In this two-part segment Frost & Sullivan will help one to analyze the current market scenario of Indian telecom and the 2nd part talks about competitive analysis, future opportunities for Indian telecom industry.

In this two-part segment Frost & Sullivan will help one to analyze the current market scenario of Indian telecom and the 2nd part talks about competitive analysis, future opportunities for Indian telecom industry.

MARKET OVERVIEW

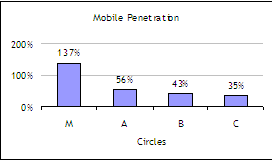

Entry and geographical expansion of services by new players ensured average monthly subscriber addition of over 18 million and unprecedented low tariff rates in the first quarter of 2010. The mobile subscriber base stood at 600 million at the end of April 2010, translating into a mobile penetration of 51 percent.

However, there is still significant disparity between urban and rural penetration. While urban penetration has crossed 100 percent, rural penetration is still below 25 percent.

Circle A and Circle B have experienced the highest subscriber growth especially in the last quarter, contributing approximately 75 percent of subscriber’s net addition. Increasing Minutes of Usage (MoU) has helped in stabilizing the (ARPU) Average Revenue Per User level, which has experienced sharp decline, especially towards the end of 2009, due to tariff wars. As a result, revenue, which had been stagnant in the last quarter of 2009, has improved.

3G AND BWA AUCTION

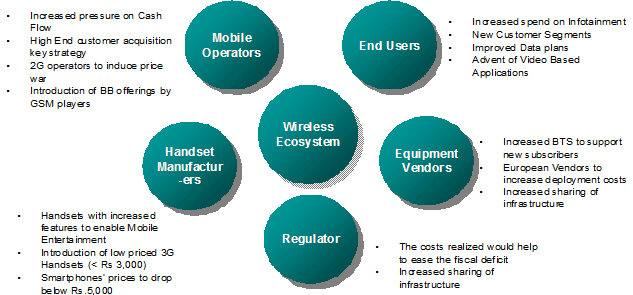

The key event in the first half of 2010 has been the 3G and Broadband wireless access (BWA) spectrum auction, which has triggered a series of effects on the different stakeholders of the mobile and wireless market. 3G auction was concluded in the month of May after 183 rounds of bidding clocking in INR 67,719 Crore of revenues for the Government.

BWA auction, which started 2 days after 3G auction, has also invited intense bidding from players, contributing INR 38,617 Crore to government coffers. The high bidding prices have put a strain on the operators’ balance sheet, forcing them to look for alternative revenue sources.

Mobile operators such as Vodafone and Aircel have started hiving off their tower infrastructure to fund the license amount. With the launch of 3G, an additional impetus is expected to be provided to the infrastructure sector due to additional demand placed for new towers leading to increased sharing of infrastructure.

TELECOM INFRASTRUCTURE

Infrastructure sharing has gained momentum in India with many infrastructure firms and telecom service providers inking long term strategic deals in this direction.

New entrants are entering into exclusive agreements with incumbent players for utilizing existing infrastructure and networks. Existing operators are also reluctant to invest in the passive infrastructure and are considering an OPEX based model.

The infrastructure companies have an advantage of getting high tenancies with the OPEX model; however the lowering rentals are creating pressure on their profit margins.

CHINESE EQUIPMENT VENDORS

The Government has on its part introduced a ban on Chinese equipment, citing security reasons. If Chinese equipment vendors are out of the race, the deployment costs are expected to increase significantly. In addition, European operators would not be compelled to offer discounts as they would no longer face a price pressure. This would in turn induce further sharing of passive and active infrastructure to achieve better economies of scale.

CUSTOMER BENEFITS

The biggest benefactor of increasing competition and launch of new technology would be the end user with enhanced Value Added Services (VAS) and other customer focused offerings as subscriber acquisition continues to remain the key strategy of the operators.

Coexistence of 2G and 3G mobile services is expected to result in operators focusing on different customer segments for respective services. While 2G services are likely to be targeted more towards rural and low revenue generating customers, 3G services are expected to be focused on the high revenue generating elite customer segment during the initial phase.

IMPACT ANALYSIS

The evolution of an ‘elite’ customer segment and its dominance.

Operators are planning to shift a portion of their customers to 3G to ease the spectrum crunch. Potential subscribers would be the metro subscribers where penetration levels are more than 100 percent and there is a need to accommodate more subscribers.

This view is confirmed by the Pan-India 3G License, wherein Delhi and Mumbai together constitute 39 percent of the total amount.

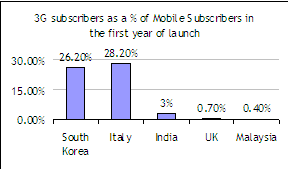

Frost & Sullivan believes that at least 20 percent of the metro subscribers would be shifted to 3G in the first year of its launch. This amounts to 18 million subscribers, which forms 3 percent of the current total mobile subscriber base. This is a realistic number when compared with 3G subscribers of other countries in the first year of its launch.

This 20 percent of the metro subscribers would lead to the formation of a new customer segment of ‘elite’ subscribers. This new breed of customers would dictate the type of mobile content and applications that would be available in the marketplace.

Increased 3G-based offerings to keep ‘elite subscribers’ happy through data plans

Internet browsing and VAS account for 10 percent of the monthly expenditure of elite subscribers.High speed mobile broadband is restricted to CDMA players and this scenario is expected to change with GSM operators becoming active in terms of enhanced data plans.

This could also lead to the much awaited advent of unlimited usage on mobile broadband. This is likely to serve as alternative broadband for many of the elite customers. In addition, this could also lead to device subsidies with respect to USB based data cards.

These dynamics could lead to increased use of data, which could translate to around 5 percent increase in data ARPU. In other words, the 10 percent spend on VAS and Internet browsing could increase to 15 percent within the first 2 years of the launch. This could be triggered by other killer applications such as video streaming, which could lead to a further uptake of video based services, for example, Mobile TV.