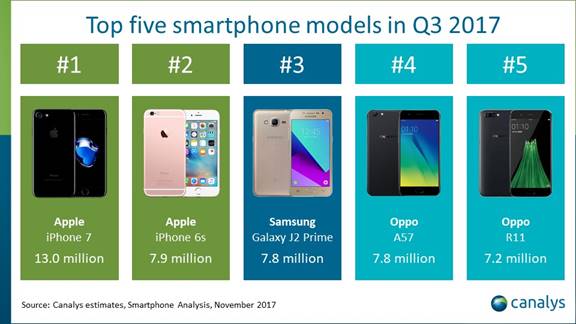

Canalys, an independent analyst company today released the worldwide Q3 2017 smartphone shipments. The Apple iPhone 7 is still the world's best-shipping smartphone in Q3 2017 with Apple shipping a whopping 13 million units. The Apple iPhone 6s is second on the list with 7.9 million shipments, while Samsung's Galaxy J2 Prime is third on the list with 7.8 million shipped.

Chinese brand Oppo's A57 and R11 smartphones took fourth and fifth place with 7.8 million and 7.2 million units respectively. The Apple iPhone 8, which was launched in mid-September, did not make the top five. Worldwide smartphone shipments reached 375.9 million, up 5.9% year on year as per the Canalys Q3 2017 report.

Apple shipped 46.7 million smartphones in Q3 2017. The new iPhone 8 and 8 Plus accounted for 11.8 million of these. This falls well short of its predecessor, the iPhone 7 line, which topped 14 million in its first quarter after the release, But while Apple shipped 5.4 million units of the iPhone 8, it shipped 6.3 million of the larger iPhone 8 Plus. This makes the iPhone 8 Plus the first iPhone Plus model to out-ship its smaller sibling in a single quarter.

“Shipments of older devices, such as the iPhone 6s and SE, saw an uptick in Q3,” said Ben Stanton. “The iPhone 7 also shipped strongly after its price cut in September. Apple grew in Q3, but it was these older, cheaper models that propped up total iPhone shipments. Apple is clearly making a portfolio play here. With the launch of the iPhone X, it now has five tiers of iPhone and delivers iOS at more price bands than ever before. This is a new strategy for Apple. It is aggressively defending its market share, but it will not compromise its rigid margin structure to do so.”

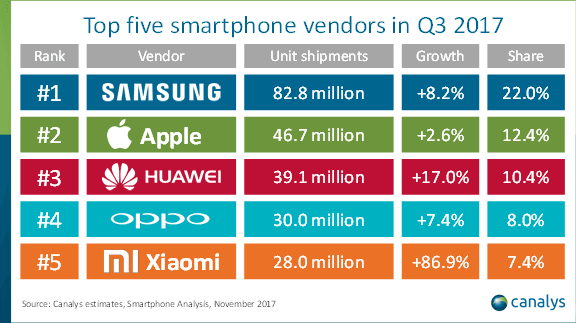

Samsung shipped 82.8 million smartphones in Q3, which is 8.2% more than what it shipped in Q3 2016. The growth in Samsung' shipments is because of the J-series of smartphones, which did extremely well in India and the Middle East. Further, Samsung shipped a whopping 4.4 million units of its flagship smartphone, the Galaxy Note 8.

“Samsung had a positive quarter,” said Canalys Analyst Ben Stanton. “It discounted the Galaxy S8 in several major countries in Q3, which helped ease inventory buildup from the previous quarter. In total, it shipped 10.3 million devices from its Galaxy S8 range in Q3. But Samsung’s golden period of having a differentiated product has now ended. Apple, Google, Huawei and others have all introduced new smartphones with 18:9 displays and thin bezels. As the battleground at the high end moves toward AI and AR, Samsung is behind, and needs to catch up with competitors such as Huawei and Apple.”