The data center market in India is growing rapidly, owing to two reasons — firstly, the rise of digitalisation, and secondly, the need for keeping data locally. Presently, a few players namely Nxtra by Airtel, NTT Global Data Centers, CtrlS Data Centres and more dominate the market. 85% of the operational capacity is amongst the major players. However, new names such as Yotta, Digital Connexion, Lumina CloudInfra, CapitaLand, Digital Edge, etc., have entered the industry with massive investments.

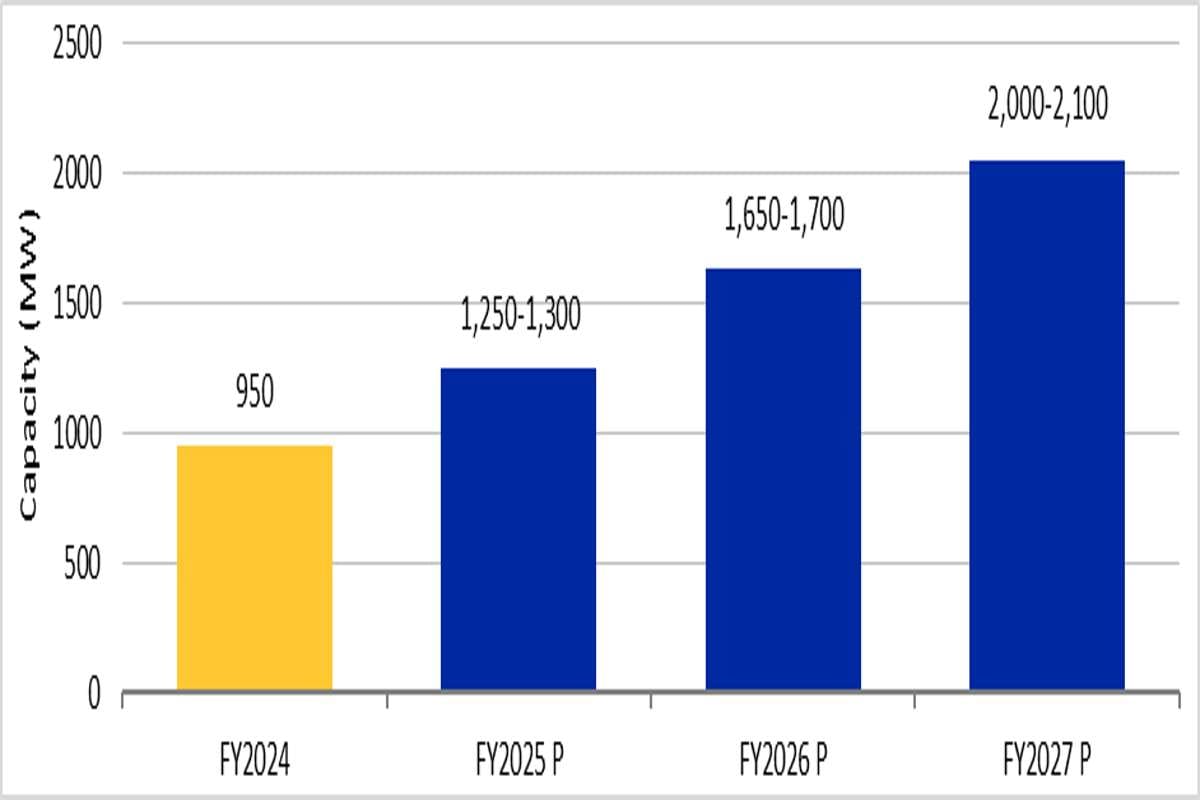

ICRA said in a release that India's data center operational capacity will double in the next 30 months from 950 MW in FY24 to 2000-2100 MW by FY27. This will be driven by investments to the tune of Rs 50,000-Rs 55,000 crores. Reliance Jio Chairman Akash Ambani also requested Prime Minister Narendra Modi that India's data center policies should be aligned towards attracting more investments to ensure that India's data stays in India only.

Yearly Trends in Data Center Operational Capacity shared by ICRA

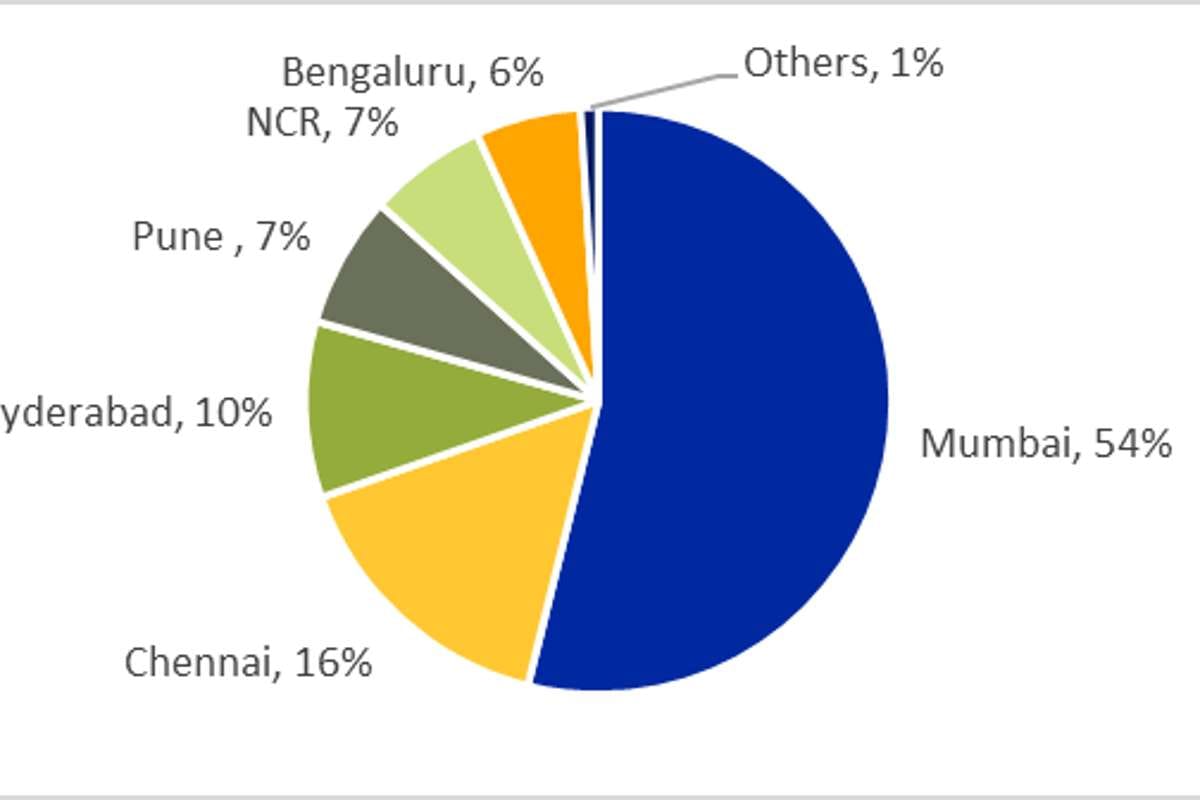

Co-location services, backed by hyper-scalers account for a majority of the revenues for data centers in the country. Location wise, six cities in the country have most of the data center capacities. ICRA said that 95% of the existing capacity is in six cities, wherein Mumbai has the largest share.

Read More - Akash Ambani Urges Rapid Adoption of AI and Data Centre Policy Reform in India

Data center players need to invest in ESG initiatives to meet green power requirements. Nxtra by Airtel has already been investing huge sums of money in getting access to green energy sources. Mumbai will stay as one of the key cities for data center companies to invest in the coming years in India. Apart from that, Chennai, Hyderabad, and Bengaluru will also see major investments from new and existing players in the data centers department.

Read More - Google Inks Nuclear Power Agreement to Power AI Data Centres