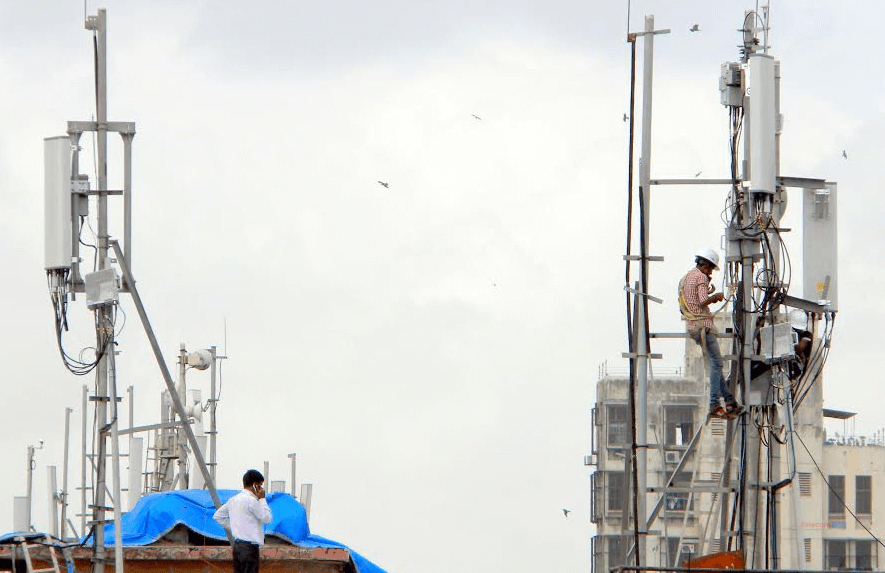

Brookfield Infrastructure, along with its institutional partners, is buying the tower business of Reliance Communications (RCom) at an upfront payment of Rs. 11,000 crores in cash, announces a statement released by RCom. The transaction is subject to authority approvals. The binding agreement will de-merge RCom’s tower business into a separate business entity, owned by Brookfield Infrastructure.

RCom will get ‘B’ class non-voting shares in the new business. Besides the non-voting shares, RCom will not be involved directly or indirectly in the management of the new company. RCom and Reliance Jio will remain as the tenants of the new company.

According to RCom, this is the largest investment by an overseas financial investor in the infrastructure sector of India. The new deal will help Anil Ambani-owned RCom to reduce its Rs. 42,000 crores debts.

RCom is on its mission to go debt-free in 2017. For the purpose, the company had signed a definitive agreement to buy Sistema Shyam Teleservices Ltd (SSTL) in a deal valued at Rs. 4500 crores. The deal enabled SSTL to gain 10% stake in RCom of Rs. 2082 crores. Besides, the company is merging its wireless business with Aircel, holding a 50% stake in the business. The debt of the company, thus, will partially be shared by Aircel. In another deal, RCom signed a spectrum sharing and trading deal with Mukesh Ambani-owned Reliance Industries Ltd for 850MHz band. Moreover, it will further monetize its real-estate to bring down debt by another Rs. 5,000 crore.

Also Read: Here’s Why RCom’s Rs. 151 Plan is the Best Recharge Pack Available in the Market Right Now

Ambit, SBI Capital Markets, and UBS Securities India are acting as financial advisers and Herbert Smith Freehills LLP and JSA Law are acting as legal advisers to RCOM for the new transaction with Brookfield.