In recent times, Indian consumers have become data-centric, especially after the entrance of Reliance Jio. Data consumption in 2016 and 2017 (till now) made India the top country in the mobile data usage category.

Data usage on the network of telecom operators doubled in six months to 359PB at the end of June 2017, as per the Nokia Mbit report. That said, this data consumption did not include those of Reliance Jio users. "Total data payload increased from 128PB to 165PB; 60% of the incremental data payload from 2015 levels was contributed by 4G," said the report.

"We have seen a significant jump in data growth. Data consumption of network of Indian telecom operators jumped 2.2 times in six months. Therefore, we have come up with the extension of the Nokia Mbit report," Nokia Head of Marketing and Corporate Affairs, Amit Marwah added.

Driven by 3G and 4G, which contributed to 76% of total traffic, wireless traffic continued to increase in 2016, as expected. Overall traffic increased by 29% from 2015 to 2016; 3G grew by 25% during the same period, while 4G contributed to 13% of the total data consumption. Also, 2G data volumes dipped for the first time in 2016 as compared to the 12% growth it witnessed in 2015, as 2G subscribers continued to migrate to 4G.

Even with limited 4G network coverage, data consumption on 4G networks reached 22 PB and is expected to exponentially increase in the coming year. "4G data subs, who are only 13% of the 3G subs base, contribute 4G data payload equivalent to 21% of 3G payload," said the report.

Mobile Circle-wise Snapshot

The Nokia Mbit 2017 report also revealed data consumption circle. In India, there are 22 telecom circles or service areas. These 22 circles are broken down into four groups: metro circles, Category A, Category B, and Category C circles.

Telecom Circles

- Metro- Delhi, Kolkata, Mumbai

- Circle Type-A: Andhra Pradesh, Gujarat, Karnataka, Maharashtra, Tamil Nadu

- Circle Type-B: Haryana, Kerala, Madhya Pradesh, Punjab, Rajasthan, Uttar Pradesh (East), Uttar Pradesh (West), West Bengal

- Circle Type-C: Assam, Bihar, Himachal Pradesh, Jammu & Kashmir, Northeast telecom circle, Orissa.

The Nokia Mbit 2017 report classified the data consumption as per these four groups. It stated that Metro and Category A circles observed a significant decline in 2G traffic and a shift towards 4G, whereas 3G continues to grow in category A circles. With 4G still in its early growth stage, 3G continued to be the primary technology for data consumption in category B and C circles

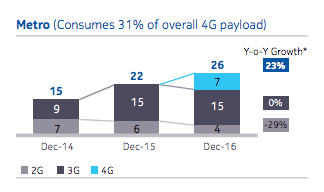

Metro Circles (Consumes 31% of overall 4G payload)

- In Metro circles, the 3G traffic consumption in 2016 remained flat. It contributed to 57% of total metro traffic in 2016.

- 2G traffic declined for the first time in metro circles, while its contribution to total metro data consumption declined from 29% in 2015 to 17% in 2016.

Category A (Consumes 38% of overall 4G data payload)

- In Category-A circles, 3G traffic grew by 30% from 2015 to 2016. It contributed to 67% of the total category A traffic in 2016.

- Also, 2G traffic declined for the first time in category A circles, while its contribution to total circles’ data consumption declined from 35% in 2015 to 20% in 2016.

Category B (Consumes 25% of overall 4G data payload)

- In Category B circles, 3G traffic grew by 33% from 2015 to 2016. It contributed to 61% of the total category B traffic in 2016.

- Contrary to metro and category A circles, 2G traffic increased in Category B circles by 4%, while its contribution to circles’ data consumption decreased from 38% in 2015 to 29% in 2016.

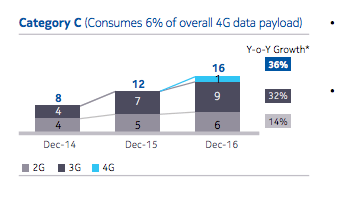

Category C (Consumes 6% of overall 4G data payload)

- Lastly, in Category C circles, 3G traffic grew by 32% from 2015 to 2016. It contributed to 54% of the total category C traffic in 2016.

- As compared to other circles, 2G traffic witnessed the fastest growth in category C with an increase of 14% over 2015, while its contribution to circles’ data consumption decreased from 44% in 2015 to 37% in 2016.

Furthermore, Nokia in the report stated that 43% of all mobile devices shipped in 2016 were smartphones. 4G-enabled smartphones saw a 2.7x increase over the last year, while 3G-enabled smartphones witnessed a 1.2x increase. Entry level price for a 4G handset dropped to Rs. 3,000 in 2016, while average selling price (ASP) of top 25 selling 4G phones was Rs. 10,000.

In 2016, only 13% of the 4G smartphone users had 4G connections and 35% of the 3G smartphone users had 3G connections, implying a significant growth opportunity for operators. Lastly, the report stated that 7 out of every 10 smartphones shipped in 2016 were 4G-enabled.