Ever since the mobile payment sector boomed in India, Paytm has been the favourite app of people. The easy to use UI, smooth experience and worthy add-ons make the application a top gainer when it comes to mobile payment apps. However, there had been major missing functionality with the popular application, and those were- receiving money directly into bank accounts and returns of failed transactions funnelling into bank accounts. Paytm has finally decided to take a step and is now rolling out an update which will solve this problem and provide users with experience of the all-in-one mobile payments app.

Sending Refunds Directly to the Payment Source:

Earlier, whenever there was a failed transaction towards a merchant on the Paytm app the app used to make the refunds only to the wallet and not to the bank account or card from where the payment was made. This undo this; users had to go through the hassle of adding the money back to their accounts whenever there was a refund.

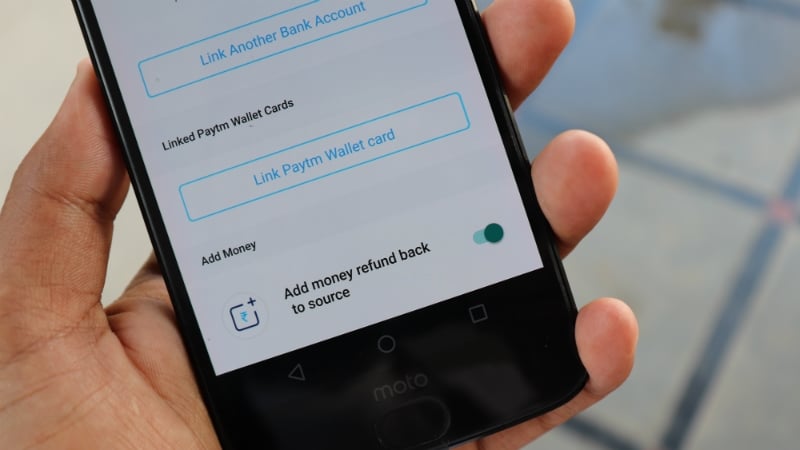

The update which Paytm will be soon rolling out will make amends to allow the refunds to go directly to the payment source. Paytm users can toggle this setting on or off by going to the ‘Profile’ section and scrolling down to payment settings and tapping on “Saved Payment Details and Settings”. At the bottom of this page, users get to see a toggle button for ‘Add money refund back to source’.

Receiving Money Directly to Bank Accounts:

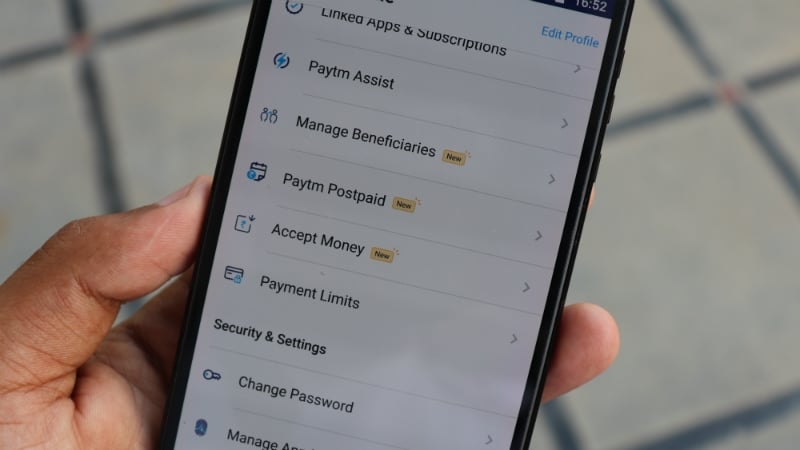

This money will allow the people to receive money directly into their bank account without requiring the sender to put in your bank account details again and again. Like the last feature, users can toggle this feature on and off too. To turn this functionality on we’ll need to go to “Accept Money” in the Profile settings and tap on “Add a Bank Account”. Then we’ll be needed to enter our account number, IFSC code, and the name of the bank. The app asks for a confirmation of the account number again for security reasons and sends an OTP on the registered phone number.

Further on, after this process, the user will be able to receive the money directly into his bank account whenever someone sends the money using UPI, QR code or using the registered mobile number. While in the past Paytm has been held by the users for charging a 3% fee on transferring funds from wallet to the bank account but it still remains unclear whether or not that will be levied on the funds transferred to accounts using this method.

Also, all these new features are made available for users in the latest Paytm app version. We're using the Paytm Beta version 6.6.3 on a Android smartphone and can see all the new features. However, the last app update as per Google Play Store is on March 8, 2018. We're assuming that these are server-side changes itself.