In a recently released Equity research report by ICICI Securities on the telecom sector, they predict leading telcos to continue reporting strong EBITDA. Some of the key assessments made are:

Lower termination to hurt revenue: Revenues of listed telecom operators will be hit by lower voice RPM, which are expected to decline by 3.3% to 11.8% YoY (down 3.0% to 3.4% QoQ) due to –

- reduction in termination rate to 14p/min (vs. 20p/min) w.e.f March 1, 2015, which implies impact of ~4.5% on voice RPM,

- higher service tax (w.e.f June 1, 2015), which will have limited impact on full recharge vouchers, and

- reduction in roaming tariff ceiling (w.e.f May 1, 2015). Minutes are estimated to grow by 5.2% to 17% YoY (1.5% to 4.5% QoQ). Data revenues likely to expand by 64% and 84% for Bharti and Idea, respectively.

Bharti’s consolidated EBITDA likely to grow by 4.5% YoY (down 0.6% QoQ) led by Bharti India’s EBITDA growth of 13.8% YoY (0.7% QoQ, lower due to Rs 1.6bn one-off gain in Q4FY15), while EBITDA of Africa business will be down by 30% YoY (down 4.6% QoQ). Africa operations continue to be hurt by the depreciation of African currencies. Consolidated net profit will be hit by forex loss in Q1FY16.

Idea likely to report robust EBITDA growth of 28% YoY (5.5% QoQ) led by strong revenue growth of 15% YoY (3.4% QoQ). Lower termination will optically improve EBITDA margin by 70bps QoQ, but like-to-like margins will remain stable. Net profit will remain flat QoQ due to higher depreciation and interest cost on account of the launch of 3G services in Delhi (using 900MHz spectrum bought in February 2014 auction).

Bharti Infratel’s EBITDA to decline 0.8% QoQ but to grow by 12.5% YoY. Bharti Infratel’s revenue is expected to grow by 6.8% YoY led by tenancy growth of 9.2% (+3,634 tenancy addition in 1Q). ICICI Securities estimates EBITDA to grow 12.5% YoY, however, it is likely to decline 0.8% QoQ due to –

- lower energy margins on account of annual renegotiation of energy reimbursements and

- Q4FY15 benefiting from the reversal of donation.

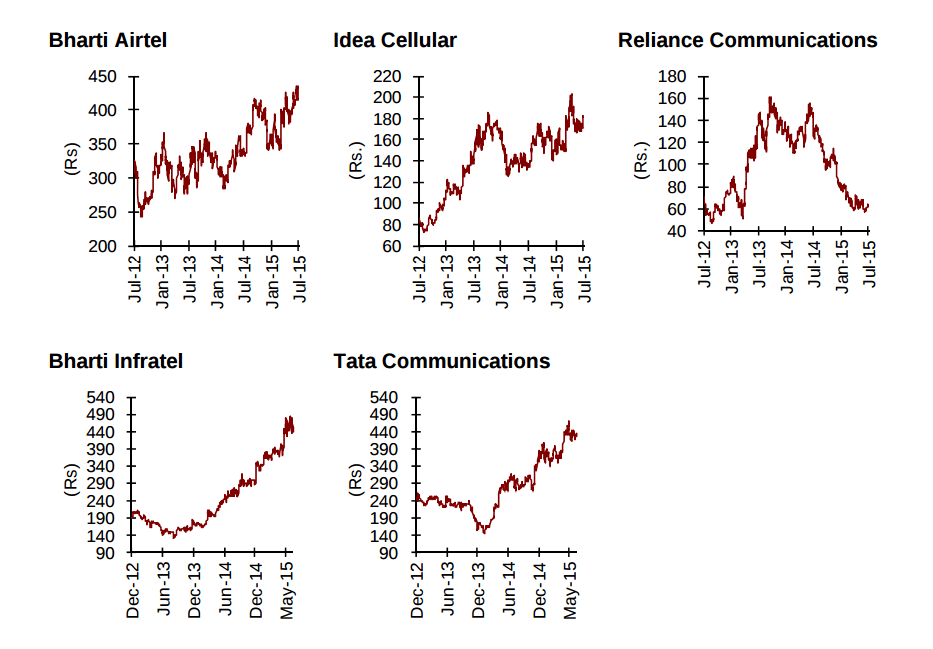

Telecom Stocks at a Glance

Terms

- EBITDA: Earnings Before Interest, Taxes, Depreciation and Amortization

- Quarter On Quarter - QOQ' A measuring technique that calculates the change between one financial quarter and the previous financial quarter

- Year over Year - YoY A comparison of a company's current earnings or other financial performance with the same data for the previous year.