As we await the imminent launch of commercial services by Reliance Jio we would like to stop and analyse what is it that a giant company like RIL is banking upon for surety of poaching the High ARPU subscribers of incumbent operators with its greenfield foray into the telecom sector. Jio's delayed launch may mean that they are losing out on the first mover advantage in the key circles where incumbents have rushed their launch to play defensive, but Jio has been incubating its own suit of media apps and it's for a reason.

With every operator in the race for offering faster mobile internet, what really distinguishes one from the other? you may say blanket coverage in your area, sure.. Pan India footprint, even better.. Cheaper data tariff, well now you're talking, Indians need it cheap.. But if you go to see, what does one really need high speed data for? Browsing of web pages, checking emails and instant messaging services are the basics which will work even on 2G data. The higher bandwidth requirement comes in the frame when you consider streaming of media like Live TV, video on demand, Full length movies, even streaming of songs with good audio bit rate.

So even when you say cheap high speed data, how cheap can cheap really get? with the changing trends in Media consumption by the end users, streaming just 1 hour of good quality video on your smartphone or tab can consume as much as 1GB of data. Even if an operator were to go as low as Rs.50 per GB one would still end up paying around Rs.150 for watching a single 3 hour movie on his device. Operators like Airtel tried launching a zero rating platform where content providers would buy data in bulk and the end consumer would only pay a fixed subscription charge to the content provider and not pay separately for data consumed for streaming, but this was criticised on the grounds of breaching net neutrality and Airtel was forced to shut the platform.

The Net neutrality angle:

Yes with platforms like VoLTE evolving where even voice becomes a service that rides on the LTE backbone, operators would soon be turned into dumb data pipes with the subscriber choosing what he wishes to use the data for. With platforms like VoIP becoming mainstream, operators started to lose out on Voice revenue from traditional GSM calls and then resorted to means like exclusion of VoIP from regular data packs and launching of special VoIP data packs of higher value, which met strong backlash from the consumers on the grounds of Net neutrality since differential pricing of data on the basis of content is illegal and they were forced to backtrack their fowl plans.

The same applies to data consumed for media streaming on the LTE network. When the incumbents launched their 4G offerings in select cities they bundled it with media content offerings on their respective platforms to catalyse content consumption and increase the data demand. Idea for example partnered with Hungama for offering music content and Eros Now for offering video on demand content at Rs.29 per month until 31st March but this did not include the data consumed in streaming. Vodafone launched vodafone play where it also partnered with Hungama and Hooq for music and video content respectively, again data charges were separately applicable. Airtel launched Wynk movies where it offered a monthly subscription of Rs.99 for unlimited access to videos from sources like Eros Now, Sony Liv, Hooq, Youtube but again data charges for streaming were separate.

Where Jio gets the edge above the incumbents:

In the recent ruling of the government, India has adopted the complete Net Neutrality plan where an operator cannot resort to differential pricing of data based on content, nor can it throttle or fast track the speeds for different kinds of data. But in this ruling there was one loophole left out purposely in the form of 'Intranet' which is not subject to net neutrality. Intranet by definition is a private connection between a company's servers and its employees or subscribers which does not depend on the internet. As reported by Economic times, HSBC has stated that this clause will be exploited by newer telcos to poach the high ARPU subscribers of incumbents by offering media content at low subscription rates.

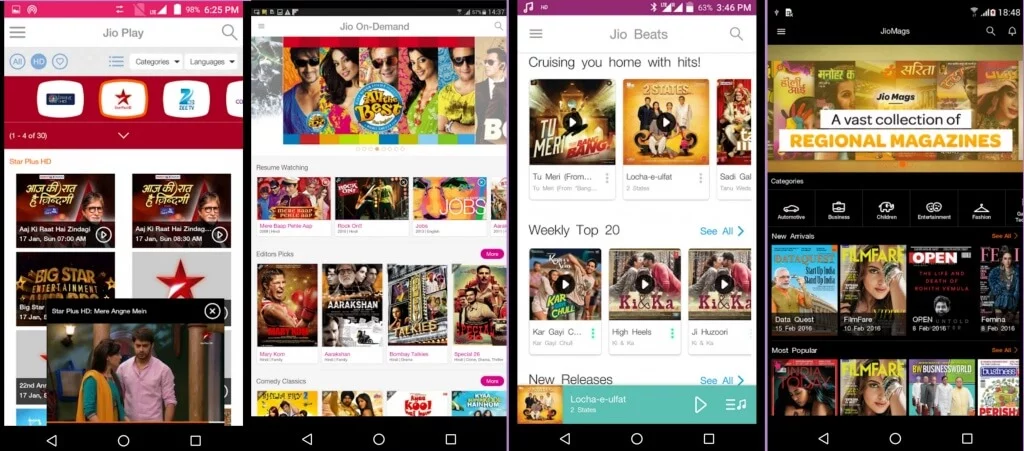

This means that for Jio's own media apps like Jio play, Jio on demand, Jio beats the content is originating from Jio's own servers and being consumed by a Jio subscriber which makes it a direct internal connection which does not depend on the internet and is thus not subject to the net neutrality clause. Which is why Jio can possibly launch with a low fixed monthly subscription charge for all content without any additional data usage charge. In the incumbent's case, the content originates from servers of Eros now, Hooq, Hungama, etc. and the only way the subscriber can access it is through the internet and has to pay separately for the data consumed in streaming.

Note:

The article is based on market speculation (HSBC report) and the author's individual analysis. We do not have a direct confirmation on the go to market strategy of Jio for any of its content and services offerings. Keep reading TelecomTalk for the latest updates in the Indian telecom sector.