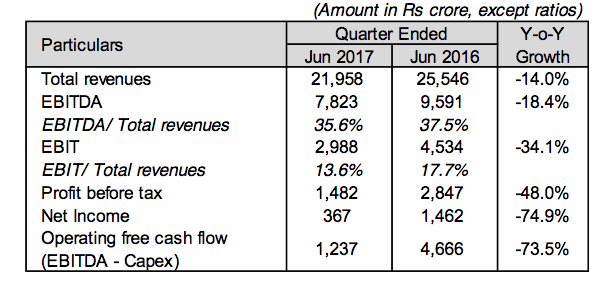

India's leading telecom Bharti Airtel on Tuesday reported around 75% yearly decline at Rs 367 crore in its first quarter profit from Rs 373 crore in the January-March quarter. The profit was impacted by the price war introduced by Reliance Jio.

Airtel's consolidated revenue fell 14% to Rs 21,958 crore from a year earlier Its India revenues stood at Rs 17,244 crore, declined by 10.0% Y-o-Y primarily led by a mobile drop of 14.1% Y-o-Y. It said that mobile market remains turbulent in the current quarter as well, due to disruptive pricing by a new operator.

Mobile data traffic has grown three fold to 472 billion MBs in the quarter as compared to 158 billion MBs in the corresponding quarter last year. Mobile broadband customers increased by 33.7% to 48.9 million from 36.6 million in the corresponding quarter last year.

"The pricing disruption in the Indian telecom market caused by the entry of a new operator continued with industry revenues declining over 15% Y-o-Y, creating further stress on sector profitability, cash flows and leverage. Consequently, our revenues declined 10% and EBITDA margin eroded by 5.3% Y-o-Y. We remain committed to providing the best value & experience to our customers and continue to invest towards it. As a result, our network witnessed data and voice traffic growth of 200% & 34% Y-o-Y respectively. We also added 5.2 Mn data customers in the last quarter – our highest ever," Gopal Vittal, MD and CEO, India & South Asia, said in a statement.

Airtel's consolidated EBITDA declined 18.4% Y-o-Y at Rs 7,823 crore with EBITDA margin dropping by 1.9% to 35.6%, led by India SA margin drop of 4.6% Y-o-Y on an underlying basis. Consequently, the consolidated EBIT dropped by 34.1% Y-o-Y to Rs 2,988 crore. Net interest costs of Rs 1,789 crore have risen from Rs 1,631 crore in the corresponding quarter last year – largely due to increased spectrum related interest costs, the telco said.

Airtel said that forex and derivative loss for the quarter were at Rs 39 crore compared to the loss of Rs 309 crore in the corresponding quarter last year.

The Consolidated Net Income after exceptional items for the quarter stands at Rs 367 crore, against Rs 373 crore in the previous quarter and Rs 1,462 crore in corresponding quarter last year.

The company’s consolidated net debt has decreased to Rs 87,840 crore from Rs 91,400 crore in the previous quarter. Net debt excluding the deferred payment liabilities to the DOT and finance lease obligations has decreased by Rs 4,633 crore sequentially in the quarter.

Airtel had over 280 million in India at the end of the first quarter, up 2.6% sequentially, and 9.7% on a yearly basis.