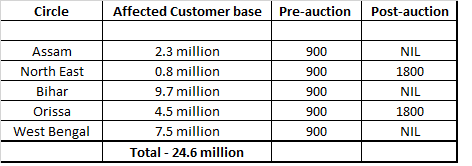

Reliance communications the 4th largest telecom operator in India was faced with the challenge of retaining its efficient 900MHz airwaves in the spectrum auction conducted earlier this year. Rcom was able to only retain the 900MHz spectrum in the 2 circles of Himachal Pradesh and Madhya Pradesh while in other two circles of Odisha and the North East it won 1800MHz spectrum for continuing its 2G operations.

But Rcom was neither able to retain the 900MHz spectrum nor win fresh 1800MHz spectrum in 3 key circles of Bihar, Assam and West Bengal, which gives rise to the big question 'What will happen to Rcom's 2G subscriber base in these 3 circles?'

The three circles of Bihar, Assam and West Bengal comprise over 19 million subscribers out of the total estimated 110 million subscriber base of Rcom which contributes to 5% of its gross revenue, according to Economic Times. Reliance would need to take remedial measures soon since the date of license expiry in these circles is 12th December 2015 which is less than 60 days away and according to a DOT mandate the operator needs to inform its subscribers 30 calendar days in advance of shutting services in a circle.

Most of Rcom's customers in these areas are already on the 3G network, since Rcom has 2100MHz spectrum in all 3 circles, therefore the overall impact on customer experience may be negligible. In these three circles, the company would either have to sign ICRA with the incumbents or consider spectrum trading and sharing in a bid to retain business. If it takes the ICRA route, Rcom will not be able to provide discounted tariffs in these circles since it would have to pay the partner network for using its active and passive infrastructure.

According to the recent guidelines, spectrum sharing may not be feasible since it is only allowed between two operators who possess airwaves in the same band in the same circle and spectrum leasing is prohibited by the guidelines. In Odisha and North East, Rcom would have to make investments to shift customers on to the 1800 Mhz band, since the higher frequency spectrum demands greater number of BTS and in turn double the investment in passive infrastructure by the telco, not to mention the degradation in quality of service for subscribers who are used to the blanket coverage of the 900 MHz spectrum.

"The cost of shifting customers from the 900 Mhz band to 1800 Mhz band in two circles could well amount to $150-200 million, assuming that RCom puts up at least 8,000-10,000 towers as it will require more towers for the 1800 Mhz band, compared to 900 Mhz," a senior analyst with a local brokerage firm said to E.T.

Reliance is yet to make an official announcement about its strategy for continuation of 2G services in these 3 circles. If it fails to come up with a feasible solution, the operator may have to give incentive discounts on its 3G services to coax 2G subscribers to upgrade to 3G or else the low ARPU 2G only subscribers may have to take the MNP route. Reliance which is currently burdened by a debt of over 38,000 crores is in the final stages of selling its entire stake in Reliance Infratel which is the mobile tower business of ADAG and is also considering monetization of the DTH arm and real estate holdings to pare debt.