Reliance Jio strengthened its hold on India’s home broadband market in December 2025, adding nearly twice as many customers as its closest rival, according to the latest subscription data released by TRAI.

Reliance Jio strengthened its hold on India’s home broadband market in December 2025, adding nearly twice as many customers as its closest rival, according to the latest subscription data released by TRAI.

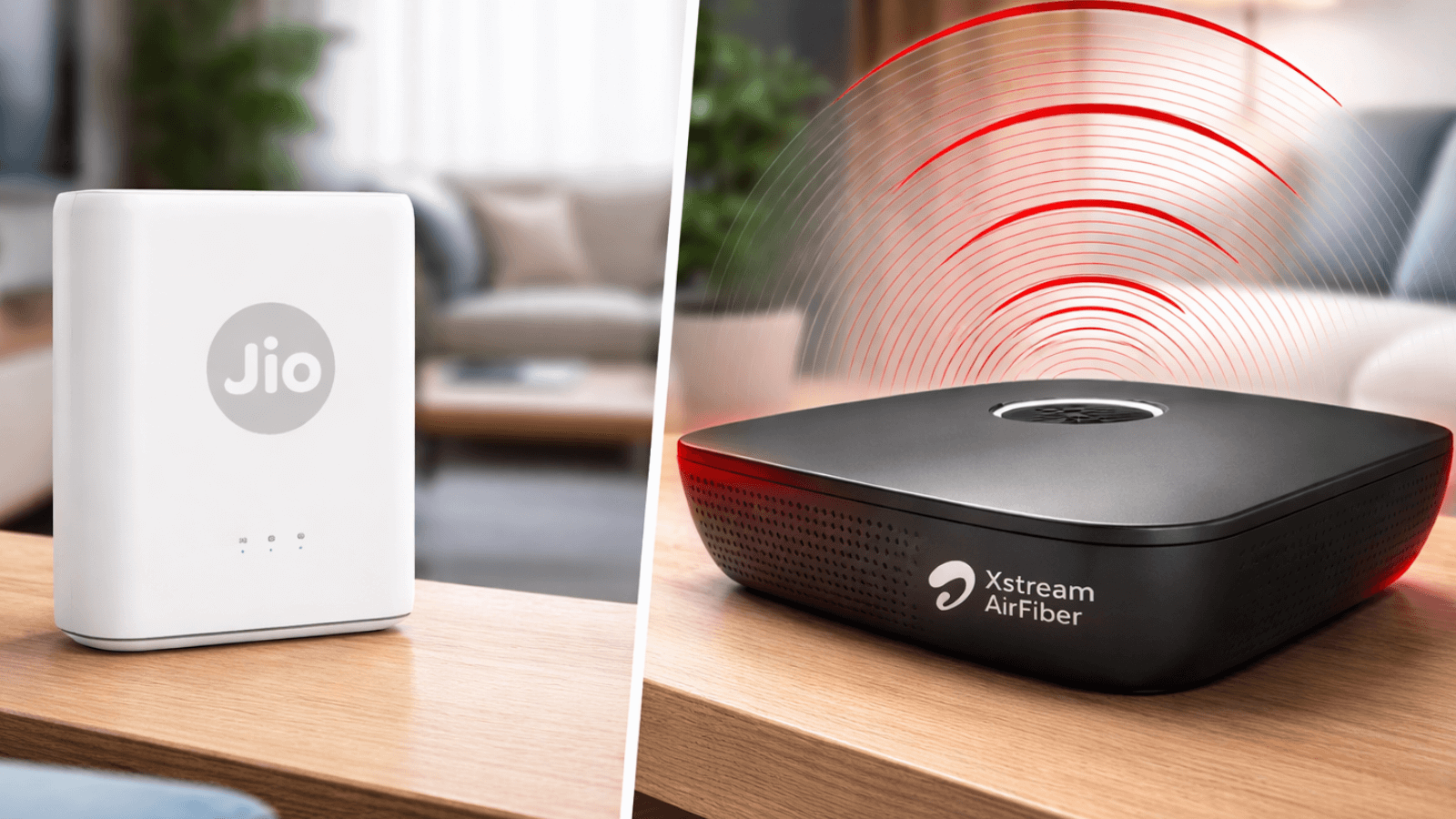

Jio added 8,72,922 broadband users during the month, compared with 4,95,561 additions by Bharti Airtel. The gap reflects Jio’s accelerating momentum in both fixed wireless access (FWA) and wired fiber broadband, segments that are increasingly central to India’s digital growth story.

Also Read: Airtel Crosses 463 Million Wireless Subscribers; Gap With Jio Shrinks: TRAI December 2025 Data

AirFiber Drives Fixed Wireless Surge

A major driver of Jio’s December performance was fixed wireless access, powered by its AirFiber rollout. During the month, Jio added 6,67,889 FWA customers. This included 2,75,746 additions under 5G FWA and 3,92,143 under UBR FWA. Airtel, in comparison, added 3,05,933 users in its 5G FWA segment.

The longer-term trend is even more striking. Over the past six months, Jio added 53,93,154 FWA subscribers, more than four times Airtel’s 13,29,605 additions. That has translated into a commanding 79% share of the fixed wireless market. The data suggests that Jio’s strategy of rapidly scaling AirFiber nationwide is gaining strong traction, particularly in areas where fiber rollout is slower or infrastructure deployment is more complex.

Wired Broadband Leadership Continues

Jio’s dominance is not limited to wireless broadband. It continues to lead the wired fiber segment as well. As of December 2025, Jio’s wired broadband base stood at 13.80 million subscribers. Airtel followed with 10.05 million, while Bharat Sanchar Nigam Limited (BSNL) had 4.47 million.

In terms of monthly additions, Jio added 2,05,033 wired broadband users in December, slightly ahead of Airtel’s 1,89,628 additions. BSNL, meanwhile, saw a decline of 27,578 subscribers during the same period.

The numbers show that Jio is not only leading in overall scale but also maintaining steady monthly growth across both broadband formats.

Nearly Double the Growth in a Single Month

When fixed wireless and wired additions are combined, the scale of Jio’s December expansion becomes clearer.

Jio’s total broadband net additions reached 8,72,922 in December, almost double Airtel’s 4,95,561. Such a gap in a single month underscores the intensity of competition in the home broadband space and Jio’s current advantage in subscriber acquisition.

With rising demand for streaming, online gaming, remote work, and smart home services, broadband connections have become critical digital infrastructure. Fixed wireless services, in particular, are emerging as a fast-growing alternative to traditional fiber installations. The December 2025 data indicates that Jio is currently capturing a significant share of this growth momentum, both through its AirFiber expansion and its established wired fiber base.

As the broadband race continues, the latest figures show Jio widening the gap — not only in subscriber numbers, but in overall market momentum.