The Telecom Regulatory Authority of India (TRAI) has recently released a consultation paper on a mega auction of spectrum in various bands, inviting opinion on issues like timing of next spectrum auction, quantum of spectrum to be put to auction, reserve prices for the spectrum, block sizes in various bands, and roll-out obligations. TRAI has proposed new bands for auction – 3300-3400 MHz and 3400-3600 MHz.

ICRA is of the opinion that the industry is not prepared for a spectrum auction of such scale at least for one year. Mr Harsh Jagnani, Sector Head and Vice President, Corporate Ratings, ICRA Limited elaborates: “The industry is undergoing many structural changes which will continue to absorb the bandwidth of the operators for some time. Entry of a new operator led to a bruising price competition amongst the telcos, and a stable pricing regime is still some time away."

"New pricing plans and products (such as 4G-enabled smartphones) are keeping the industry dynamic. In addition, many important and sizeable merger transactions are under process which will materially alter the industry structure. On top of all these factors, the industry is reeling under high debt level, which coupled with deterioration in financials raises questions on the capability of the industry to participate in the auctions. We expect that most of these issues will take at least a year to settle, till which time the operators will find it difficult to decide on their spectrum strategy. Also, the fact that operators hold unutilised spectrum and do not face major expiries till FY2022 alleviate the urgency for auction,” he added.

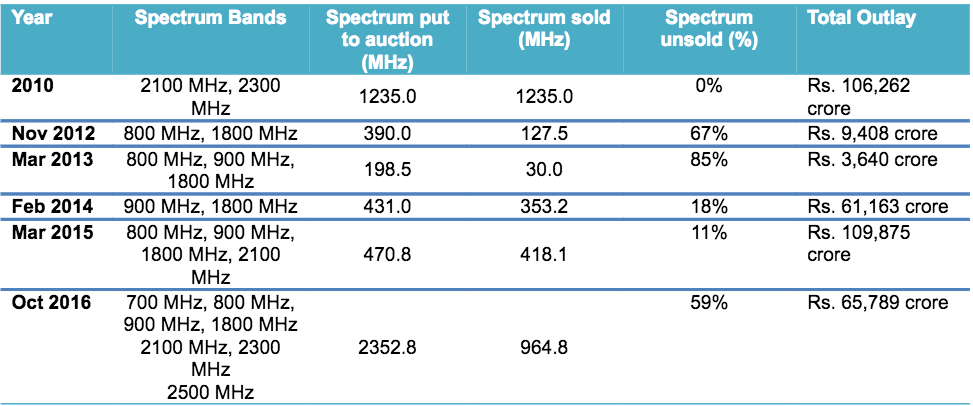

Lack of industry preparedness impacting the spectrum auction participation has been evidenced in the past as well. Till now, the telecom industry in India has witnessed six rounds of auctions, the snapshot of which is tabulated below:

Over the last seven years, the industry has spent a total of Rs. 356,137 crore for acquisition of 3128.5 MHz of spectrum across various bands. After the February 2014 and March 2015 auctions which witnessed enthusiastic participation by the telcos, exacerbated by impending expiries for many operators, October 2016 auctions witnessed muted participation, with 59% spectrum put to auction remaining unsold. Further, the next major spectrum expiries are due in FY2022, diminishing the necessity of auctions.

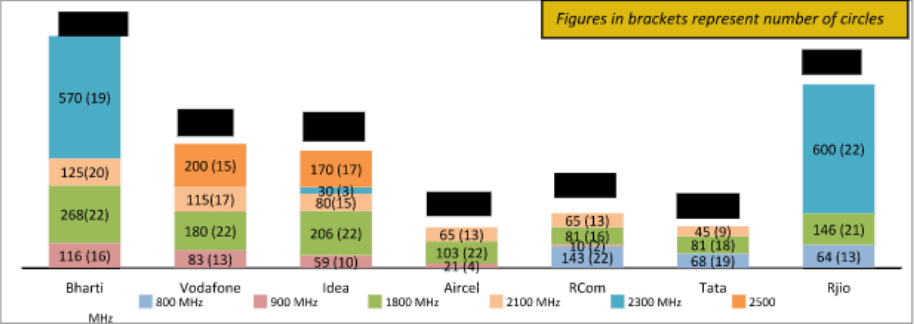

For the proposed auctions, TRAI has included the unsold portion of the previous auctions along with the inclusion of two new bands i.e. 3300-3400 MHz and 3400-3600 MHz. These bands are academically suited for 5G services, wherein deployment across the world is limited. In India, the requirement of this spectrum is some time away, especially when seen in the light of the fact that spectrum in the 2300 MHz band, auctioned in 2010 has not been fully deployed. As of now, the operators in India hold 4345 MHz of spectrum across six bands. The industry appears adequately stocked with spectrum and would look to commit its resources towards deploying the spectrum already acquired instead of buying more. The telco-wise holding of the spectrum is as follows:

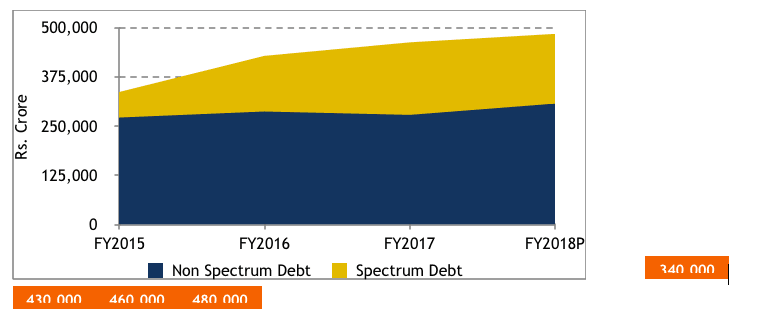

Spectrum auctions in the past have contributed to sizeable debt on the books of the industry - estimated at Rs. 4.6 lakh crore as on March 31, 2017. Out of this – Rs. 2.8 lakh crore pertains to non-spectrum debt while Rs. 1.8 lakh crore is the deferred spectrum payout related debt. In absence of any fresh auctions, ICRA expects this debt to rise to Rs. 4.8 lakh crore by March 2018. The annual repayment obligations for the spectrum debt remain high at around Rs. 28,000 crores for FY2018 and around Rs. 35,000 crores per year from FY2019 to FY2025. The movement of debt levels is as shown below:

At a time when there are talks to provide some incentives to the industry, which is ailing with pressure on profitability, high repayment burden of elevated debt levels, and high capex requirements, a mega spectrum auction definitely appears counter-intuitive.