Indian telecom scene was quite dull in 2015-16 until Jio stepped in and started offering free services. Entry of Jio, the ambitious telecom project by country's richest man Mukesh Ambani has forced the Indian telecom to undergo a major overhaul of sorts.

The most obvious change is merger and acquisition of telecom companies - which makes the telecom market quite smaller. If all go right, India will have only 5-6 players -

• Reliance Jio

• Airtel (acquisition of Telenor India, Augere Wireless, Videocon (partially) and 4G spectrum of Tikona & Aircel)

• Vodafone-Idea (to be merged soon)

• RCom-Aircel-SSTL

• Tata Tele (rumour is they might merge with merged entity of RCOM-AIRCEL-SSTL)

• BSNL/MTNL (there are chances that both PSU may merge)

Among all, Vodafone & Idea's merger seems to create the strongest entity which may give real tough competition to Jio and Airtel. RCom - Aircel -MTS(+Tata Tele) does not seem to be in a position to create a stir in the market as their present 4G coverage is based on RCom's 850 MHz band only, and they may extend 4G to 1800MHz band; but the super -merged entity would not have any 4G network on 2300/2500 MHz where Jio, Airtel, and Vodafone-Idea are placed too firmly.

Jio vs. Incumbents

Reliance Jio has been offering free services to everybody since September 2016 which ended on 15th April 2017 officially. Jio's strategy was pretty simple - try before you hop on to Jio 4G. Jio is LTE- only network, which has never been tested for huge data load, or how VoLTE executes for Jio's voice services. Apart from regular voice, text and data, Jio extended the free offerings on all of Jio's digital services (Jio TV, Jio Cinema, Jio Music and others).

Jio wants incumbents to bleed, and die. And it's working, Airtel acquired several companies, and Vodafone is to be merged with Idea.

But Jio has some issues - their voice network (VoLTE) is not stable (improving gradually, though), and customers have a problem making calls, during the call, and getting calls. Even their LTE network sometimes fell prey of the free users. As Jio’s services have been launched commercially, we can hope these issues will be ironed out soon with the help of rented towers (Jio made a deal with several tower companies) and rented network (fibre and telecom networking sharing).

When Jio was in its nascent stages, many predicted that Jio would disrupt the market by price & services. Jio definitely did a price disruption - free data & voice (and extended them to Summer Surprise Offer too) - which made a huge blow to revenue of other companies (those got a Jio SIM, did not recharge their data packs on existing SIM). Airtel, Vodafone & Idea responded quickly with the introduction of every plan from Jio. Even Aircel & BSNL followed the trend to keep customers intact. RCom and Tata - kept quiet and I seriously doubt if they have any intention to stay in the market on a long-term basis.

In short, I feel Jio would have a great future if they can stabilise their network, improve customer care, and other technical issues.

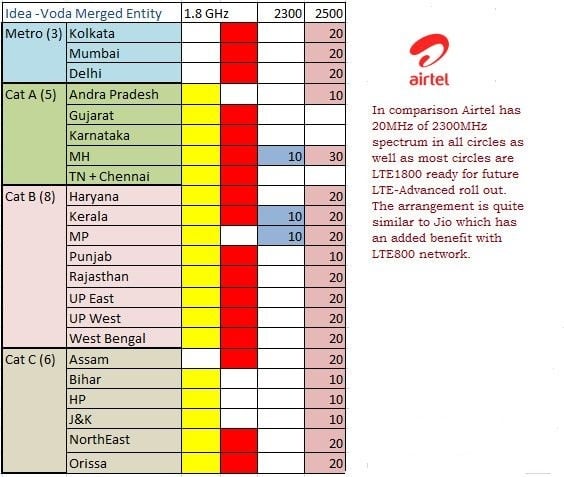

Airtel vs. Vodafone-Idea's Merged Entity

As of now, the merger is yet to begin, and Airtel is still in power. However, after their businesses merge, Voda-Idea can cause the immense problem to Airtel, just like Jio. Still, I believe Airtel will continue to do better than the combined entity for at least 2-3 years. With the recent acquisitions, Airtel now has a 4G spectrum on 2300MHz in all 22 circles, and LTE2300 network is backed up by Airtel's legacy 2G/3G network. Just like Jio, Airtel has extended LTE network on 1800MHz also. Airtel's dual LTE network is already available in many cities, and the company is not sitting idle - they have started VoLTE trials across several cities to match with latest technological upgrades.

In comparison, Vodafone-Idea's LTE network is solely based on refarmed 1800MHz on 2 x 2.5MHz channels. Both companies had acquired LTE-ready spectrum on 2500MHz (only Idea has 2300MHz spectrum in 3 circles). Though in reality, the 2500MHz band is almost similar to the 2300MHz band, the former might need little more nano cells to match up the coverage of 2300MHz. Vodafone and Idea may already have started testing and deploying LTE-TDD on 2500MHz band, but it will take another two years to reach the level playing range of Jio and Airtel.

Interesting time ahead!