The wait is finally over as the big day has arrived. The largest spectrum auction in the history of Indian telecom industry is set to commence today as 800MHz, 900MHz, 1800MHz and 2100MHz bands go up for sale. The government will be auctioning 380.75 MHz of spectrum in 800, 900 and 1800MHz bands and 85MHz in 2100MHz band.

A total of 8 telecom operators will be bidding for spectrum out of which Aircel and Tata Docomo are not allowed to bid for spectrum in bands in which they do not already own spectrum in a particular circle. Also state owned telecom operators MTNL and BSNL along with pure play CDMA operator MTS and regional player Videocon are also not participating in the auction. But the major risk involved in this auction is for the incumbent players Airtel, Vodafone, Idea cellular and Reliance communications whose 900MHz spectrum is completing its 20 year licence period and are up for renewal. If these operators are not able to win back their 900MHz spectrum they will have to move to the higher frequency 1800MHz spectrum which has lower penetration inside buildings and thus requires greater number of towers to offer the same coverage which again adds to the capital expenditure and may cause a temporary disruption of services during the transition.

What is at stake?

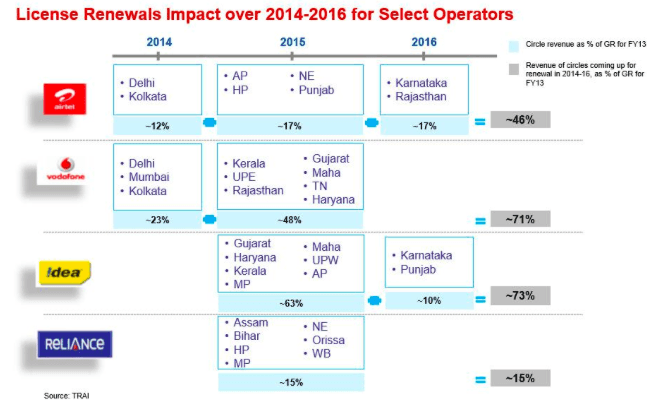

In 2015-16 Bharti Airtel has licences in Andhra Pradesh, Himachal Pradesh, North East, Punjab, Karnataka and Rajasthan coming up for renewal. These 6 circles comprise of 34% of the gross revenue of Airtel. Luckily Airtel has sufficient fall back spectrum in 1800MHz band in all these circles and can migrate its operations to the higher frequency band if it fails to win back its 900MHz spectrum. Vodafone has licences in Kerala, UP East, Rajasthan, Gujarat, Maharashtra, Tamil Nadu and Haryana coming up for renewal. These 7 circles comprise of 48% of the gross revenue of Vodfone. Currently it lacks sufficient fall back 1800MHz spectrum in Rajasthan, Gujarat and Maharashtra circles and will have to retain its 900MHz spectrum in these circles or shut down operations if it fails to do so. Idea cellular has licences in Gujarat, Haryana, Kerala, Madhya Pradesh, Maharashtra, UP West, Andhra Pradesh, Karnataka and Punjab coming up for renewal. These 9 circles comprise of 73% of the gross revenue of Idea. Currently it lacks sufficient fall back 1800MHz spectrum in Gujarat and UP West circles and will have to aggressively defend its 900MHz spectrum in these circles or shut down operations there. Reliance communications has licences in Assam, Bihar, Himachal Pradesh, Madhya Pradesh, North East, Orissa and West Bengal coming up for renewal. These 7 circles comprise of just 15% of the gross revenue of Reliance. Currently it lacks fall back spectrum in 1800MHz band in any of these 7 circles and is in a do or die situation and faces a huge risk competing with AVoId and RJio for retaining its 900MHz spectrum.

TT perspective:

The biggest risk factor for the incumbents in defending their 900MHz spectrum is the participation of Mukesh Ambani led Reliance Jio. Jio has submitted the highest Earnest money deposit of Rs.4500 crore which is 87% of the minimum required for a new operator to bid for spectrum in all circles and all bands. Jio currently owns Pan India 2300MHz spectrum and 1800MHz in 14 of the 22 telecom circles. 2300MHz is favourable for deploying TD-LTE and 1800MHz is favourable for deploying FD-LTE or 2G voice and data. It is evident that Jio needs 3G spectrum for offering voice services through CSFB in conjunction to its high speed LTE network. Since both 2300MHz and 2100MHz are high frequency bands with low coverage they are suited for offering services only in metro cities and urban areas. Jio will want to acquire 900MHz spectrum in all 18 non metro category A, B and C circles where lesser number of towers are available. This will pose a challenge to the incumbents. Jio will also look to acquire 2100MHz spectrum in the metro circles of Mumbai, Delhi and Kolkata where they did not win 900MHz spectrum last year, and deploying of 3G on high frequency band in the metro circles is not much of a problem. Jammu Kashmir circle lacks sufficient spectrum in both 900 as well as 1800MHz band. Jio will not have much luck with the 1800MHz spectrum in the 8 circles where it currently lacks spectrum in that band, since there is no contiguous chunk of 5MHz in those circles in 1800MHz band that it needs to offer services.

As the spectrum auction progresses we will keep bringing you the newest developments and keep you updated. Keep reading TelecomTalk for the latest news and analysis of the Indian telecom industry.