They Say "The intensity of the pain can't be felt unless or until experienced." While the layoffs have been happening for a while, few days back a HR Services Company floated a report whose gist is something as titled "Telecom to lose more jobs; on course to cull 90,000 more." If you read the piece of news carefully, the entire scenario is put forward in a raw manner, but who cares? we see a lot of these now and then in the IT Sector. Fine, since our focus area is Telecom, let's only discuss it.

Before going forward, let me put straight, this is just a high-level overview. I have neither focused on any precise statistical numbers nor on the as-is detail layout structure of the Industry.

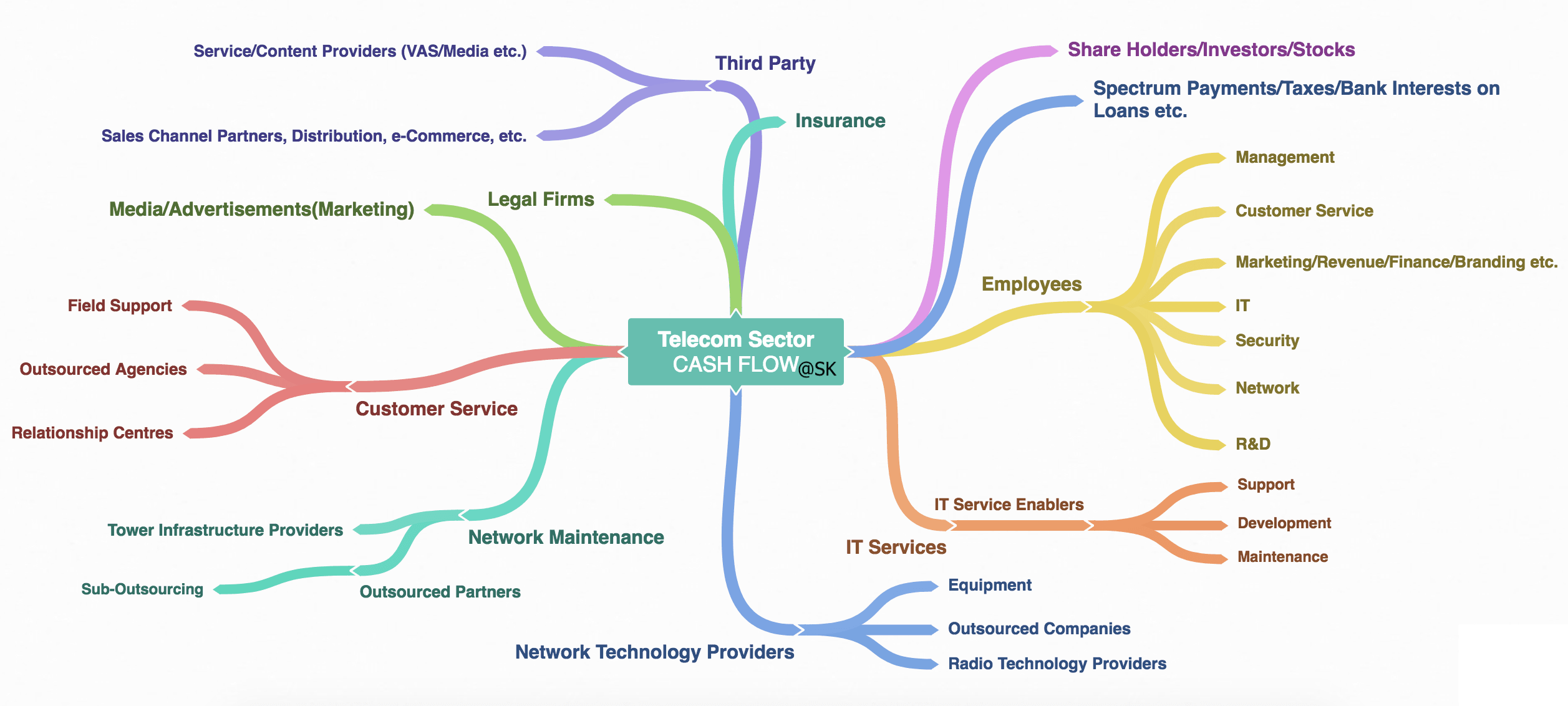

Our Telecom Sector somehow can be represented in the below way.

The image speaks it all. One can relate to a number of fields and jobs our telecom sector directly or indirectly is generating in the country. So, who gives money to all those dependent sectors or accounts? We can say our Telcos generate majority capital/Investment by charging for services and content and take care of the entire expenditure towards the development of the ecosystem by managing cash flows at every level.

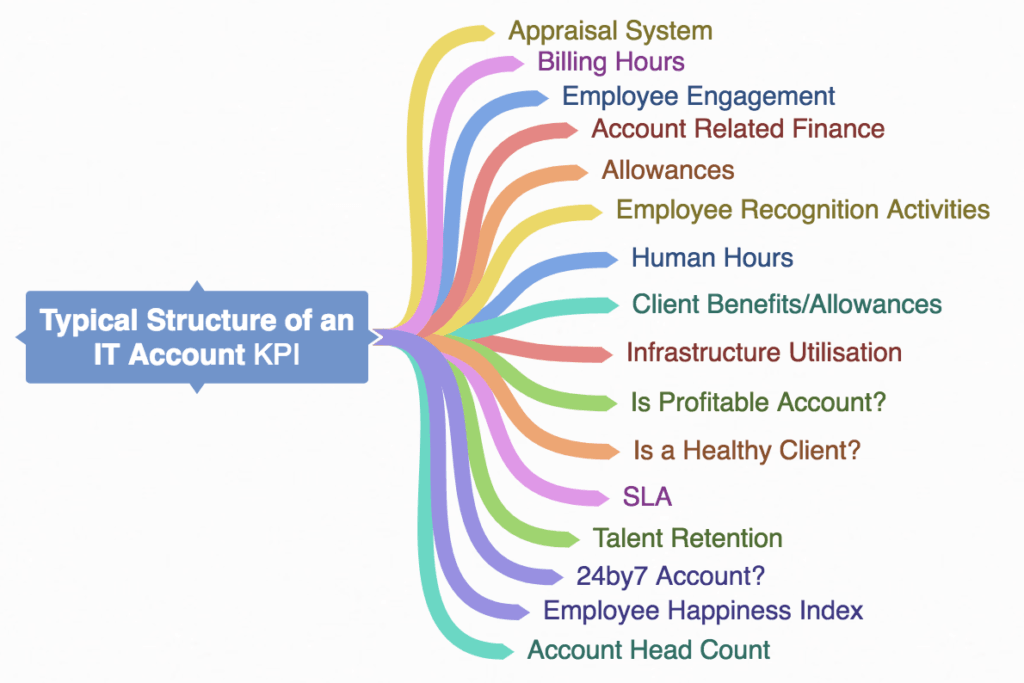

Now, coming to the layoffs related to Telecom Domain in the IT sector and what it has in relation to the Telecom Sector. To understand you should also have a fair understanding of how a typical project is handled at management level in a Service-based IT company. The image below represents typical performance indicators in a Software Company.

- IT Services :

Basically, projects from a particular company are treated as Accounts. To explain in simple terms, if TelecomTalk has outsourced a project to an IT company, the project is termed 'TelecomTalk Account' inside the company and employees working in that project refer 'TelecomTalk Account' whenever their project details are asked internally.

So, once a project agreement is done between TelecomTalk and the IT Company, the SLA (Service Level Agreement) starts. Suppose if TelecomTalk and the IT Company after project estimates agree to the contract for 1Million, the company should provide services as per the agreement whatever the consequences are. So, now TelecomTalk is a big client of the IT Company. The IT company now builds infrastructure, trains/hires talent as per the requirement of the TelecomTalk Account. As long as TelecomTalk is Financially Healthy and paying well, the employees will have some flexibility in the account with benefits. Now, TT is going through a rough phase and the project renewal agreement is quoted at half of the budget as earlier. Now, the IT company still handles the project but at half the cost as before. After all it is just another IT company which is working for Profits, Stability and Accountability. So, now this effects the employees and their benefits and the overall performance indicators as shown in the infographic. As a consequence, the headcount in the account is reduced, less number of employees need to give the same productivity, stress increases when the workload sharing is reduced. This directly also affects their annual hike or compensation. No company purposefully intends to get rid of the aligned talent pool, but then these companies have no option either and finally, layoffs happen from those accounts. Typically big companies absorb losses incurred from less profitable accounts from other profitable accounts in possible scenarios but it has a threshold limit.

Now, there are individual questions arising from the above scenario "Will I work for a company with less or no annual Hike? Should I take the stress levels when I have talent? What is my future when I'm not able to align some other technology?" Typical, Software Job questions in Service Sector irrelevant of Telecom Domain and days pass by like any other day. This is how outsourcing Industry has been working lately.

And for truth's sake, please don't take Automation or AI as major reasons for these layoffs. AI is not yet dominant enough to use in large-scale Telecom Automation for consumer use cases in India. To give an example: Just imagine the responses you get from an automated engine to your emailed query. What if you are answered by an Automated IVR/Bot Agent instead of a Human Agent every time you call CC for assistance? We already know how AI-powered smartphone assistants work. Though those days are not far, please don't think of these technologies as reasons for the current scenario as the layoff reasons are clearly mentioned in the report. Now, we are done with IT services segment of the Industry.

The same may be the case with any other Industry whose employment is directly dependent on the Telecom field with a different set of parameters.

2. Third Party : Channel Partners/Distribution

Lets now understand the situation with Sales Channel Partners and Distribution segments. We got a chance to interact and put forward personal opinions of few people who are in this line of Industry for a very long time. Below are the questions put forward by TT and just to note the answers are purely based on their personal opinions and not of the Industry or TT.

Opinion 1 -

a. How is your business going on in the current scenario of Telecom in the country?

Right, now business has improved from the situation which was in early 2017, mainly due to incumbents providing good margins as ever. And retaining their customers and still committing their bulk of sales through the offline retail chain. But if I compare my business to before Jio launch, its only 60% of that time. But still, we are unsure of future.

b. But, in this digital era of Recharges and payments how crucial is your role in the sector for sales and distribution Network?

Our role is still crucial because whatever types of digital modes come for recharges, still, more than 80% recharges are being sold through offline retail. Because they trust going to a shop for latest schemes. And to provide recharges to the mass population still offline retail chain is crucial which is good for our business. We provide retail stores, training regarding SIM Activation and stuff like that. Different types of canopy activities too we provide.

c. Do you think the current tariff is healthy for the sector?

I really don't think these tariffs are sustainable for any company or distributor or a retailer. Because it's creating too much financial pressure on all the companies. These tariffs will give only cheaper tariffs. That will not provide good quality to any customer since companies will not be able to invest in its resources and infrastructure to maintain their quality.

d. If you have employees working for you, has this situation impacted their salaries or benefits?

In a direct way it has not impacted my employee's salary, but it has certainly impacted a lot of job opportunities for many youngsters. Bcoz if I have more margin and sales then I might create more jobs and vice versa.

e. Now everyone recharges with 199, 399, 509 or some other combo. Isn't this raising ARPU in return benefitting you than those with 110, 55, 250 earlier?

When people recharged with normal top-ups, power-ups, net packs, SMS packs individually, on an average we were getting a good ARPU. Sometimes maybe more like in the 3G era. But now it's around less than half of what used to be per month per user earlier. But still at that time also we used to think there should be some combo packs for customers to just recharge and enjoy everything. Now, it's here, but the price is too low. Now we focus more on selling these combo packs to increase our sales. For example, if I sale daily around 40 UL packs plus normal recharges then it will reach some margin which is not possible daily. These packs are helping little to give stable steady sales but not helping a lot to give sales growth because sales are already down 40% to 50% from where it was 1 and half year ago. So these packs are good but the price point should be higher for a month.

f. Anything would you like to share?

This phase in Indian telecom industry is really the most difficult one and the most testing one which I have seen in my life. I've seen the telecom sector which has been the most important sector as employer for Indians in the past till late 2016 and now has been in real difficult time. And that's a bizarre for Indian economy too. The number of employees dependent on telecom in an indirect way (through distribution or retail channel) was more than the direct company employees. We are just waiting and watching when the scenario changes.

Opinion 2 -

a. So, How is your business in the current scenario?

It is very bad since 2016. Many of whom I know already closed their business due to the sustainability factor. My margins down almost by 4 Lakhs and I'm not able to increase salaries of the people working for me.

b. So, why are you not closing yours?

I have another business and a majority of my monthly income comes from that. I sometimes use that income to balance the losses occurred here and pay salaries. If not the other business, I would have closed this business a year ago. Also, I have made some investment here and is the reason I'm still continuing.

c. Are you aware of the current Industry Scenario?

Yes, why not? We (group of friends involved in the same business sitting around) are completely aware of the situation. I read the news to follow the industry. I interact with people who deploy towers and infrastructure. We are also aware what is our Government up to on Telecom sector, we can correlate things.

What Telcos are expecting for this segment from Budget 2018: Taken Excerpts shared by COAI

Another key area of concern is the high withholding tax applicable on discounts extended to prepaid distributors. A possible solution, according to COAI's Mathews, is reducing the applicable withholding tax on discounts offered to prepaid distributors to 1% from the present 5% as the latter are not agents and earn very low margins,"

We are now done with this segment of the Industry.

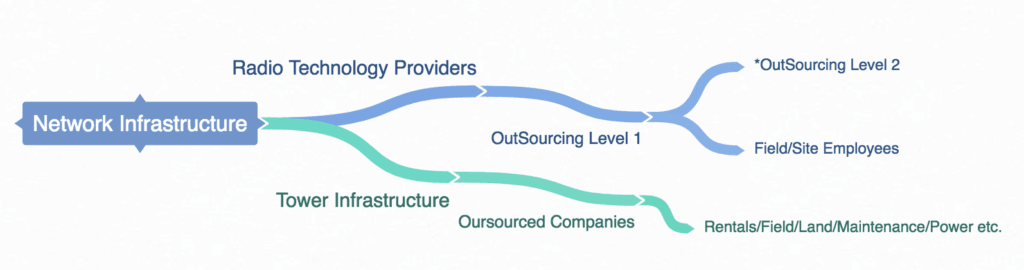

3. Network Infrastructure Rollout :

Excerpts from the discussion with a Network Rollout team

We are rolling out Networks at a much faster pace than earlier. The productivity needs to be increased at same or less the salary. Fewer benefits from our companies compared to earlier. Sometimes, our companies don't get timely payments and we are also affected. At times the deferred payment news doesn't come out as it damages any companies reputation but it has its effects directly or indirectly on the employees. A piece can be read here.

So, Network is one crucial aspect of this entire ecosystem and just to enlighten users involved in a discussion I read on the forum: "A Single RAN Advanced Solution used in Network infrastructure doesn't help Telcos to reduce the cost to a consumer at a drastic level to that of now as the *benefits range approximately 20-30% over a span of 2-3 years. Also significant CAPEX savings are achievable when the RAN is shared between two or more operators."

Today's Data Strong Network may lack the QoS tomorrow if there is no proper maintenance. So, this is something which needs to be done on a regular basis. Upgrading a live Network is like trying to change the wheel of a car while it is still moving without effecting the performance and you can understand the complexity.

What Telcos are expecting for this segment from Budget 2018: Taken Excerpts shared by COAI

Sizeable customs duties on 4G network gear and connectivity devices used in new-age technologies such as internet of things (IoT) and machine-to-machine (M2M) communication services. A cut in customs duty on 4G LTE equipment, would boost 4G penetration, especially in rural areas and help bridge the digital divide. Exempting 4G network equipment from the the 10.3% basic customs duty (BCD) would reduce the cost of rolling out high-capacity data networks. Such duty exemptions are also likely to encourage telcos to invest aggressively in rural areas where the returns are inadequate

4. Spectrum Payments/Taxes/Interests etc:

What Telcos are expecting for this segment from Budget 2018: Taken Excerpts shared by COAI Telcos feel financial stress levels in the telecom sector could ease significantly if the Budget paves the way for cuts in key telecom levies such as spectrum usage charges (SUC), licence fee and Universal Service Obligation Fund (USOF) fees.

As much as 30% of every Rs 100 a telco earns is paid to the government as levies. A reduction in levies is likely to improve the financial health of the debt-laden telecom industry and allow telcos to deliver voice and data services at cheaper rates.

--

The losses occurred by the Telecom Vertical can be absorbed by the profits from a different vertical provided the company has multiple verticals, but what if a company has only Telecom and it's related verticals? Considering Salaries, Hikes, Savings, Profits, Loss, Inflation, Interests, Taxes, Fines etc just because there is hyper-competition in the market, doesn't mean there is no accountability. It's a very basic expectation that every rupee invested has to answer back the investor though there are risks involved.

The above opinions may not depict the complete scenario of the sector or true to exactly be in sync with the current scenario. Like any other business, there are rough and smooth phases involved in the Telecom Sector too. But for now, the Telecom Industry is in a Transitory phase trying to cope up with the technological and pricing challenges. The Technological advancements (IoT/AI/ML/Cloud/VR) may also drive away traditional employment or revenue generation models and pave way for a completely new model of Business. For now, the Industry is optimistic about its journey towards a fully connected Nation. Who knows, all the pains today, may lead to an entirely new Business Model tomorrow but some results are permanent in a temporary competitive field and only those directly or indirectly involved can feel them. Lets Hope for a better, progressive, connected and digital tomorrow.

Note : The infographics are out of the knowledge capacity of that of the author and not from anyone else. The sources of questionnaire answers have been closely associated with Industry from a long time. Based on personal opinions and may not very well reflect the scenario of the Industry. The Key lists used in the infographics are not exhaustive and are only for reference purposes.