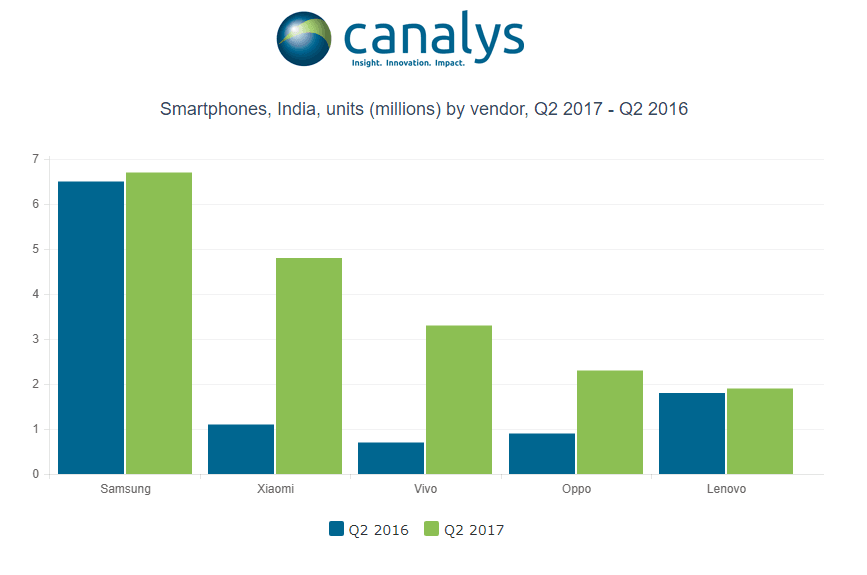

The Indian smartphone market witnessed a decline for the first time in its history, as the shipments fell 4% year on year to just under 27 million units in Q2 2017. Samsung continues to lead the market, with a 25% share, followed by Xiaomi, which more than quadrupled its shipments to 4.8 million units this quarter.

Vivo took third place, shipping an all-time high of 3.4 million units, owing to its rising popularity among tier-two and tier-three cities. Oppo displaced Lenovo to take fourth place, while Lenovo finished fifth with 1.9 million smartphones.

“With China suffering its own decline this quarter, India is a market of huge strategic importance to Chinese smartphone vendors,” said Canalys Research Analyst Ishan Dutt. “Samsung is under immense pressure in the mid-tier from the Chinese players. For now, its low-end J Series is helping it sustain its lead and maintain share. But it needs to use its brand to make its mid-tier devices more desirable. The recently launched S8 and S8+ have helped it win back some of its premium shares. It now needs to generate a halo effect around these products in the mid-tier to counteract the threat from China.” Collectively, Xiaomi, Oppo, Vivo, Gionee and Lenovo control over 50% of India’s smartphone market.

The Goods and Services Tax (GST) regime, which became effective in India from July 1, 2017, across all the products and services, has adversely affected the market this quarter.

“There is general confusion in the entire market over GST and a lack of awareness about the changes that are needed. Apprehension among distributors and retailers regarding the impact on prices has caused the market to adopt a wait-and-see policy,” said Canalys Analyst Rushabh Doshi. “The market will emerge stronger post-GST. Vendors can look forward to leaner distribution, faster delivery and increased demand from local retailers and distributors,” he added.

It's no doubt that the Indian market leader, Samsung is facing the heat, especially after the entrance of Xiaomi to the offline market. Reportedly, Samsung had cancelled the exclusive contract with many of the retailers in the Delhi NCR area for them becoming the Xiaomi's exclusive partner. Few more Chinese brands such as the iVoomi, Tecno Mobiles, and Comio are looking to disrupt the Indian market with affordable handsets, while Indian brand Micromax is looking to step the game as well.