The upcoming auction would have long term implications for the sector in terms of deployment of technology (as the auctioned spectrum would be liberalized), competitive intensity, spectrum holding, and pricing power of the operators.

The upcoming auction would have long term implications for the sector in terms of deployment of technology (as the auctioned spectrum would be liberalized), competitive intensity, spectrum holding, and pricing power of the operators.

This auction is likely to be used as market entering strategy by some new operators and strengthening strategy by the incumbent operators.

The high spectrum cost would impact the cost metrics for the operators, who are already burdened by highly leveraged balance sheets. This would exert pressure on the operators to hike the tariffs to recover the additional costs however the quantum and timing of the same remains uncertain.

Spectrum usage charges:

As recommended by the EGoM, no change has been made to the existing slab rate system for Spectrum Usage Charges, paid annually by the operators as a percentage of their Adjusted Gross revenues.

Impact Assessment :

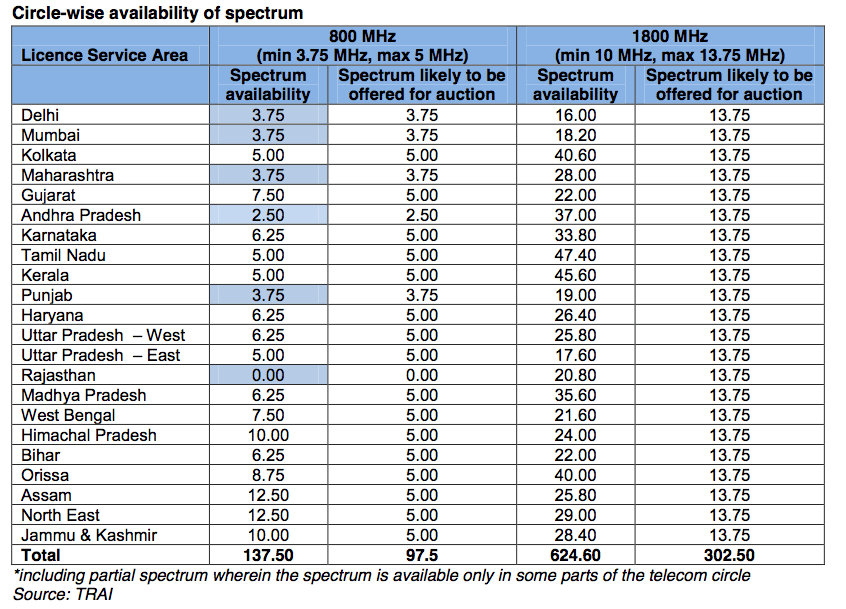

In each of the 22 telecom circles, sufficient spectrum is available in 1800 MHz band to auction the maximum of 13.75 MHz. In the 800 MHz band, there is no spectrum in the Rajasthan circle, only 2.5 MHz in Andhra Pradesh circle and minimum of 3.75 MHz spectrum is available in four circles. In the remaining 16 circles, there is sufficient spectrum to auction the maximum of 5 MHz in 800 MHz band.

Circle-wise availability of spectrum as of Aug 2012:

As per TRAI recommendations, the total spectrum available in the 800 MHz and 1800 MHz, including the spectrum to be vacated due to cancellation of license, would be 137.5 MHz and 624.6 MHz respectively. However, the spectrum likely to be put up for auction in the 800 MHz and 1800 MHz is likely to be around 97.50 MHz and 302.5 MHz respectively, which is significantly lower than the available spectrum.

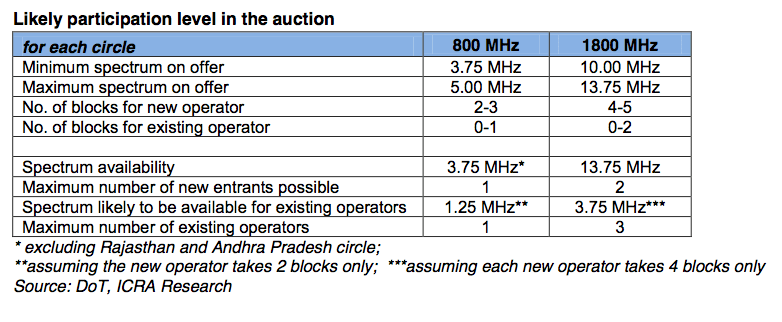

The proposed auction structure and the quantum of spectrum likely to be offered would allow for one new entrant in the 800 MHz band and two new entrants in the 1800 MHz band.

The operators whose licenses were cancelled are – Idea Cellular (Idea), Tata Teleservices (TTSL), Uninor, STel, Etisalat DB, Sistema Shyam, Loop Mobile, Videocon. Out of these, operators like STel, and Etisalat DB have expressed their unwillingness to continue operations in India.

Out of the remaining, operators like Idea and TTSL are likely to bid for spectrum in the cancelled circles to gain pan-India presence.

For the remaining operators, namely, Uninor, Sistema Shyam, Videocon and Loop, there is an uncertainty on the participation, given that they would need to bid for atleast 5 MHz in each telecom circle and a pan-India spectrum would cost Rs. 14000 crore (in 1800 MHz).

For the incumbent operators - Bharti Airtel, Vodafone, Idea, Reliance Communication (RCom), TTSL, and Aircel, the likely strategy would be to take stock of their current spectrum holding and bid selectively in the circles where they are facing spectrum constraints. Assuming the current technology paradigm of using 800MHz for 2G CDMA operations and using 1800 MHz for 2G GSM operations, auction of 1800 MHz is likely to be more aggressive, given that there are more participants present in this frequency band.

A key implication for the reserve price set up by the Union Cabinet is on the possible cash outflows for future spectrum charges like spectrum renewal fees and one time spectrum charge (if levied) for the existing telecom operators, since the prices discovered through the upcoming spectrum auctions would form the base for these charges.

Going by the reserve price, the telecom operators might have to incur substantial cash outflow at the time of renewal of spectrum (starting earliest by FY2015 for Bharti Airtel).A one-time spectrum charge would be an additional financial burden for the telecom operators, although there is no certainty on levy of the same.

Source : ICRA Research.