If you know, Samsung is the biggest supplier for many companies, including Apple. Samsung will not go out of business, at least in the recent future.

Samsung is slightly improving their high-end devices. The Galaxy Alpha, and the Galaxy Note 4 come with solid specifications and metal build. They are also working on metal-bodied mid-range smartphones; Galaxy A3, Galaxy A5, and Galaxy A7. As the industry moves on, competition would reduce and pricing power would eventually come back to Samsung. Till then, Samsung needs to compete with other players, even if its profits decline. The emerging markets are good for showing the numbers and the scale while focusing on high-end smartphones for developed markets will bring profits.